We can judge whether Brookdale Senior Living, Inc. (NYSE:BKD) is a good investment right now by following the lead of some of the best investors in the world and piggybacking their ideas. There’s no better way to get these firms’ immense resources and analytical capabilities working for us than to follow their lead into their best ideas. While not all of these picks will be winners, our research shows that these picks historically outperformed the market when we factor in known risk factors.

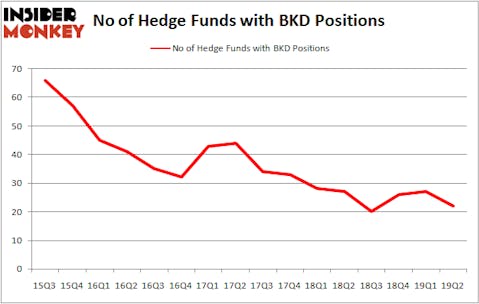

Brookdale Senior Living, Inc. (NYSE:BKD) was in 22 hedge funds’ portfolios at the end of June. BKD has seen a decrease in hedge fund interest of late. There were 27 hedge funds in our database with BKD positions at the end of the previous quarter. Our calculations also showed that BKD isn’t among the 30 most popular stocks among hedge funds (see the video below).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

According to most stock holders, hedge funds are seen as worthless, old investment vehicles of the past. While there are more than 8000 funds trading at present, Our researchers look at the moguls of this group, around 750 funds. These investment experts handle most of all hedge funds’ total capital, and by watching their highest performing equity investments, Insider Monkey has determined many investment strategies that have historically outrun the broader indices. Insider Monkey’s flagship hedge fund strategy outrun the S&P 500 index by around 5 percentage points per year since its inception in May 2014. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 25.7% since February 2017 (through September 30th) even though the market was up more than 33% during the same period. We just shared a list of 10 short targets in our latest quarterly update .

Unlike former hedge manager, Dr. Steve Sjuggerud, who is convinced Dow will soar past 40000, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. We’re going to review the fresh hedge fund action encompassing Brookdale Senior Living, Inc. (NYSE:BKD).

How are hedge funds trading Brookdale Senior Living, Inc. (NYSE:BKD)?

At the end of the second quarter, a total of 22 of the hedge funds tracked by Insider Monkey were long this stock, a change of -19% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards BKD over the last 16 quarters. With hedge funds’ capital changing hands, there exists an “upper tier” of noteworthy hedge fund managers who were adding to their stakes meaningfully (or already accumulated large positions).

Of the funds tracked by Insider Monkey, Glenview Capital, managed by Larry Robbins, holds the number one position in Brookdale Senior Living, Inc. (NYSE:BKD). Glenview Capital has a $132.9 million position in the stock, comprising 1.2% of its 13F portfolio. The second most bullish fund manager is Stephen DuBois of Camber Capital Management, with a $90.1 million position; the fund has 4.2% of its 13F portfolio invested in the stock. Some other members of the smart money with similar optimism consist of Renaissance Technologies, James E. Flynn’s Deerfield Management and Jonathan Litt’s Land & Buildings Investment Management.

Because Brookdale Senior Living, Inc. (NYSE:BKD) has experienced declining sentiment from the smart money, it’s safe to say that there was a specific group of hedge funds who were dropping their positions entirely heading into Q3. Interestingly, Paul Marshall and Ian Wace’s Marshall Wace LLP said goodbye to the biggest investment of all the hedgies monitored by Insider Monkey, comprising close to $2 million in stock, and Benjamin A. Smith’s Laurion Capital Management was right behind this move, as the fund dropped about $1.4 million worth. These transactions are interesting, as total hedge fund interest fell by 5 funds heading into Q3.

Let’s check out hedge fund activity in other stocks similar to Brookdale Senior Living, Inc. (NYSE:BKD). We will take a look at Linx S.A. (NYSE:LINX), Sirius International Insurance Group, Ltd. (NASDAQ:SG), Cavco Industries, Inc. (NASDAQ:CVCO), and Cars.com Inc. (NYSE:CARS). This group of stocks’ market values are similar to BKD’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| LINX | 14 | 84329 | 14 |

| SG | 1 | 3377 | 0 |

| CVCO | 16 | 135968 | -3 |

| CARS | 29 | 323559 | 2 |

| Average | 15 | 136808 | 3.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 15 hedge funds with bullish positions and the average amount invested in these stocks was $137 million. That figure was $473 million in BKD’s case. Cars.com Inc. (NYSE:CARS) is the most popular stock in this table. On the other hand Sirius International Insurance Group, Ltd. (NASDAQ:SG) is the least popular one with only 1 bullish hedge fund positions. Brookdale Senior Living, Inc. (NYSE:BKD) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. Hedge funds were also right about betting on BKD, though not to the same extent, as the stock returned 5.1% during the third quarter and outperformed the market as well.

Disclosure: None. This article was originally published at Insider Monkey.