It’s been a great year so far for Buffalo Wild Wings (NASDAQ:BWLD). The company’s shares have increased over 40% since January just as Buffalo Wild Wings (NASDAQ:BWLD) has turned in some very favorable earnings reports. Last quarter, the company’s net income was up 41% year over year. But even with the impressive start to this year, there is plenty of reason to believe 2013 can still hold some sizzle.

Football season

The biggest time of year for this company is undoubtedly football season. Buffalo Wild Wings (NASDAQ:BWLD)’ revenue consistently tapers in the summer before spiking to new all-time highs in the fall and winter.

BWLD Revenue Quarterly data by YCharts

It’s no secret that chicken wings are the perfect companion to football. That’s why the timing of McDonald’s Corporation (NYSE:MCD) “Mighty Wings” launch is no surprise. Football season officially kicks off with Thursday Night Football on September 5. Mighty Wings debut on September 9 — the same day as Monday Night Football’s start. McDonald’s Corporation (NYSE:MCD) chicken wings will be available only through November — or the majority of football season.

Football season is quintessential for chicken wings, but while McDonald’s Corporation (NYSE:MCD) looks to boost lackluster comp-sales through limited-time menu offerings, chicken wings are Buffalo Wild Wings (NASDAQ:BWLD)’ bread and butter. Chicken wings — both traditional and boneless — made up 39% of this company’s sales last quarter.

The lure of Buffalo’s restaurants is watching the game — whatever game it is — and taking advantage of the big flat-screen TVs, good food, and beer. In keeping with the trend, the company’s revenue should spike once the NFL season starts. The NFL remains immensely popular in the US, accounting for 24 of the top 25 most- watched TV shows in 2012.

Chicken prices

One major weakness for Buffalo Wild Wings (NASDAQ:BWLD) is its dependency on chicken wing sales, considering that the company does not hedge wing costs. The company has always paid the real-time market price for wings, which hurt its profits last year as the US drought took hold and wing prices spiked from just $0.90/pound in 2011 to over $2.00/pound. The bulk of this inflation occurred so fast that new menu prices couldn’t be rolled out in time. Unfortunately for the company, this spike coincided with football season.

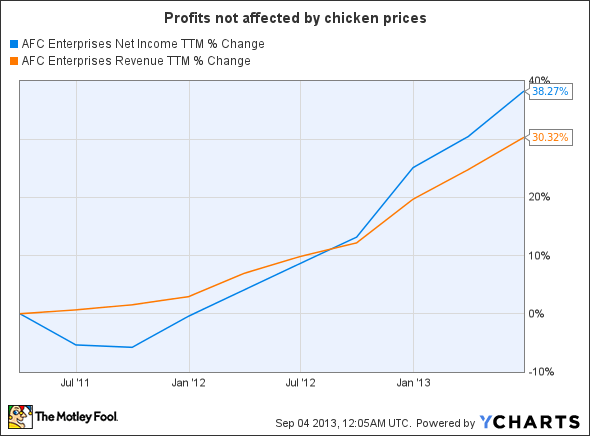

Commodity contracts are quite common and are one of the things that has helped AFC Enterprises, Inc. (NASDAQ:AFCE) on its way to higher profits. This parent company to Popeye’s Louisiana Kitchen was not crippled by high chicken prices, despite chicken accounting for 40% of sales.

AFCE Net Income TTM data by YCharts

Given AFC Enterprises, Inc. (NASDAQ:AFCE)’s chicken contracts, its management expects big third and fourth quarters. In addition to excellent cost management, this chain of 2,153 restaurants expects to add 85 to 115 new locations this year. These factors point toward the company delivering on its guidance of 15% earnings-per-share growth over the long-term.

Since Buffalo Wild Wings (NASDAQ:BWLD) doesn’t have such contracts, the company has increased prices, and has even overhauled how wings are priced. Now, instead of charging per wing, customers are billed by weight. This will greatly help the company deal with inconsistent wing sizes. It will buy and sell using the same metric: the pound. The company’s costs will be more predictable, and the customer will get a more consistent product.

While menu prices have already gone up, this year wing prices have gone down. Wings average $1.64/pound compared to $1.97/pound at the same time last year, -17% in Buffalo Wild Wings’ favor.

Remaining 2013 pipeline

By averaging 70 new locations per year over the last decade, Buffalo Wild Wings has swelled to 930 units. So far this year, 41 new locations have opened. A whopping 62 locations, both franchised and company-owned, are scheduled to be open before year’s end.

The timing of these openings couldn’t be better, coinciding with the football season. In all, there are currently 97 more restaurants open now than at the start of football season last year. In short, Buffalo Wild Wings (NASDAQ:BWLD) will be packed out in 10% more locations than last year.

Conclusion

With chicken wing prices coming down, a new pricing system, and scores of new locations opening, Buffalo Wild Wings is ready for its favorite time of year: football season. This fall looks to be just the latest accomplishment for a company poised to open another 500 locations in the next four to five years.

The article This Company Is Ready for Game Time originally appeared on Fool.com and is written by Jon Quast.

Jon Quast has no position in any stocks mentioned. The Motley Fool recommends Buffalo Wild Wings and McDonald’s. The Motley Fool owns shares of AFC Enterprises, Buffalo Wild Wings, and McDonald’s.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.