Boyar Value Group commentary for the second quarter ended June 2020, discussing that S&P 500 is a market cap weighted index.

“What you need to do is operate your company in such way, knowing That you will be weighted one day. Never spend any time thinking about the daily stock price. I never do.” – Jeff Bezos

The Boyar Value Group (like most companies) continues to work remotely. Our investment in technology is paying dividends, as we were able to seamlessly transition to a remote environment, and it is business as usual. Our group is in constant contact, and our analyst team is working diligently to uncover value on behalf of our clients. We hope to return to our New York City office as soon as possible.

Q2 2020 hedge fund letters, conferences and more

Index Leadership

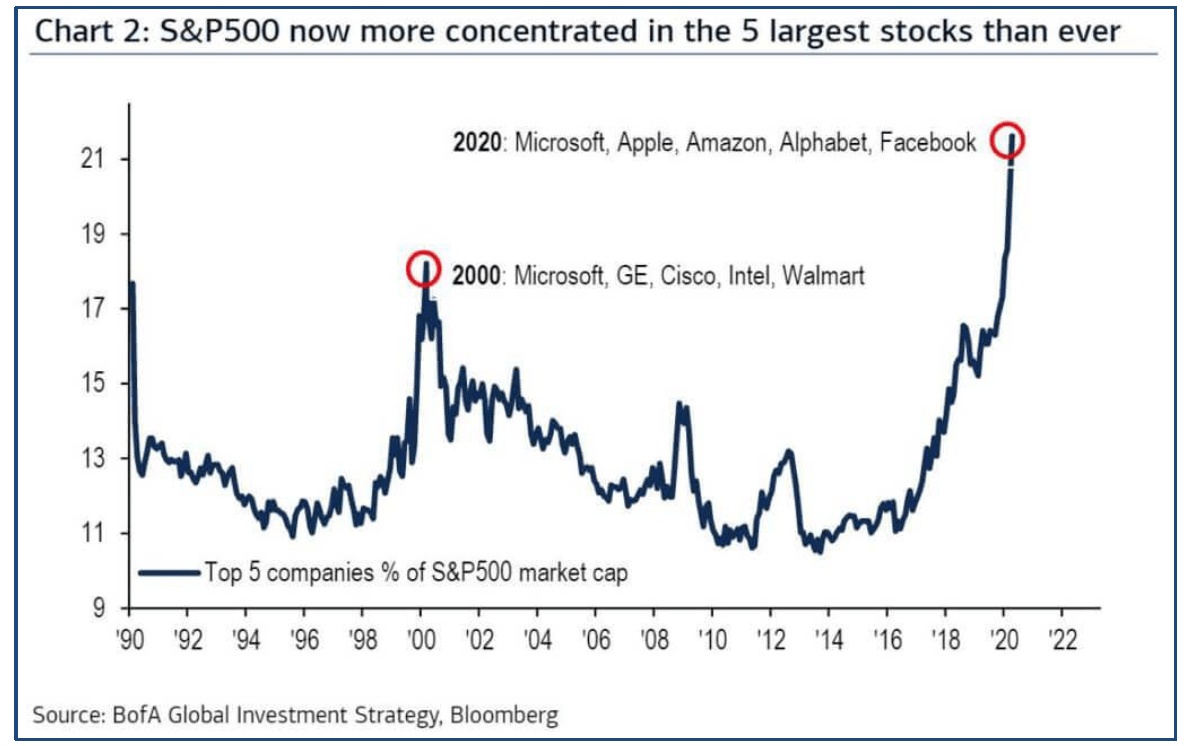

The S&P 500 is a market cap weighted index: the larger the market capitalization of a company, the greater its impact on the index’s return. As of July 10, Microsoft’s average weight for the year was 5.34%, Apple’s 5.09%, Amazon’s 3.71%, Facebook’s 1.96%, and Alphabet’s 3.25%. On average, these 5 companies have accounted for ~19.35 % of the index throughout 2020—and it would take the next 19 largest companies in the index (including such heavyweights as Berkshire Hathaway (NYSE:BRK-B), Intel (INTC), Procter & Gamble (PG), and Home Depot) to equal their weighting.

Through July 10, these 5 mega capitalization technology stocks produced an average return of 31.7% while the S&P 500 decreased by .41%. These high-flyers are masking the pain that many of the stocks in the index are experiencing. Without these 5 stocks, the S&P would be down ~6.85% for the year. This return would still outpace the performance of a “typical” stock in the index for 2020, as the “average” stock in the S&P has decreased by about 11% and well over 160 stocks in the S&P 500 have lost 20% or more of their value. Because of the tech stock outperformance, the index weightings of these 5 major technology companies have increased significantly throughout 2020, making their contributions to the index’s return even more impactful.

Index Concentration-Buyer Beware

If history is any guide, this index concentration could be dangerous for investors in these high-flying shares. In 2000, around 19% of the S&P 500 was concentrated in Microsoft, General Electric, Cisco, Intel, and Walmart. From the bursting of the dotcom bubble to the October 9, 2002, S&P 500 low, each of these stocks (except for Walmart, which lost 7.39% of its value), significantly underperformed the S&P 500. This underperformance ranged from ~9% in the case of GE, which lost 56% of its value (compared with the S&P, which lost 47.5% of its value), to Cisco Systems, which lost a staggering 88%.

Calculating the return of these stocks from the dotcom bust to the 2007 S&P 500 peak reveals that each former Wall Street darling significantly underperformed the S&P 500’s 14.95% return. The “best” performer in the group was GE, which lost a mere 5%, and the worst performer was Intel, which lost 60%. Like today’s market leaders, these were great companies that were dominant in their respective fields. However, from an investment perspective, they were simply too expensive. Cisco Systems sold for well over 100x earnings, Intel for 60x, and Microsoft for 73x. While today’s leaders (except Amazon) are not as expensive on a p/e basis, investors in these companies should proceed with caution. Remember—you can buy the greatest company in the world, but if you pay too much for it, you will not receive a satisfactory return. The price you pay for a stock is just as important to your investment outcome as which stock you purchase.

A senior strategist at Ned Davis Research, a well-known investment research firm, has warned that Facebook, Amazon, Netflix, Microsoft, Apple, and Alphabet have bubble like characteristics. Ned Davis compiles a historical bubble composite, which according to an article written by Ben Levisohn of Barron’s aggregates the 1929 Dow Jones Industrial Average, the price of gold in 1980, Japan’s Nikkei 225 in 1989, and the Nasdaq Composite in 2000 (all peak bubble periods).

Ned Davis has pointed out that a market cap weighted index of the aforementioned 6 technology names tracks the bubble composite almost perfectly. The composite of the bubble periods just mentioned gained 33.33% annually during the 5 years heading into its peak, whereas these 6 technology stocks have gained 32.91% annually during the 5 years ending July 10. Ned Davis Research also notes that they trade at 36x earnings and 6x sales, the latter of which is the highest figure on record. However, they are not calling a market top, believing that if the rest of the market advances, the Big 6 may reach new highs.

Major Index Performance

The Nasdaq 100 index, which is heavily weighted toward technology shares, has been 2020’s standout performer (advancing almost 25% through July 10). Almost 40% of the index’s weight consists of Apple, Microsoft, Amazon, and Facebook shares. (These 4 companies have increased an average of 40% for 2020.) Buyers of this index, however, are paying a heavy price—it is currently trading at a nosebleed 34x earnings. What’s more, the Nasdaq 100 is also currently exhibiting certain similarities between now and the dotcom era, trading 21% above its average price over the past 100 days—the widest spread since March 2000.

At ~22x earnings, the S&P 500 is certainly no bargain either (especially considering all the uncertainty in the world). During the March 2020 low, the index briefly reached a more reasonable ~14.6x. The S&P 500 equal weighted index sells for 18.4x earnings—clearly cheaper, but still far from cheap.

Small capitalization stocks have fared the worst. As of July 9, the Russell 2000 (a basket of small company stocks) was down ~14%, but the “typical” stock in the index has done far worse. Simply computing the average of all the companies in the index masks the real pain within the index, with outliers like Novavax Inc. (which has gained more than 2000% for the year) skewing the results. Calculating the median return for each company, however, produces a negative 20% return. In addition, approximately 30% of the stocks in the Russell 2000 have lost 33% of their value in 2020. Things are the bleakest for small cap value shares. Through July 9, the Russell 2000 value index has lost ~28% of its value. The median stock in the index lost over 31%, and ~20% of the companies in the index have lost 50% or more of their value.

The Perils of Trying to Time the Market

The old stock market adage that “it is time in the market, not market timing” certainly held true during the first half of this current year. For all the dizzying turbulence, it is worth noting that the S&P 500 is nearly flat for anyone who sat tight and held through the chaos. Periods of stock market volatility should be the time when active managers shine, but the downside of getting it wrong (especially by trying to time the market) has rarely been greater. One stark statistic highlighting the risk of market timing focuses on the penalty an investor would have incurred by not being invested during the biggest single-day stock market gains. According to Bloomberg News, if an investor missed the five best days of this year, a mediocre 2020 became a disastrous one, with investors who were out of the market on those days down 30%. While it is highly unlikely that someone would miss just those days, this statistic helps demonstrate the value of staying the course.

With the number of days when the S&P 500 has increased or decreased by 2% increasing at a pace not seen in decades, now might seem like a great time to sit on the sidelines. However, trying to time the market is a fool’s errand—often the stock market rallies just when the situation looks the bleakest. This year is a perfect example: the S&P 500 dropped more than 5% during five sessions, four of them in March, when the world was in an all-out panic. However, that same terror-filled month, Bloomberg notes, also accounted for four of the five biggest gains. Timing the market is extremely difficult, but that hasn’t stopped investors from trying. Bears haven’t stopped calling for the S&P 500 to crash, potentially revisiting its March low, but if history is any guide, that scenario may not play out.

During the eight market cycles since World War II, only once has the S&P 500 come within 5% of its bear market low after 3 months have passed, according to a study by BMO Capital Markets.

– Analysis based on data reported by Lu Wang and Vildana Hajric of Bloomberg News.

Value Versus Growth

As we’ve described, the S&P’s recent rally has been fueled in large part by the significant advance of a small number of large capitalization technology-oriented growth stocks. In fact, growth stocks have been outperforming value by the widest margin in decades, with economic uncertainty pushing investors into companies that can deliver fast growth.

As the chart below shows, value shares haven’t been this cheap relative to growth stocks since the dotcom era when the bull market for growth stocks continued unabated until March 2000, when the dotcom craze took a nosedive that lasted years. The NASDAQ Index, which had risen fivefold between 1995 and 2000, tumbled from a peak of 5,048 on March 10, 2000, to 1,139 on October 4, 2002—a decline of 76.81%. During the next couple of years, our style of investing came back into vogue as value once again shone. We see no reason history should not repeat itself once again.

Conventional investment theory suggests that value stocks, such as banks and industrials, tend to do better when the economy begins to recover from a downturn, because many value stocks are particularly sensitive to the ebb and flow of economic activity. A recent note penned by David Kostin, chief U.S. equity strategist for Goldman Sachs, offers some insight:

“In our view the extreme valuation between the most expensive and least expensive stocks will most likely be closed when an ‘improving economic environment causes low valuation stocks to catch up with the current market leaders.’”

For the most part, today’s market leaders are not nearly as stretched as they were in 1999, but by any acceptable analytical benchmark, they are certainly not inexpensive. Throughout our careers we have seen growth trounce value for extended periods from time to time. When this has happened, we have been called dinosaurs, with more than a few market observers concluding that value investors’ metrics were no longer relevant and our investment style passé. In each instance, the naysayers were proven wrong. Although precisely when this will occur is anyone’s guess, we are confident that in the not-too-distant future value will once again have its day in the sun.

What Happens to the Market After a 30+% Intra-Year Decline?

At one point this year the S&P 500 was down 34%. Fortunately, such negative intrayear declines are rare. Before 2020, they had occurred only 4 times since 1980: In 1987, the S&P 500 was down 34% but ended the year up 2%. In 2001 the S&P was once down 30% but finished the year only down 13%. In 2002 the S&P 500 declined 34% intrayear and finished down 23%. In 2008, when the index dropped 49% intrayear, it finished down 38%.

More interesting (and encouraging) is what happened in the years immediately following a period when the stock market was down 30% or more intrayear: In 1987 the year ended up 2%, and the following 2 years registered gains of 12% and 27% respectively. In 2002, after losing 34% at one point, the S&P 500 had 5 positive years in a row, advancing 26% in 2003, 9% in 2004, 3% in 2005, 14% in 2006, and 4% in 2007. After the 2008 debacle, when at one point the index was down over 49%, the next 2 years registered gains of 23% and 13%, respectively. The only year when a gain did not occur the year after a 30+% intrayear decline was 2002, when the following year registered a loss of 23%. Admittedly, this is a small sample set, but if history is any guide, we could be in for future gains over the following years.

Fiscal Stimulus Coming to an End

Jamie Dimon, who is chairman and CEO of JP Morgan (and thus uniquely qualified to assess the state of the broader economy), made some interesting remarks in the company’s latest conference call:

“This is not a normal recession. The recessionary part of this you’re going to see down the road… You will see the effect of this recession. You’re just not going to see it right away because of all the stimulus.”

A large part of the fiscal stimulus ($600 a week in extra unemployment benefits) expires at the end of July. This has been a lifeline for many Americans who, through no fault of their own, lost their jobs. Congress and the president are currently negotiating what extension, if any, could occur, but with the economic recovery on shaky ground, and a vaccine or more established treatment still many months away (using the most optimistic scenarios), the federal government needs to continue benefits in some form to keep the economy afloat. If nothing is done, the “recessionary part” of the recession Mr. Dimon spoke of will become quite evident, as these payments have been quite significant. Unemployment benefits as a share of personal income usually are significantly less than 1% but at present are 6%. If these benefits lapse significantly, the nascent recovery could be derailed.

Tesla

Tesla’s (NASDAQ:TSLA) share price performance continues to defy gravity. Tesla shares started 2020 trading at ~$418 per share and now change hands at over $1,600 per share. Tesla’s market capitalization is over $300 billion and is now bigger than those of Bank of America and American Express combined. Elon Musk’s personal stake in Tesla is worth nearly as much as the combined market capitalization of General Motors and Ford, even though Tesla ended 2Q delivering only 90,650 vehicles. (For context, Ford delivered 2.4 million cars in 2019.)

As always, we’re available to answer any questions you might have. If you’d like to discuss these issues further, please reach out to us at jboyar@boyarvaluegroup.com or 212-995-8300.

Best regards,

Mark A. Boyar

Jonathan I. Boyar

See the full letter here.

This article first appeared on ValueWalk Premium.