We at Insider Monkey have gone over 700 13F filings that hedge funds and prominent investors are required to file by the SEC. The 13F filings show the funds’ and investors’ portfolio positions as of September 30th. In this article, we look at what those investors think of CarMax Inc (NYSE:KMX).

Hedge fund interest in CarMax Inc (NYSE:KMX) shares was flat at the end of last quarter. This is usually a negative indicator. Our calculations also showed that BBX isn’t among the 30 most popular stocks among hedge funds. At the end of this article, we will also compare KMX to other stocks including Dover Corporation (NYSE:DOV), Mohawk Industries, Inc. (NYSE:MHK), and ZTO Express (Cayman) Inc. (NYSE:ZTO) to get a better sense of its popularity.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ small-cap stock picks managed to the beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the market by 18 percentage points since May 2014 through December 3, 2018 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter.

Mar Vista Investment Partners invested in the United States’ largest used-car retailer in the 2017 fourth quarter. In a letter to its shareholders, the fund gave its own perspective on the company. We bring you that portion of the report:

“CarMax is the largest domestic used car retailer with a highly disruptive business model. The company delivers value to consumers through its fully transparent sales process and a nationwide network of 65,000 high quality used vehicles. Since 1993, CarMax has sold over 6.5 million vehicles and appraised another 25 million used cars. The data intelligence collected from these transactions gives CarMax a valuable informational advantage that is difficult to replicate. Over the past twenty years, CarMax’s intrinsic value has compounded by 13% annually. With only 185 stores and 3% of the used vehicle market share, we think CarMax has ample opportunities to expand its store base over our investment horizon.

CarMax’s other main contributor to intrinsic value is its CarMax Auto Finance (CAF) which provides used car financing solely to its prime customers. CAF’s loss adverse underwriting culture is another source of competitive advantage. Moody’s and S&P have validated CAF’s stringent credit standards by assigning AAA ratings to its asset-backed securitizations. CAF’s high-quality nonrecourse loan portfolio lowers its capital requirements to less than 1% of total securitizations. From our vantage point, investors periodically undervalue the financing business due to its capital markets dependency and interest rate sensitivity. We think the benefits of the loss adverse underwriting culture and nonrecourse credit warehouse facilities supersede the earnings volatility.

During the quarter, CarMax’s stock declined 17% after same-store-sales slowed due to a temporary compression between new and used vehicle prices related to hurricane replacement demand. We view this used car price inflation as transitory. Eventually, excess used vehicle supply will force price depreciation to resume. We took advantage of these cyclical issues and purchased the equity at 13x normalized earnings.”

Let’s take a peek at the latest hedge fund action encompassing CarMax Inc (NYSE:KMX).

What have hedge funds been doing with CarMax Inc (NYSE:KMX)?

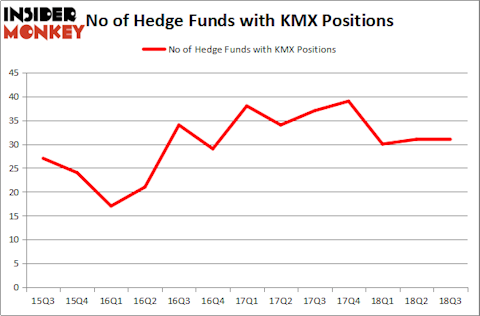

At the end of the third quarter, a total of 31 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 0% from the previous quarter. Below, you can check out the change in hedge fund sentiment towards KMX over the last 13 quarters. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in CarMax Inc (NYSE:KMX) was held by Akre Capital Management, which reported holding $392.4 million worth of stock at the end of September. It was followed by Markel Gayner Asset Management with a $366.9 million position. Other investors bullish on the company included SQ Advisors, D E Shaw, and Giverny Capital.

Since CarMax Inc (NYSE:KMX) has experienced a decline in interest from the aggregate hedge fund industry, it’s safe to say that there were a few money managers who sold off their full holdings by the end of the third quarter. Interestingly, Alexander Mitchell’s Scopus Asset Management dumped the largest position of the “upper crust” of funds tracked by Insider Monkey, comprising about $72.9 million in stock, and Alexander Mitchell’s Scopus Asset Management was right behind this move, as the fund dumped about $69.2 million worth. These transactions are important to note, as aggregate hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as CarMax Inc (NYSE:KMX) but similarly valued. We will take a look at Dover Corporation (NYSE:DOV), Mohawk Industries, Inc. (NYSE:MHK), ZTO Express (Cayman) Inc. (NYSE:ZTO), and Henry Schein, Inc. (NASDAQ:HSIC). This group of stocks’ market caps match KMX’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| DOV | 23 | 1251557 | -1 |

| MHK | 49 | 2513475 | 3 |

| ZTO | 12 | 244946 | -3 |

| HSIC | 22 | 1894898 | 2 |

| Average | 26.5 | 1476 | 0.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 26.5 hedge funds with bullish positions and the average amount invested in these stocks was $1476 million. That figure was $1756 million in KMX’s case. Mohawk Industries, Inc. (NYSE:MHK) is the most popular stock in this table. On the other hand ZTO Express (Cayman) Inc. (NYSE:ZTO) is the least popular one with only 12 bullish hedge fund positions. CarMax Inc (NYSE:KMX) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. In this regard, MHK might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.