Bruker Corporation (NASDAQ:BRKR) Q4 2022 Earnings Call Transcript February 9, 2023

Operator: Good morning, and welcome to the Bruker Corporation’s Fourth Quarter 2022 Earnings Conference Call. Please note, this event is being recorded. I’d like to turn the floor over to Justin Ward, Senior Director of Investor Relations and Corporate Development. Please go ahead.

Justin Ward: Thank you, Anthony and good morning, everyone. I would like to welcome everyone to Bruker Corporation’s fourth quarter and full year 2022 earnings call. My name is Justin Ward and I am Bruker’s Senior Director of Investor Relations and Corporate Development. Joining me on today’s call are Frank Laukien, our President and CEO; and Gerald Herman, our Executive Vice President and CFO. In addition to the earnings release we issued earlier today, during today’s call, we will be referencing a slide presentation that can be downloaded from the Events & Presentations section of Bruker’s Investor Relations website. During today’s call, we will be highlighting non-GAAP financial information. Reconciliations of our non-GAAP to GAAP financial measures are included in our earnings release and are posted on our website at ir.bruker.com.

Before we begin, I would like to reference Bruker’s safe harbor statement which is shown on Slide 2 of the presentation. During this call, we will make forward-looking statements regarding future events and the financial and operational performance of the company that involve risks and uncertainties, including those related to elevated geopolitical and energy risk the COVID 19 pandemic, and supply chain logistics and inflation challenges. The company’s actual results may differ materially from such statements. Factors that might cause such differences include but are not limited to those discussed in today’s earnings release, and in our Form 10-K as updated by our other SEC filings, which are available on our website and on the SEC website.

Also note that the following information is based on current business conditions and to our outlook as of today, February 9, 2023. We do not intend to update our forward-looking statements based on new information, future events or for other reasons, except as may be required by law prior to the release of our first quarter 2023 financial results expected in early May 2023. You should not rely on these forward-looking statements as representing our views or outlook as of any date after today. We will begin today’s call with Frank providing an overview of our business progress. Gerald will then cover the financials for the fourth quarter and full year 2022 in more detail, and he will share our fiscal year 2023 financial outlook. Now I’d like to turn the call over to Bruker CEO, Frank Laukien.

Frank Laukien: Thank you, Justin. Good morning, everyone. And thank you for joining us on today’s earnings call. In fiscal year 2022, Bruker achieved solid operating and financial improvements with 10% organic revenue growth, 150 basis points gross margin expansion and 11% non-GAAP EPS growth all while all with a non-GAAP return on invested capital above 20%. And while investing significantly in proteomics and spatial biology. We have made several key acquisitions and investments in the last 13 months in order to expand the breadth of our proteomics capabilities into proteomics consumables automation software and expert proteomics drug discovery services and also in order to enter attractive new markets in cancer research tools and neuroscience research tools and solutions.

Our teams also have been effectively navigating supply chain and geopolitical challenges which are gradually improving but not fully resolved yet and probably will not be fully resolved until the end of 2023. And in some areas of electronics even into early 2024. Most importantly, we are advancing our Project Accelerate 2.0 high growth high margin initiatives with as you know a particular focus on the large opportunities in proteomics and the related field of spatial biology while also investing in operational excellence, productivity and our capacity growth for the next 10 years. Bruker again has introduced key lifetime tools innovations in 2022. And demand for our high value solutions and differentiated instruments is strong. In fiscal year 2022, our scientific instruments segment generated double digit year-over-year organic bookings growth and build additional backlog for good visibility into the year.

In 2023, we intend to drive strong revenue growth and another solid EPS increase, while further expanding our focus strategic investments in the recently acquired additional proteomics capabilities and in our other key Project Accelerate 2.0 initiatives. Our medium-term goal is to continue to transform Bruker Brooker into a high revenue growth and consistent double digit EPS growth company with significant further growth and operating margin expansion potential. Turning now to slide 4, Bruker’s solid 8.9% year-over-year organic revenue growth in the fourth quarter capped off another strong year for the company. Continued demand for our differentiated high value solutions drove robust performance in bookings and revenues. And our fourth quarter €˜22 scientific instruments segment book-to-bill ratio was again greater than one.

For the full year 2022, our BSI segment organic bookings and backlog both increase in the double-digit percentage year-over-year. For the fourth quarter of 2022, the BSI segment order bookings continue to grow nicely driven by broad based customer demand, with demand in Europe being particularly strong. Bruker’s Q4 €˜22 reported revenue increased 3.6% year-over-year to $708 million. This was in comparison to a strong prior year Q4 of €˜21 and with a 7% Q4 €˜22 headwind from FX. So on an organic basis, our Q4 2022 revenues increased 8.9% year-over-year. Our Q4 2022 non-GAAP gross margin increased 140 basis points year-over-year to 52.6%. While our non-GAAP margin was 21.0%, the same as in the fourth quarter of €˜21. Despite inflation headwinds, our gross margin expansion is clearly benefiting from Project Accelerate 2.0 margin mix, our operational excellence productivity gains as well as volume leverage, pricing and currency tailwind.

In the fourth quarter of ;22, Bruker reported GAAP diluted earnings per share of $0.66 up 32% compared to $0.50 reported in the fourth quarter of €˜21. On a non-GAAP basis, fourth quarter €˜22 diluted EPS was $0.74, up 25% from $0.59 for the fourth quarter of €˜21. In summary, the fourth quarter of €˜22 was a quarter of good execution and continued broad demand for our differentiated portfolio. Moving on to slide 5, we show Bruker’s performance for the full year 2022. Our revenues increased by $113 million year-over-year, or by 4.7% to $2.53 billion on an organic basis fiscal Year 2022 revenues grew 10.2% year-over-year. For the full year ’22 book-to-bill for Bruker’s three scientific instruments group are all above 1.1. Geographically our €˜22 BSI odor bookings were led by double digit organic growth in Asia Pacific, South Asia and Australia, New Zealand, the APAC region as we abbreviated and with mid-teens percentage organic growth in Europe and Middle East Africa or EMEA and mid-single digit percentage organic order bookings growth in the Americas.

In fiscal year 2022, we experienced particularly strong organic growth in our proteomics, biopharma, semiconductor metrology and industrial research markets. In fiscal year 2022, we delivered double digit organic revenue growth 150 bps year-over-year gross margin expansion, 60 bps year-over-year operating margin expansion and double-digit percentage non-GAAP EPS growth. Our non-GAAP return on invested capital of 24.3%, was again well above our long-term target of ROIC greater than 20%. And this continues to confirm our differentiated strategy and entrepreneurial management process and culture are working. Finally, we’re also pleased with our 7% year-over-year, non-GAAP EBITDA growth bringing 2022 non-GAAP EBITDA to $547.5 million and the related non-GAAP EBITDA margin up 40 bps to 21.6%.

So, please turn to slide 6 and 7 where we highlight the full year 2022 performance of our three scientific instruments groups, and of our BEST segments all on a constant currency and year-over-year basis. In 2022, BioSpin Group revenue grew in the high single digits percentage year-over-year to $697.7 million with strong growth in its services and support revenues as well as strong growth in preclinical imaging and a notable contribution from our biopharma process analytical technology software acquisition Optimal. Bruker BioSpin recognized revenue on 4 GHz-class NMRs instruments in €˜22 consistent with four systems recognized in €˜21. You may have seen our press release last week in which we detail the customer acceptance of the first two 1.0 gigahertz NMR systems already in the fourth quarter of €˜22, one at Ryokan in Japan and one in Barcelona, Spain.

These acceptances were ahead of schedule as this new compact, single story 1.0 gigahertz product launch is technically going really very well. It resulted in some hot 1.2 gigahertz installations however, moving to this year 2023. And in 2023, we are going to expect to install four gigahertz class NMR and by the way there none are expected in the first quarter of 2023. I know some of you are following that quarter by quarter. Moving on for the full year 2022, CALID Group revenues increased in the high single digit percentage to $822 million with continued growth in our life science mass spectrometry business and notable strength in proteomics applications and our timsTOF portfolio with now more than 600 units installed in customer labs. We continue to experience some supply chain delays, however, slowing revenue execution in CALID and hence the backlog went up.

Our timsTOF platforms are very robust demand in applications for 40 proteomics, PTM or epi proteomics as well as single cell proteomics and mass spec imaging all on the various models of the timsTOF platform. Our Microbiology and Molecular diagnostics revenue was up slightly year-over-year as aftermarket strength of said modest instrument demand which faced a difficult comp and comparable from 2021. Moving on to slide 7, our full year ;22 Bruker Nano revenues grew in the high teens, our growth start high teens percentage to $787 million. Nano’s revenue growth in semiconductor industrial markets was particularly strong. Our Nano surfaces division drove the Nano Group strength while x-ray and data analysis divisions also grew further versus 2021.

Nano’s microelectronics and semicon metrology tools performed well in ’22 with strong bookings and a strong backlog that provide us with good visibility into 2023. Bruker Nano Life Science fluorescence microscopy showed strong year-over-year growth as a result of product innovation and life science research demand and that’s also where we have made some additional acquisitions I’ll discuss in a moment. So last but not least at all fiscal year’22 BEST revenue grew in the mid-teens percentage net of Intercompany Eliminations driven by contributions from big science, clean energy research and robust demand for our MRI superconductors by our medtech OEM customers. That superconductor demand appears healthy but we continue to experience supply chain challenges there as well, due to some material shortages.

Moving to slide 8 and 9 now, we continue to make good progress with our Project Accelerate 2.0 initiatives which in €˜22 now represent 56% of our total revenue. On slide 8, we highlight two recent acquisitions in Inscopix and Biognosys, and Inscopix is part of our fluorescence microscopy business, although it’s a very specialized way of doing life animal fluorescence microscopy, and Inscopix has really generated and pioneered that field of fundamental neuroscience, brain circuitry research. So this is not molecular and this is not just behavior this is crucial in between that we need to understand brain function in vivo brain function much better, they had about $20 million in ’22 revenue, their gross margins are well above 60%. And while this year, they only have a single digit EBIT margin because they’re investing a lot and we support that we expect them to have not only a double-digit revenue CAGR, but also to become accretive to operating margin over time, and become one of our more profitable businesses over a few years.

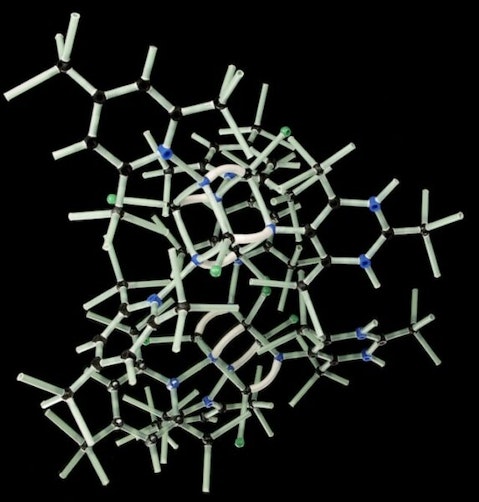

Photo by Photoholgic on Unsplash

But right now, they’re very much in growth and fast investment mode. Somewhat similar but, but also a slightly different story on Biognosys where we did go into this specialty drug discovery and development research services or DRO services, not a general strategy for us, as you may know, but very much beneficial in the specialty proteomics services field, where by the way Biognosys also has some very key consumables kits and software. So they’re a mix of DRO drug discovery, and proteomics specialty tools businesses, they had about $15 million in €˜22 revenue, we’re also expecting them to have a long-term double digit CAGR, CAGR in the double digits. And this year, because of in €˜23, because of significant investments that we support, including their rollout of their US facility, we expect them to be not — do not expect them to be profitable.

But over time, we think they will also then become accretive to our operating margin over time. This will take a few years, but a very key additional acquisition in proteomics. Moving on to slide 9, just very briefly, something that you probably don’t have much visibility on, and we had a press release on this in December. But many of our technologies within BEST are not only used for high energy physics experiments, or big science or MRI, by our MRI OEM customers, but increasingly also by clean tech as clean tech technologies under development. And here are examples of contracts that we have received for over $50 million for superconducting materials from an Asian Pilot Plant on fusion magnetic confinement fusion Pilot Plant, as well as from ITER indirectly, for something that is part of the diverter, or I don’t expect you to be experts in how magnetic fusion and ITER work.

But those are the parts of the ITER machine that have the highest heat and radiation low and we have some very specialized materials there and got those long-term contracts. By the way, these are all multiyear contracts. This will not be all be €˜23 or €˜24 revenue. Superconductors also may play an increasing role in offshore 20 megawatt and larger wind turbines. The investments in Europe and Asia and particularly in the US that are planned for offshore wind are enormous and larger, more efficient wind turbines probably will get away from rare earth materials because they get too heavy. It also is only sourced in one country, China in this case. And so there may be a bright future for superconductors in offshore wind turbines, more of an outlook for some future growth areas on which you probably haven’t had much visibility.

So let me wrap up on slide 10 illustrates our revenue mix continues to improve, Project Accelerate 2.0 now present 56% of our revenues. Year-by-year the changes are incremental. But if you look at this at the last pre COVID year, not 2019. It’s up from 46% to now 56%. This along with operational excellence obviously advances our growth and our operating margins, and opens up very new, very large new TAMs for us, particularly the large opportunities for this decade and the next in proteomics and spatial biology. We’re still an instruments company and proud to be that one, an instruments company because that’s where we innovate and create new markets. But our recurring revenue has advanced from the mid-20s percentage to 30% as you see in the lower left, and our geographic balance has really changed dramatically with fast growth particularly in the Americas, to where Americas and EMEA are at parity and about 33% and very, very similar to our broader APAC, South Asia revenue, which is about 34% of Bruker’s total global revenue, also quite a different picture than from a few years ago.

Well, let me wrap things up. In summary, during 2022 Bruker again made excellent progress. We closed several key technology and capabilities acquisitions, particularly in fluorescence microscopy, neuroscience and proteomics in the last 13 months, and we are expanding the breadth and depth of our capabilities as well as entering new attractive markets as I’ve referred to earlier, very proud of the agility and responsiveness of our teams and addressing the supply chain challenges. Moving forward, our high backlog for 2023 gives us good visibility into another promising year ahead. And in 2023, we intend to combine rapid revenue growth, further gross margin expansion and solid EPS growth with additional strategic R&D and Commercial Investments, particularly in proteomics and spatial biology.

And for 2023, we expect to reach our previously announced medium term target of R&D investment of 10% of revenues, which is a 70 bps step up or increase from 9.3% in 2022. So we are really investing very significantly while improving our financial performance year-over-year. It’s a good strategy. It’s a good process. And with that, let me turn the call over to our CFO, Gerald Herman, who will review Bruker’s financial performance and outlook in more detail. Gerald?

Gerald Herman: Thank you, Frank. And thank you everyone for joining us today. I am pleased to provide more detail on Bruker’s fourth quarter and full year 2022 financials. Starting in slide 12, in the fourth quarter of 2022, Bruker’s reported revenue increased 3.6% to approximately $708 million, which reflects an organic revenue increase of 8.9% year-over-year. We reported GAAP EPS of $0.66 per share, compared to $0.50 in the fourth quarter of 2021. On a non-GAAP basis, the fourth quarter €˜22 EPS was $0.74 per share, an increase of 25% compared to $0.59 in the fourth quarter of 2021. Our fourth quarter 2022 non-GAAP operating income grew 3.5% year-over-year, with the fourth quarter €˜22 non-GAAP operating margins about flat year-over-year at 21%.

Now the strong gross margin expansion was offset by higher R&D and Commercial Investments for Project Accelerate 2.0 initiatives as well as by inflation related costs. We finished the fourth quarter with cash, cash equivalents and short-term investments of approximately $646 million. During the quarter, we used cash to fund selected Project Accelerate 2.0 investments in our key strategic opportunities, capital expenditures, and of course, our dividend program. In the fourth quarter, we purchased approximately 435,000 shares of Bruker stock, for total consideration is about $26 million. For the full year of 2022, our repurchases totaled 4.2 million shares, or approximately $265 million. We generated $159 million of operating cash flow in the fourth quarter, which after a capital expenditure investment resulted in $135 million in free cash flow for the fourth quarter of €˜22.

This represents a $25 million increase from the fourth quarter of €˜21 due primarily to higher net income in the quarter. Slide 13 shows the revenue bridge for the fourth quarter of €˜22. As noted earlier, organic revenue in the quarter increased 8.9%. We had a positive revenue contribution from acquisitions of 1.7% and a foreign currency headwind of 7%. From an organic revenue growth perspective, and compared to the fourth quarter of 202, BioSpin fourth quarter revenue for the fourth quarter €˜22 slightly increase in the high single digit percentage with a notable strength in our PCI and BioSpin software businesses. Nano organic revenue grew in the low 20% on strength in semicon metrology and our surface materials and Nano analysis tools divisions.

CALID Group performance was constrained by supply chain delays in the fourth quarter of €˜22. But bookings were again robust. Order bookings in CALID in the fourth quarter were significantly higher than revenues for a book-to-bill meaningfully above one. Fourth quarter €˜22 BSI systems revenue and aftermarket were both up high single digit percentages organically compared to the fourth quarter of 2021. Geographically and on an organic basis in the fourth quarter of 2022, our European revenue is down mid-single digit percentage year-over-year, Americas grew in the high single digit percentage range, and the APAC region grew in the 20% range year-over-year. The rest of world fourth quarter €˜22 revenue was higher year-over-year in the high teens percentage.

Slide 14 shows our fourth quarter €˜22 P&L performance on — fourth quarter €˜22 non-GAAP gross margin of 52.6% increased to 140 basis points from 51.2% in the fourth quarter of ’21 due to increased capacity utilization, favorable revenue mix and volume leverage. Fourth quarter €˜22 non-GAAP operating expenses were up 8.2% compared to the fourth quarter of 2021 and reflect the continuing acceleration of R&D and Commercial Investments in Project Accelerate 2.0, including in proteomics and spatial biology, in addition to increased costs related to inflation. For the fourth quarter of 2022, our non-GAAP effective tax rate was 20.6% compared to 34.4% in the fourth quarter €˜21, primarily due to a favorable US tax clarification issued in the fourth quarter of €˜22.

Weighted average diluted shares outstanding in the fourth quarter of €˜22 was $147.9 million, a reduction of approximately 4.6 million shares or 3% from the fourth quarter of €˜21, resulting from our share repurchase activity over the past year. Finally, fourth quarter €˜22 non-GAAP EPS of $0.74 was up 25% compared to $0.59 in the fourth quarter of €˜21. Slide 15 shows the year-over-year revenue bridge for the full year of €˜22. Revenue was up $113 million, or 4.7%, including organic growth 10.2% following a very strong 2021 organic growth comp of over 19%. Acquisitions added 1.4% to our top line, while foreign exchange was a 7% headwind for the full year of €˜22. P&L results for the full year €˜22 is summarized on slide 16. For the full year, gross margin expanded 150 basis points to 52.6% reflecting higher revenue, volume leverage and more favorable mix from Project Accelerate 2.0 while operating margins grew 60 basis points to 20.0% for many of the same reasons.

The full non-GAAP tax rate was 27.7% compared to a 28% rate in /21. Turning now to slide 17, in the full year of €˜22, we generated $143 million of free cash flow, approximately $47 million lower than in 2021. Full year €˜22 free cash flow benefited from higher net income more than offset by higher working capital related to our increased volume, proper inventories and the timing of receivables. Our capital expenditures in the year reflect our continuing investments in growth capacity and productivity as part of our operational excellence drive. Our cash conversion cycle at the end of the fourth quarter of €˜22 was 229 days, an increase in 21 days compared to the fourth quarter of €˜21. This increases due to higher working capital needs to cushion supply chain risks.

Turning now to slide 19, given our continued strong bookings growth and backlog in 2022, we expect solid growth in 2023. Our outlook for 2023 includes, we are now guiding to organic revenue growth of 8% to 10% year-over-year, we estimate a foreign currency tailwind of about 1.5% with acquisitions also contributing about 1.5% to growth. This is expected to lead to reported revenue of $2.81 billion to $2.86 billion, representing growth in a range of 11% to 13% compared to 2022. For 2023, we expect to reach our medium-term R&D target of approximately 10% of revenues. That’s a 70 basis points step up from the 9.3% level we delivered in 2022. Nonetheless, we expect our innovative portfolio to continue to deliver solid gross margin expansion and operating profit growth in €˜23.

And we’re targeting 7% to 9% year-over-year non-GAAP operating profit growth in 2023. Organic operating margins are expected to expand approximately 50 basis points in 2023 with a combined transitory headwind in 2023 of about 120 basis points from foreign exchange and dilution from our recent acquisitions, is expected to decrease our non-GAAP operating margins by approximately 70 basis points to about 19.3% for 2023. We expect operating margins to rebound from this anticipated 2023 dip in 2024. And our medium-term goal continues to be to expand our non-GAAP operating margins well beyond our 20% level, which we achieved for the first time in 2022. As Frank mentioned, our recent acquisitions are highly synergistic and strategic. We expect them to develop to deliver double digit revenue growth, rapid margin improvement, and strong shareholder returns over time.

On the bottom line, we’re guiding to non-GAAP EPS for 2023 in a range of $2.52 to $2.57, or non-GAAP EPS growth of 8% to 10% compared to 2022. This would also represent a 13% non-GAAP EPS CAGR from our $1.57 pre-pandemic level in fiscal year 2019. We are projecting a non-GAAP tax rate of approximately 28% for the full year €˜23. Other guidance assumptions are listed on the slide. And our full year 2023 ranges have been updated for foreign currency rates as of January 31, 2023. So to wrap up, Bruker delivered strong bookings, backlog and revenue growth in the fourth quarter, capping off another year of very good financial improvement. We’re carrying bookings momentum, innovative products and a record backlog in 2023, giving us good confidence in our ability to deliver another solid financial performance in 2023.

With that, I’d like to turn the call over to Justin to start the Q&A session. Thank you very much.

Justin Ward: Thank you, Gerald. I’d now like to turn the call over to the operator to begin the Q&A portion of the call. As a reminder, to allow everyone time for questions, we ask that you limit yourself to one question and one follow up. Operator?

See also 15 Most Sustainable Companies in the World and 10 Largest Prisons in the World.

Q&A Session

Follow Bruker Corp (NASDAQ:BRKR)

Follow Bruker Corp (NASDAQ:BRKR)

Receive real-time insider trading and news alerts

Operator: Our first question will come from Puneet Souda with SVB Securities.

Puneet Souda: Yes. Hi, Frank. Gerald, thanks for taking my questions. So first one is on just book-to-bill that came in obviously greater than one. Could you maybe elaborate on bookings? Are they skewing to one segment versus the other among the instrumentation? And on CALID, you were supply, you said your supply chain constraint. We obviously have been hearing from other peer groups on instrumentations supply chains have been getting addressed throughout the year. So could you talk a little bit about that and what visibility you have on supply chains there and what instruments are maybe sort of impacted there. And then I have follow-up.

Frank Laukien : Hi. I’d I’ll start with that the book-to-bill greater than one in the BSI segment, strength in timsTOF for sure, BioSpin had very strong bookings. But it was really nothing that dropped out or something like that. Some of the applied and industrial areas remained pretty resilient. We kept an eye on that. And then geographically a bit of a surprise is that Europe had such strong bookings in Q4. I think those are maybe the more remarkable things that you may, some of them may surprise you and some are as expected. To the second point supply chain. Yes, it is getting better, but that just certainly not getting worse. But there still are some things that sometimes there’s just a part or a few parts that delayed deliveries we got, for instance in the CALID Group, both the Bruker optics, molecular spectroscopy, but also our timsTOF line got delayed and some deliveries sometimes it’s even just even the chromatography equipment and so on that can be delayed.

So I don’t want to bore you with the details, but it’s not that it’s all smooth sailing, this will still take some time to sort itself out, it is getting better, but that it’s not gone. And so it still is a drag on revenue, which is we didn’t really intend to build our backlog further in Q4, but that we delivered good revenue growth. But we also had delightfully better than expected, perhaps, or better than feared if you — if we were all a little concerned what’s going on with the economy. So we’re pretty pleased that our bookings were so strong and yes, that our backlog went up yet again. So that’s the bigger picture there.

Puneet Souda: Got it. Okay, helpful. And then just general on off margin, dip in here in 2023. Could you talk a little bit about those R&D investments that you’re talking about? How should we think about off margin cadence throughout the year, and then just if I could squeeze one in on China? Frank, we’ve been hearing €“

Frank Laukien : One by one, – sorry.

Puneet Souda: Appreciate it. But this is an important one, I would love to get your view on the RMB 1.7 trillion and 200 billion instrumentation, certainly sort of stimulus there. I know it’s a loan, but love to get you because you’re obviously strong in instrumentation. So we’d love to get your thoughts there that could be meaningful. Thank you.