Chipotle Mexican Grill, Inc. (NYSE:CMG) has been one of the fastest rising restaurant stocks in the past decade. Since its public debut in 2006, the stock has risen 760%, easily outperforming both McDonald’s Corporation (NYSE:MCD) and Yum! Brands, Inc. (NYSE:YUM).

Although Chipotle only started with 16 locations when it was founded in 1993, a major investment from McDonald’s helped the company expand to 500 locations by the end of 2005. Despite its growth, Chipotle is a very divisive stock with value and growth investors, due to its consistently high P/E ratio. Let’s look back at Chipotle’s first quarter earnings to see if it can continue to outperform its industry peers.

A spicy first quarter

By comparison, McDonald’s Corporation (NYSE:MCD)’s first quarter earnings grew by an anemic 0.8%, while revenue rose 1%. However, Chipotle’s main competitor, Yum! Brands, Inc. (NYSE:YUM)’s Taco Bell, which is mainly located in North America, reported 8% same-store sales growth in 2012.

Sales growth

Most of Chipotle’s surge in revenue was attributed to its 48 new restaurant openings during the quarter, which brought its total store count to 1,458 at the end of March. But same-store sales only rose 1%, a disappointing decline from the 12.7% growth it reported in the prior year quarter. Excluding the impact of Easter and the lack of a leap day, same-store sales actually rose 3%.

Chipotle’s same-stores sales growth actually outpaced McDonald’s, which reported a 1% decline in global same-store sales. McDonald’s U.S. same-store sales notably dropped 1.2%, as the company attempted to boost sales by emphasizing its value menu. Chipotle Mexican Grill, Inc. (NYSE:CMG), on the other hand, doesn’t offer a value menu. Both companies, along with the rest of the quick serve restaurant industry, have struggled with rising food costs, adverse weather conditions and a slowdown in consumer spending.

The bistro revolution

Much of Chipotle’s success has been attributed to the rising popularity of ‘bistro quick serve restaurants’, such as Chipotle and Panera Bread Co (NASDAQ:PNRA). Both Chipotle and Panera are increasingly regarded as healthier alternatives to traditional fast food chains McDonald’s and Yum! Brands.

Chipotle Mexican Grill, Inc. (NYSE:CMG) has carved out a niche for itself with health-conscious consumers by using locally grown, organic ingredients. Panera has also adopted the same approach, and claims to use mostly organic ingredients in its sandwiches, salads and soups.

This movement started by Chipotle and Panera Bread Co (NASDAQ:PNRA) has caused ripples throughout the North American restaurant industry, with many customers now favoring restaurants that use locally grown ingredients over those that rely on international food service companies such as SYSCO Corporation (NYSE:SYY). This backlash has hit both lower-end fast food restaurants, such as McDonald’s and Yum!, as well as more expensive full-service diners, such as Darden Restaurants, Inc. (NYSE:DRI), the parent company of Olive Garden and Red Lobster.

Chipotle’s 1,458 locations are concentrated mostly in the United States and Canada, which has insulated it from the Chinese troubles that have sunk Yum! Brands, and the European woes that continue to weigh on McDonald’s. Chipotle has relatively minor exposure to Europe with stores in England and France.

Rising food costs

Rising food costs, exacerbated by high fuel costs and adverse weather conditions, remain a huge burden for the restaurant industry. Chipotle Mexican Grill, Inc. (NYSE:CMG)’s food costs increased 80 basis points to 33.0% of total revenue during the quarter, which forced the company to slightly raise its menu prices. Prices for chicken, cheese and salsa ingredients were hit the hardest.

These costs are widely expected to continue rising in 2013, but a recent decline in corn and soybean prices could reduce the costs of chicken feed and chickens, while a dip in oil prices, caused by a surplus in the United States and lower demand from China, could reduce transportation costs.

By raising menu prices during the quarter, Chipotle was able to preserve its margins and profits at the expense of sales volume. Meanwhile, McDonald’s took the opposite approach, using an aggressive value menu strategy to gain market share at the expense of leaner margins.

Margins and expenses

Despite these efforts, Chipotle’s restaurant level operating margin (total revenue minus restaurant operating costs) still declined 110 basis points year-on-year to 26.3%. Total operating margins, however, rose 50 basis points due to reduced expenses. Chipotle Mexican Grill, Inc. (NYSE:CMG) decreased its SG&A (sales, general and administrative) expenses from the previous year, although occupancy costs rose to 6.6% of total revenue.

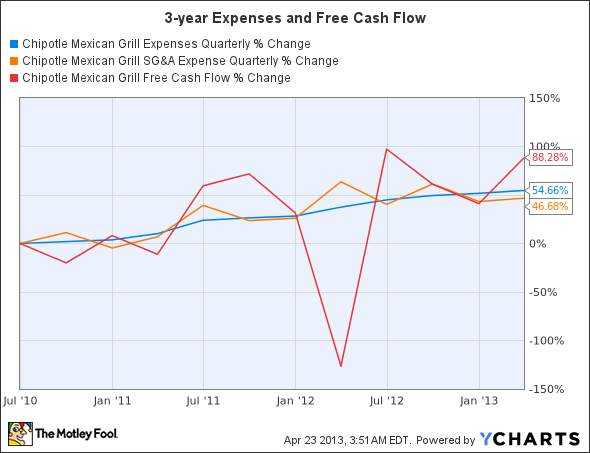

Although these improvements are encouraging, the following chart shows that Chipotle’s long-term uptrend in expenses still appears intact.

Rising expenses, especially occupancy costs, will likely keep rising, especially since Chipotle intends to open 165 to 180 new restaurants in 2013.

Chipotle also finished the quarter with a strong cash position of $346.9 million, up from $322.6 million in the prior year quarter. Chipotle also repurchased $51 million in shares during the quarter, and added $100 million to its current share repurchase program.

The Bottom Line

A big issue that fundamental investors have with Chipotle is its high P/E. Compared to McDonald’s, Yum! Brands or Panera, it is trading at a high premium.

Chipotle’s trailing P/E has come down considerably since early 2012, yet its price seems to be trending back toward its all-time highs. That means that Chipotle Mexican Grill, Inc. (NYSE:CMG)’s share price is gradually reconciling with its high P/E ratio, a positive sign that the company’s growth is sustainable.

A look at its fundamentals, compared to McDonald’s, Yum! and Panera, reveals a fairly mixed picture, however.

| Forward P?E | 5-year PEG | Price to Sales (ttm) | Return on Equity (ttm) | Debt to Equity | Profit Margin | |

| Chipotle | 29.19 | 1.68 | 3.98 | 23.75% | No debt | 10.36% |

McDonald’s | 15.74 | 2.04 | 3.61 | N/A | 89.14 | 19.79% |

Yum! Brands | 17.40 | 1.89 | 2.16 | 76.06% | 127.25 | 11.71% |

Panera Bread | 21.93 | 1.35 | 2.46 | 23.49% | 0.81 | 8.14% |

Advantage | McDonald’s | Panera | Yum! Brands | Yum! Brands | Chipotle | McDonald’s |

Source: Yahoo Finance April 23

Although McDonald’s is the cheapest fundamentally, it is also the slowest growing one of this group. The company is weighed down by endless troubles in Europe, which account for roughly 40% of its top line, and faces difficulties expanding in China under the shadow of Yum! Brands. Meanwhile, Yum! had a great run, but an endless stream of bad news in China — macroeconomic declines, chemically tainted chicken and the avian flu — all point to tough times ahead for the KFC parent.

That means Chipotle and Panera, two ‘bistro fast food’ establishments, are more likely to benefit from more limited global exposure than its larger rivals. A growing preference for healthier fast food should also help these two companies outperform their larger rivals over the next few years.

However, Chipotle’s anemic same-store sales growth and cautious outlook for 2013 suggests that investors shouldn’t be in a hurry to pick up shares, as any big market swoon will likely present a better entry point than current prices.

The article Can Chipotle Keep Climbing in 2013? originally appeared on Fool.com and is written by Leo Sun.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.