“We now value Tesla Motors Inc (NASDAQ:TSLA) by taking the average of 3 scenarios. In the first scenario, we assume total sales of 105K (Model S: 50K units, Next Gen: 55K) and operating margins of 14.6% implying an EPS of $5.99. Layering on a 20x multiple given the growth prospects implies a value of $120 which discounted at 20% implies a stock price of $58,” said Archambault.

He then goes on to explain the 2 others scenarios in which he values the stock price at $113 and $83 for an average of $84. I disagree with the valuation, mostly because of the number of cars sold in each scenario, but disregarding the valuation let’s look at the “downgrade” itself.

Before the report, Goldman Sachs Group, Inc. (NYSE:GS) was holding a Neutral rating on Tesla Motors Inc (NASDAQ:TSLA) with a price target of $61. The news is that Goldman is keeping the Neutral rating and increasing the target by $23 to $84. This should be good news. Granted the target is under the current trading price and the stock should suffer, but the only new piece of information here is an increase of $23.

We already knew that Goldman Sachs Group, Inc. (NYSE:GS) was pessimistic about Tesla Motors Inc (NASDAQ:TSLA) and now we know that they are a little less pessimistic.

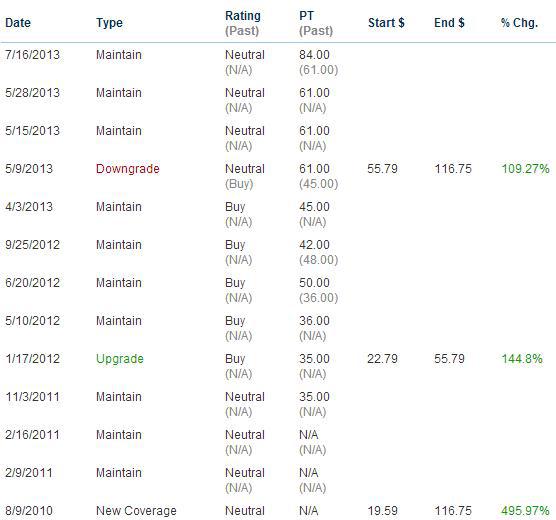

With all respect to Patrick Archambault, if I look at the history of the coverage of Tesla by Goldman Sachs, I give little to no weight to this report.

As you can see, they have been constantly moving their target higher. They are basically playing catch up.

500,000 cars a year

Going back to the report. In his “bullish” scenario, Archambault bases his valuation on sales of 200,000 cars a year. I would consider this scenario bearish since Tesla Motors Inc (NASDAQ:TSLA)’s current factory has a potential of 500,000 cars a year (the rate when General Motors Company (NYSE:GM) and Toyota were operating it) and 200,000 cars only represent 3.5% of the global luxury and mid-luxury car market, while 8.75% (the demand to match the full production potential) is more realistic.

The US market for cars starting at $80,000 represented 60,000 units in 2012. Tesla started delivering the Model S in the fourth quarter of 2012 and managed to produce 4,500 units. It represented a 7.5% market penetration in only one quarter.

This is the reason why a company like BMW needs to start worrying. In one quarter, Tesla Motors Inc (NASDAQ:TSLA) sold more Model S at an average of $105,000 than they sold Roadsters in 4 years. Their sales grow exponentially. After winning the Motor trend car of the year and getting 99 out of 100 from Consumer Report, a case can be made that the Model S is the best car on the road today regardless of the fact that it is an EV. If you are anticipating a 3.5% market share then you are saying that the Model S is not the best car. Otherwise, how can the best car out there can only get 3.5% of market share? Unless Patrick Archambault knows more about cars than Motor Trend and Consumer Report.