Billionaire hedge fund managers such as Steve Cohen and Stan Druckenmiller can generate millions or even billions of dollars every year by pinning down high-potential small-cap stocks and pouring cash into these candidates. Small-cap stocks are overlooked by most investors, brokerage houses, and financial services hubs, while the unlimited research abilities of the big players within the hedge fund industry can easily identify the undervalued and high-potential stocks that reside the ignored corners of equity markets. There are numerous small-cap stocks that have turned out to be great winners, which is one of the main reasons the Insider Monkey team pays close attention to the hedge fund activity in relation to these stocks.

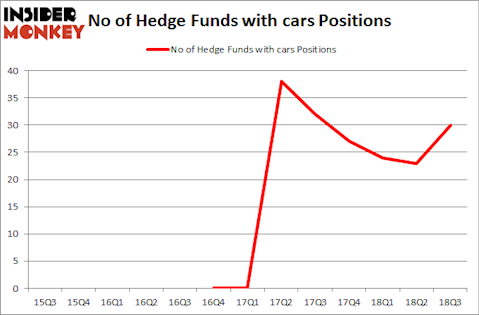

Cars.com Inc. (NYSE:CARS) was in 30 hedge funds’ portfolios at the end of the third quarter of 2018. CARS has seen an increase in hedge fund sentiment recently. There were 23 hedge funds in our database with CARS positions at the end of the previous quarter. Our calculations also showed that cars isn’t among the 30 most popular stocks among hedge funds.

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 18 percentage points since May 2014 through December 3, 2018 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 24% through December 3, 2018. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

We’re going to review the key hedge fund action surrounding Cars.com Inc. (NYSE:CARS).

How are hedge funds trading Cars.com Inc. (NYSE:CARS)?

Heading into the fourth quarter of 2018, a total of 30 of the hedge funds tracked by Insider Monkey were long this stock, a change of 30% from the previous quarter. On the other hand, there were a total of 27 hedge funds with a bullish position in CARS at the beginning of this year. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Starboard Value LP held the most valuable stake in Cars.com Inc. (NYSE:CARS), which was worth $173.7 million at the end of the third quarter. On the second spot was Sessa Capital which amassed $48.3 million worth of shares. Moreover, Silver Point Capital, Steadfast Capital Management, and Kavi Asset Management were also bullish on Cars.com Inc. (NYSE:CARS), allocating a large percentage of their portfolios to this stock.

As industrywide interest jumped, key hedge funds have been driving this bullishness. Kavi Asset Management, managed by Manoneet Singh, created the largest call position in Cars.com Inc. (NYSE:CARS). Kavi Asset Management had $13 million invested in the company at the end of the quarter. Jim Simons’s Renaissance Technologies also initiated a $3.9 million position during the quarter. The other funds with brand new CARS positions are Michael Platt and William Reeves’s BlueCrest Capital Mgmt., Mike Vranos’s Ellington, and D. E. Shaw’s D E Shaw.

Let’s also examine hedge fund activity in other stocks similar to Cars.com Inc. (NYSE:CARS). These stocks are The Greenbrier Companies, Inc. (NYSE:GBX), HNI Corp (NYSE:HNI), International Speedway Corporation (NASDAQ:ISCA), and Northwest Natural Holding Company (NYSE:NWN). This group of stocks’ market values are closest to CARS’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| GBX | 15 | 105838 | -7 |

| HNI | 10 | 25685 | 0 |

| ISCA | 17 | 174152 | -2 |

| NWN | 9 | 72010 | -1 |

| Average | 12.75 | 94421 | -2.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 12.75 hedge funds with bullish positions and the average amount invested in these stocks was $94 million. That figure was $448 million in CARS’s case. International Speedway Corporation (NASDAQ:ISCA) is the most popular stock in this table. On the other hand Northwest Natural Gas Co (NYSE:NWN) is the least popular one with only 9 bullish hedge fund positions. Compared to these stocks Cars.com Inc. (NYSE:CARS) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio.

Disclosure: None. This article was originally published at Insider Monkey.