Cboe Global Markets Inc (BATS:CBOE) operates as an options exchange in the United States. It operates in five segments: Options, U.S. Equities, Futures, European Equities, and Global FX.

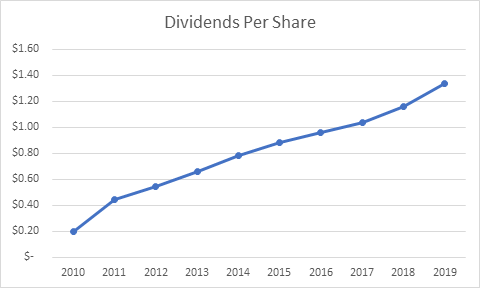

The company has managed to increase dividends for ten years in a row, which makes it a newly minted dividend contender.

Cboe Global Markets Hiked Dividends By 16.70% In August

The last dividend increase was in August 2020, when it hiked the quarterly dividend by 16.70% to 42 cents/share.

“This year marked the 10th anniversary of our IPO and each year since, we’ve raised our dividend, demonstrating Cboe Global Markets’ ongoing commitment to returning capital to our shareholders,” said Ed Tilly, Chairman, President and Chief Executive Officer, Cboe Global Markets. “The increase in our dividend reflects Cboe’s financial strength and cash flow generating capabilities, while we execute on our growth initiatives and deliver sustainable returns to our shareholders.”

Since initiating a quarterly dividend in 2010 at 10 cents/share, the company has managed to quadruple its quarterly distribution to 42 cents/share.

Q3 2020 hedge fund letters, conferences and more

Between 2010 and 2019, Cboe Global Markets grew earnings from $1.03/share to $3.34/share. The company is expected to generate $5.16/share in 2020.

Key Growth Initiatives

CBOEs key growth initiatives are the following:

- Expand product lines across asset classes

- Broaden geographic reach

- Diversify business mix with non transactional revenues

- Leverage leading proprietary trading technology

- Build upon core proprietary products

The company operates the largest options exchange in the US, where we have equity and index options being traded. A large portion of revenues is derived by trading fees. With the proliferation of online trading, exchanges such as Cboe Global Markets should benefit form all this speculation. The company has a dominant position in options. It is the second largest exchange for equities trading in the US after Nasdaq, but ahead of NYSE.

Some popular products include its options products on S&P 500 options, which are under license from S&P until 2030. Other products include VIX options and VIX Futures, which are widely followed as well. The implosion of several VIX funds in early 2018 was a negative for CBOE however. Both S&P 500 options and VIX futures can be a positive for CBOE when there is increased market volatility and when investors want to hedge their market exposure.

Focusing on costs, and driving efficiencies across its business can results in higher profits over time and a better customer experience. Investing in the trading platforms through technological advances will definitely be a plus.

Synergies From The Acquisition Of BATS

New products and bolt on acquisitions can further be accretive to its offerings to clients, and further strengthen the moat. Acquisitions could be accretive due to synergies realized. Cboe Global Markets realized synergies from its acquisition of BATS from a couple of years ago for example, which boosted revenues and increased profits.

The acquisition of BATS also diversified the revenue mix from 81%/19% in options/futures to options (51%), futures (11%), US Equities (27%), European Equities (7%) and Global FX ( 5%). This merger also reduced the transactional fees as a percentage of revenues from 68% to 57%.

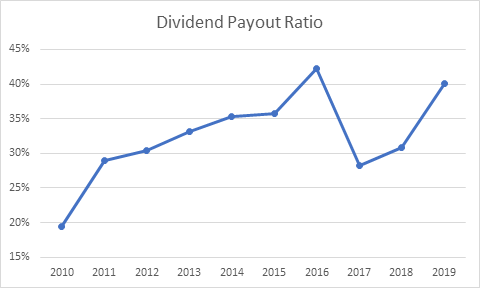

The dividend payout ratio increased from 19% in 2010 to 40% in 2019. A large part of the increase in the payout ratio was the initiation of the dividend later in the year in 2010.

It is possible for this phenomenon to continue in the 2020s as well, but sooner or later dividend growth and earnings growth would converge. If management takes the payout ratio too far, it is very likely that the next step would be dividend growth going slower than earnings. But I am getting ahead of myself here.

The number of shares outstanding have increased over the past decade. Between 2010 and 2016, the number of shares went down from 96 million to 81 million. After the acquisition of BATS however, the number of shares outstanding increased to 111 – 112 million.

Currently, the Cboe Global Markets stock is attractively valued at 16.30 times forward earnings. It offers a dividend yield of 2%.

Relevant Articles: