Duke Energy Corp (NYSE:DUK) is one of the largest energy generators in the United States with over 57,700 MW of owned generating capacity. It has scrambled in the last few years to shift away from a coal-heavy portfolio and into the cheaper, cleaner arms of natural gas. In 2011 60% of the company’s generating capacity was chalked up to coal versus 1.4% for oil and gas, which last year quickly changed to 46.2% and 16.6%, respectively.

No matter: the company’s coal capacity is still one of the highest in the industry. It is much harder than it seems to make such a switch, so Duke Energy Corp (NYSE:DUK) investors will be exposed to large amounts of coal for the next few years. Turns out that may not be such a bad thing after all.

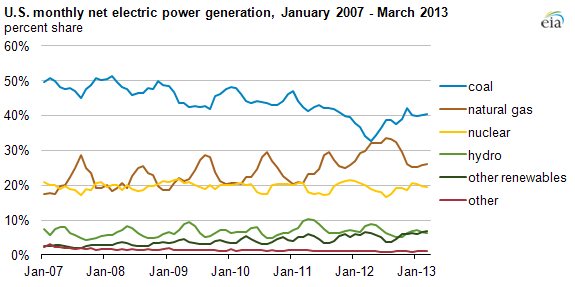

Despite all of the hoopla surrounding natural gas it is still looking up to coal in the standings. With natural gas prices soaring over the winter and remaining higher this spring compared to the year-ago period, coal has actually regained some lost ground.

Source: EIA

It may sound like a sick joke, but could coal actually send Duke Energy Corp (NYSE:DUK) shares higher? Or is this just a short-term trend? Let’s review.

Prices drive generation

Calling this a short-term trend depends on your definition of the word “short term”. It also depends on your faith in energy projections. However, it seems unlikely that natural gas prices will return to 2012 levels any time soon. I believe the industry learned its lesson from cranking the supply faucet too far open and saturating the market. Besides, once commercial-scale manufacturing plants and liquefied export facilities open to exploit reserves there will be more sources to stabilize and prop up prices.

Natural gas prices have roared back from the lows of last year to a more “normal” average. Here’s how the EIA predicts prices per MMBtu and generation in kilowatt-hours per day through 2014 compared to historical averages.

| 2011 | 2012 | 2013 | 2014 | |

|---|---|---|---|---|

| Natural gas price | $4.73 | $3.39 | $4.55 | $4.74 |

| Coal price | $2.39 | $2.40 | $2.40 | $2.44 |

| Natural gas generation | 2.777 | 3.363 | 3.116 | 3.052 |

| Coal generation | 4.749 | 4.145 | 4.507 | 4.575 |

Source: EIA

Two takeaways: coal generation was hurt by the severe price drop in natural gas in 2012, and coal prices are extremely stable. So as long as the price in natural gas continues to climb investors can have confidence that coal will continue to fight back into the nation’s energy supply. That is good news for coal-heavy companies such as Duke Energy Corp (NYSE:DUK), The Southern Company (NYSE:SO), and Dominion Resources, Inc. (NYSE:D).

| Coal % | Natural Gas % | Total Capacity | |

|---|---|---|---|

| Duke Energy Corp (NYSE:DUK) | 46% | 17% | 57,700 MW |

| The Southern Company (NYSE:SO) | 38% | 42% | 45,740 MW |

| Dominion Resources, Inc. (NYSE:D) | 22% | 17% | 27,500 MW |

Source: Company SEC filings

It is worth noting that natural gas will still likely be cheaper than coal due to efficiency and relative cleanliness. For instance, The Southern Company (NYSE:SO) notes that fuel costs per net kilowatt hour in 2011 were 4.02 cents for coal and 3.89 cents for natural gas — despite the large difference in price per Btu reported above. That gap widened considerably last year to 3.96 cents for coal and 2.86 cents for natural gas, but it should close in the years to come. Just don’t think coal is anywhere near snuffing out its new rival hailing from the shale fields.