The societal effects of an energy source are important for policy makers. Before approving a new nuclear power plant regulators look at all parts of the facility and its potential impact on the surrounding area. The Fukushima disaster tarnished nuclear’s image even though researchers estimate that just 130 people will die from directly related cancers. Nuclear energy does have some health costs, but the history shows that it is a very safe form of power.

What do the Studies Show?

In 2007 a study was published that looked at the number of deaths causes by various power sources. Occupational deaths include deaths from mining and refinement to its final use in a power plant. Nuclear’s estimated 0.019 occupational deaths per terawatt hour (TWh) are substantially lower than coal’s 0.10 occupational deaths per TWh. Only natural gas came in lower at 0.001 occupational deaths per TWh.

The same study looked at the number of deaths among the public. This figure is very important because this shows the safety of the fuel source for the average consumer. Here nuclear is the clear winner with an estimate of 0.003 deaths per TWh versus 0.02 per TWh for coal and natural gas.

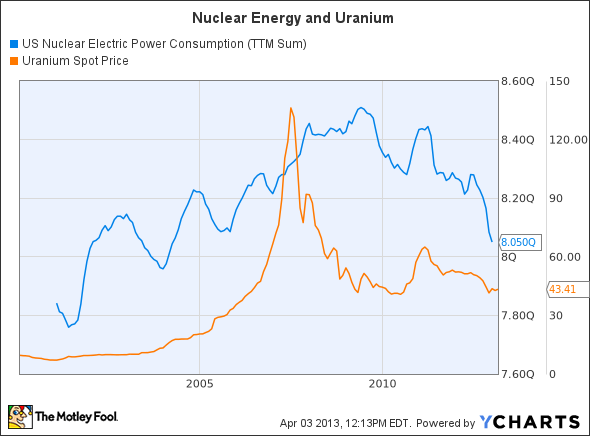

US Nuclear Electric Power Consumption data by YCharts

How do Safety Concerns Impact Uranium Miners?

Uranium miners live by selling fuel to nuclear power generators. If the nuclear power plants were shut down because of health concerns, then uranium miners would go bankrupt. Thankfully this is not the case. Nuclear power is a relatively safe fuel for the public and the miners.

Cameco Corporation (USA) (NYSE:CCJ) is one of the world’s top uranium miners. It has decades of experience in developed countries like Canada where worker safety is taken very seriously. Recently it was rated one of the top ten employers in the nation. Its prime mines are found in high yield formations in Saskatchewan, Canada. Additionally, the company operates facilities in the U.S and is exploring in Mongolia.

Financially the company is in good shape. Its low total debt to equity ratio of 0.31 is reasonable for a large firm with steady revenue. The high yield mines in Canada help it to remain profitable in the midst of market fluctuations. Its current EBIT margin of 12.9% and profit margin of 11.4% are encouraging. Over the long term uranium demand will be strong and Cameco Corporation (USA) (NYSE:CCJ) is in a great place to meet the world’s needs.

The company uses in-situ technology to extract Uranium Resources, Inc. (NASDAQ:URRE) without digging up huge swaths of land. It already has some operating facilities, but it is expected to lose $0.30 per share in 2014. Thankfully, the firm has little debt with a total debt to equity ratio of just 0.12. With a $45 million market cap the company is highly speculative. Until it is cash flow positive, it is a firm best left on the watch list.

Market Vectors Nuclear is a small ETF that offers a good look at the entire nuclear industry. Its largest position is in the nuclear-oriented utility Exelon. Its position in Mitsubishi offers exposure to the construction side of the nuclear industry. Uranium Resources, Inc. (NASDAQ:URRE) miners like Cameco also form a major part of its holdings.

For a niche ETF with a market cap around $70 million, its net expense ratio of 0.60% is reasonable. The fund is a great look at the entire fuel cycle and the global economy. Approximately a quarter of the holdings are in the United States, a quarter in Canada, and a quarter in Japan. Overall this ETF will be more stable than a small mining firm like Uranium Res because of the large caps it holds.

Conclusion

In the long term the nuclear industry is very safe. The above study showed how coal is more dangerous for the workers and the public. Cameco Corporation (USA) (NYSE:CCJ) is a strong miner with profitable operations and high quality mines. Market Vectors Nuclear is another strong investment with diversified exposure to many parts of the nuclear industry. Uranium Res is the one company that should be avoided due to small size and continued stock dilution.

The article Nuclear’s Health Risks Are Over-Inflated originally appeared on Fool.com is written by Joshua Bondy.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.