Investing in hedge funds can bring large profits, but it’s not for everybody, since hedge funds are available only for high-net-worth individuals. They generate significant returns for investors to justify their large fees and they allocate a lot of time and employ complex research processes to determine the best stocks to invest in. A particularly interesting group of stocks that hedge funds like is the small-caps. The huge amount of capital does not allow hedge funds to invest a lot in small-caps, but our research showed that their most popular small-cap ideas are less efficiently priced and generate stronger returns than their large- and mega-cap picks and the broader market. That is why we pay special attention to the hedge fund activity in the small-cap space. Nevertheless, it is also possible to find underpriced large-cap stocks by following the hedge funds’ moves. In this article, we look at what those funds think of Brookfield Asset Management Inc. (NYSE:BAM) based on that data.

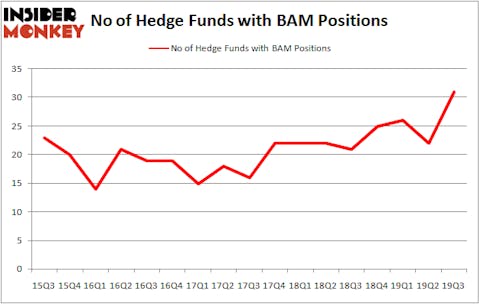

Brookfield Asset Management Inc. (NYSE:BAM) shareholders have witnessed an increase in support from the world’s most elite money managers in recent months. Our calculations also showed that BAM isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video at the end of this article for Q2 rankings).

According to most shareholders, hedge funds are assumed to be unimportant, old investment tools of the past. While there are over 8000 funds trading at present, Our researchers choose to focus on the masters of this group, approximately 750 funds. These hedge fund managers handle the lion’s share of all hedge funds’ total capital, and by shadowing their matchless investments, Insider Monkey has unearthed various investment strategies that have historically outstripped Mr. Market. Insider Monkey’s flagship short hedge fund strategy outstripped the S&P 500 short ETFs by around 20 percentage points annually since its inception in May 2014. Our portfolio of short stocks lost 27.8% since February 2017 (through November 21st) even though the market was up more than 39% during the same period. We just shared a list of 7 short targets in our latest quarterly update .

Tom Gayner of Markel Gayner Asset Management

We leave no stone unturned when looking for the next great investment idea. For example Discover is offering this insane cashback card, so we look into shorting the stock. One of the most bullish analysts in America just put his money where his mouth is. He says, “I’m investing more today than I did back in early 2009.” So we check out his pitch. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. We even check out this option genius’ weekly trade ideas. This December, we recommended Adams Energy as a one-way bet based on an under-the-radar fund manager’s investor letter and the stock already gained 20 percent. Keeping this in mind we’re going to go over the fresh hedge fund action surrounding Brookfield Asset Management Inc. (NYSE:BAM).

How have hedgies been trading Brookfield Asset Management Inc. (NYSE:BAM)?

Heading into the fourth quarter of 2019, a total of 31 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 41% from the second quarter of 2019. Below, you can check out the change in hedge fund sentiment towards BAM over the last 17 quarters. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to Insider Monkey’s hedge fund database, Markel Gayner Asset Management, managed by Tom Gayner, holds the number one position in Brookfield Asset Management Inc. (NYSE:BAM). Markel Gayner Asset Management has a $307 million position in the stock, comprising 4.6% of its 13F portfolio. The second most bullish fund manager is Akre Capital Management, managed by Charles Akre, which holds a $282.7 million position; the fund has 2.8% of its 13F portfolio invested in the stock. Some other members of the smart money that are bullish encompass Robert Joseph Caruso’s Select Equity Group, Martin Whitman’s Third Avenue Management and Murray Stahl’s Horizon Asset Management. In terms of the portfolio weights assigned to each position Greenlea Lane Capital allocated the biggest weight to Brookfield Asset Management Inc. (NYSE:BAM), around 22.4% of its 13F portfolio. Third Avenue Management is also relatively very bullish on the stock, designating 7.59 percent of its 13F equity portfolio to BAM.

As aggregate interest increased, key money managers were breaking ground themselves. Akre Capital Management, managed by Charles Akre, initiated the most outsized position in Brookfield Asset Management Inc. (NYSE:BAM). Akre Capital Management had $282.7 million invested in the company at the end of the quarter. Steve Cohen’s Point72 Asset Management also made a $11.6 million investment in the stock during the quarter. The other funds with brand new BAM positions are Andrew Weiss’s Weiss Asset Management, David Alexander Witkin’s Beryl Capital Management, and James Dondero’s Highland Capital Management.

Let’s also examine hedge fund activity in other stocks similar to Brookfield Asset Management Inc. (NYSE:BAM). These stocks are General Dynamics Corporation (NYSE:GD), HDFC Bank Limited (NYSE:HDB), Uber Technologies, Inc. (NYSE:UBER), and Intercontinental Exchange Inc (NYSE:ICE). This group of stocks’ market values are similar to BAM’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| GD | 40 | 7033615 | 0 |

| HDB | 36 | 2347772 | 9 |

| UBER | 45 | 3397033 | -11 |

| ICE | 43 | 2290732 | 8 |

| Average | 41 | 3767288 | 1.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 41 hedge funds with bullish positions and the average amount invested in these stocks was $3767 million. That figure was $1143 million in BAM’s case. Uber Technologies, Inc. (NYSE:UBER) is the most popular stock in this table. On the other hand HDFC Bank Limited (NYSE:HDB) is the least popular one with only 36 bullish hedge fund positions. Compared to these stocks Brookfield Asset Management Inc. (NYSE:BAM) is even less popular than HDB. Hedge funds clearly dropped the ball on BAM as the stock delivered strong returns, though hedge funds’ consensus picks still generated respectable returns. Our calculations showed that top 20 most popular stocks among hedge funds returned 41.1% in 2019 through December 23rd and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. A small number of hedge funds were also right about betting on BAM as the stock returned 52.5% in 2019 (through December 23rd) and outperformed the market by an even larger margin.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Disclosure: None. This article was originally published at Insider Monkey.