Apple Inc. (NASDAQ:AAPL) designs, manufactures, and markets mobile communication and media devices, personal computers, and portable digital music players to consumers, small and mid-sized businesses, education, and enterprise and government customers worldwide. The company is the largest publicly traded company in the US by market capitalization. The company started paying a dividend in 2012, and has been raising it every year since then.

The company has increased dividends for 4 years in a row, since it initiated a quarterly dividend in 2012 at roughly 38 cents/share. The last dividend increase was in April 2016, when the company raised its quarterly dividend by 9.60% to 57 cents/share. After the latest string of dividend increases, many investors are wondering if Apple can become the next dividend growth darling to fill in their portfolios at a lower valuation than many other companies.

According to reports I have been reading, Apple now has a brand which is supposedly more valuable than that of Coca-Cola.

To be honest, I am not a big fan of Apple as an investment. The reason is that I guess I just cannot forecast whether earnings per share will be sustainable over next 5 – 10 years, or they will plateau and go down. The future value of the business 15 – 20 years from now will be largely driven out of the profits that will be generated in 15 – 20 years. Given the competitive nature of the technology industry, and the rapid product obsolescence, it is more difficult to determine the sustainability of Apple’s earnings.

Follow Apple Inc. (NASDAQ:AAPL)

Follow Apple Inc. (NASDAQ:AAPL)

Receive real-time insider trading and news alerts

Currently, almost 2/3 rds of revenues are derived from sales of iPhones, while 10% of revenues are derived from the sale of iPads. The smartphone and the tablet were product categories that existed before, but Apple essentially created and invigorated with its product launches. Sales of Macs accounted for 11% of revenues and the rest is from services and other hardware.

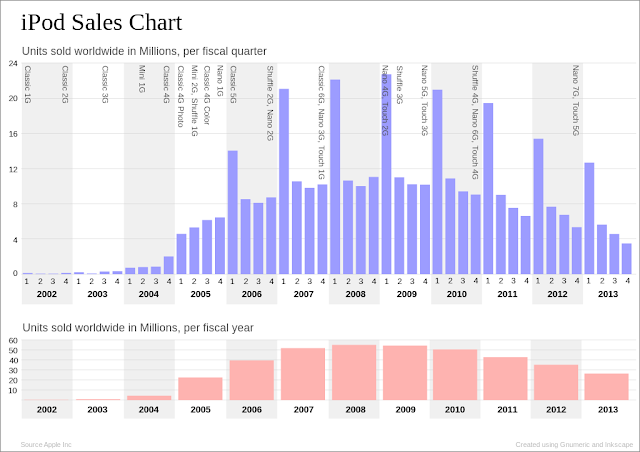

I do not know if iPhone/iPad next iWhatever will keep selling. Will people keep upgrading every few years, and pay a premium for features that are available elsewhere? This is an issue to think about, because products that are not as hot, have a steep declining curve of sales. I came to this idea after observing sales of iPod’s over the years. It is true that iPod sales were cannibalized by the iPhone. However, if iPhone or iPad sales are affected by an external threat, we may see a decline in sales in corresponding proportions. If a product that accounts for 2/3rds of revenues is not so hot anymore, the company may have some problems at hand, especially if it fails to energize its consumers with new offerings, such as iWatches for example.

I am wondering if we are seeing a similar issue with iPad sales today:

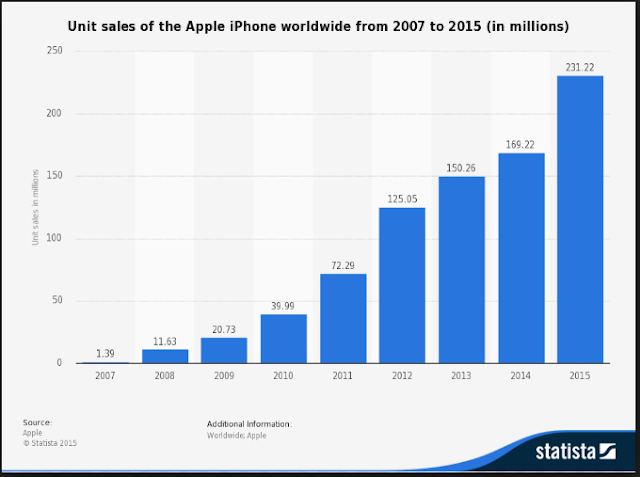

So far, sales of iPhones have been going strong. However, according to this website, this year could be the first drop in sales ever.

It was the rage with PC’s, where corporations upgrade every 3 – 5 years or so, which resulted in recurring revenues.. However. now tablets are eating PC’s lunch. And honestly, is the iPad/iPhone something that is much different compared to say Samsung/anything that is Android? Everyone is trying to create an ecosystem, but then if you have changes in technology, would that ecosystem survive?

I am also looking at Blackberry, which generated $6.24 in EPS for year ended Feb 2011. The company also had spent a couple billion buying back stock at a P/E below 10. Remember all those managers that were addicted to their “crackberries”a few years ago? What are they using now to check work email? The steep decline in sales for Blackberries between 2007 – 2013 is just something that gives me a pause, before going for Apple.

Currently, the stock is cheap, as it sells for 13.70 times forward earnings, and yields 2%. Out of $618 billion in market cap, you also have some downside protection in terms of almost 1/4 of the market cap being in a net cash position on Balance Sheet. So if you have confidence in Apple being able to roll out new products/services and generate high margins and high earnings for foreseeable future, then it might be a good hold for you. If you also get something like a valuation expansion, you could probably do pretty well for yourself as well. And in the meantime, you will likely be paid a nice growing dividend, while you are waiting. If earnings start dropping from here however, you may see losses in capital, and the dividend will be in danger. The low P/E ratio reflects the overall bearishness on the company’s ability to maintain profits going forward, given the intensely competitive nature of the smartphone market. Sales of smartphones have accounted for a large part of Apple’s growth over the past five years. Competition from Samsung, LG, and HTC has eroded Apple’s market share.

On the other hand, Apple has been the dominant leader in smartphones. This is evident by the high amount of profits earned, high margins, and high customer loyalty. iPhone’s are perceived as quality products, which is why people are willing to pay a premium for them. The company’s other competitors have not done as well. More recently, Samsung’s newest phone has been having some issues, which have led to it halting sales to the recent model. This could be advantageous to Apple in the short-run, assuming that its latest phones do not catch on fire either. If the design flaw is due to a Samsung related issue, then Apple will clearly benefit. If the design flaw is due to an issue related to a supplier however, or a flaw that is copied from Apple, then Apple may not benefit as much from this fiasco.

The issue with Apple is that if there is something wrong with the iPhone, and a product has to be recalled, it would really affect the bottom line given the fact that it accounts for 2/3rds of sales. So if you are an Apple investor, I am hopeful that the quality control is up to par.

So my conclusion is that the world of technology is unpredictable. While some brand affinity exists, the rate of innovation is high enough to warrant consumers to switch to another competitor. I know that Apple is trying to build a moat.

I am hesitant because I do not see it as a recurring product you would buy over and over. For example, with Nike (NKE), I am not sure technology will easily disrupt the way you put shoes on. If there is change in shoes, it will be very slow and gradual, which would allow Nike to respond. There are significant improvements along the way, and the company invests to be the best brand, but I don’t think technology plays same role as say Apple. I could be wrong, or I could be right. Let’s circle back on this one in 10 years.

Since this business is outside my margin of safety, I will not invest in Apple ( though I do own it indirectly through the mutual funds I own in my 401 K).