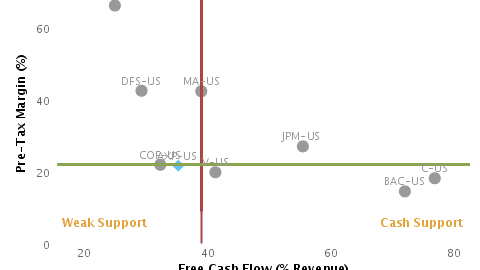

Citigroup Inc. (NYSE:C) – Shares in Citigroup are on the rise Tuesday despite the unexpected departure of CEO, Vikram Pandit, and President and COO, John P. Havens, this morning. The stock fell ahead of the opening bell on the announcement, but reversed losses at the open, gaining as much as 2% to $37.40 in the first half of the session. Trading traffic in out-of-the-money calls expiring in January of 2013 suggests some strategists are positioning for shares to reach their highest levels since July 2011 in the next few months. Traders exchanged more than 4,500 calls at the Jan. 2013 $41 strike this morning against open interest of 2,697 contracts. It looks like most of the volume was purchased for an average premium of $0.81 apiece, thus positioning buyers to profit in the event of an 11% move up in the price of the underlying to top the breakeven price of $41.81 by expiration next year. Bullish positioning at the higher Jan. 2013 $44 strike, where around 750 calls were purchased this morning at an average premium of $0.33 each, indicates traders are prepared to profit should the stock jump 18.5% to exceed $44.33 by January 2013 expiration. Overall options volume topping 200,000 contracts by 11:35 a.m. ET on Citigroup is well above the stock’s average daily options volume of 140,192 contracts. Calls are more active than puts, with roughly 1.3 call options changing hands on the stock for each single put option. Shares in the name rose on Monday following the company’s third-quarter earnings report.

Domino’s Pizza, Inc. (NYSE:DPZ) – The pop in shares of Domino’s Pizza following the company’s better-than-expected third-quarter earnings report this morning is delivering hefty paper profits to traders who snapped up call options on the stock yesterday. Shares in DPZ rallied more than 8% this morning to touch $41.51, the highest level since March, after the company posted earnings and sales for the third quarter that beat analyst expectations. One or more options players benefiting from the sharp rise in the price of the underlying today purchased 277 calls at the Oct. $37 strike on Monday for a premium of $1.95 apiece. Premium required to buy these deep in-the-money calls has doubled overnight to $3.90 as of midday on Tuesday. Meanwhile, traders positioning for shares in Domino’s to extend gains in the near term picked up around 640 calls at the Oct. $42 strike for an average premium of $0.32 apiece. Buyers of the $42 calls profit at expiration later this week as long as DPZ shares rally 2% to exceed $42.32. Like-minded bulls purchased Nov. $42 strike calls today that make money given a more than 3% move to surpass $42.80 by November expiration.

The Home Depot, Inc. (NYSE:HD) – Options activity on home improvement retailer, Home Depot, Inc., this morning suggests one player sees shares in the name trading in a range through January 2013 expiration. The shares today are up 0.35% to stand at $60.85 as of 12:05 p.m. ET. Shares are off roughly 4% since the stock traded up to a more than 10-year high of $63.20 on October 5th. A 2,000-lot straddle established at the Jan. 2013 $60 strike this morning results in maximum possible profits of $4.97 per contract for the seller if Home Depot’s shares settle at $60.00 at January expiration. The straddle-seller may keep some portion of the $4.97 in premium received on the strategy as long as HD shares trade above the lower breakeven price of $55.03 or below the upper breakeven price of $64.97. The strategy starts to lose money given a more than 6.5% rally or near 10% pullback in the price of the underlying from the current level of $60.85 by expiration next year.

Caitlin Duffy

Equity Options Analyst

The material presented in this commentary is provided for informational purposes only and is based upon information that is considered to be reliable. However, neither Interactive Brokers LLC nor its affiliates warrant its completeness, accuracy or adequacy and it should not be relied upon as such. Neither IB nor its affiliates are responsible for any errors or omissions or for results obtained from the use of this information. Past performance is not necessarily indicative of future results.

This material is not intended as an offer or solicitation for the purchase or sale of any security or other financial instrument. Securities or other financial instruments mentioned in this material are not suitable for all investors. Any opinions expressed herein are given in good faith, are subject to change without notice, and are only correct as of the stated date of their issue. The information contained herein does not constitute advice on the tax consequences of making any particular investment decision. This material does not take into account your particular investment objectives, financial situations or needs and is not intended as a recommendation to you of any particular securities, financial instruments or strategies. Before investing, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.