Reputable billionaire investors such as Nelson Peltz and David Tepper generate exorbitant profits for their wealthy accredited investors (a minimum of $1 million in investable assets would be required to invest in a hedge fund and most successful hedge funds won’t accept your savings unless you commit at least $5 million) by pinpointing winning small-cap stocks. There is little or no publicly-available information at all on some of these small companies, which makes it hard for an individual investor to pin down a winner within the small-cap space. However, hedge funds and other big asset managers can do the due diligence and analysis for you instead, thanks to their highly-skilled research teams and vast resources to conduct an appropriate evaluation process. Looking for potential winners within the small-cap galaxy of stocks? We believe following the smart money is a good starting point.

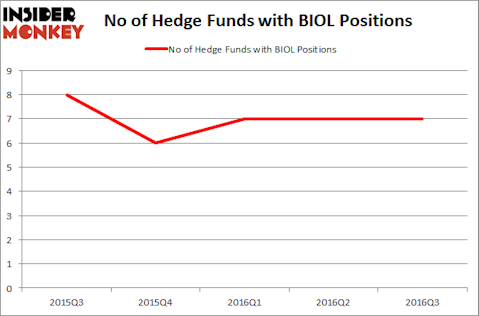

Hedge fund interest in BIOLASE Inc (NASDAQ:BIOL) shares was flat during the third quarter. This is usually a negative indicator. 7 hedge funds that we track owned the stock on September 30, same as on June 30. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Nabriva Therapeutics AG-ADR (NASDAQ:NBRV), Crown Crafts, Inc. (NASDAQ:CRWS), and First Trust Strategic High Income Fd II (NYSE:FHY) to gather more data points.

Follow Biolase Inc (NASDAQ:BIOL)

Follow Biolase Inc (NASDAQ:BIOL)

Receive real-time insider trading and news alerts

We care about hedge fund sentiment because historically hedge funds’ stock picks delivered strong risk adjusted returns. There are certain segments of the market where hedge funds’ stock picks performed much better than its benchmarks. For instance, the 30 most popular mid-cap stocks among the best performing hedge funds returned 18% over the last 12 months outpacing S&P 500 Index by more than 10 percentage points. We developed this strategy 2.5 years ago and started sharing its picks in our quarterly newsletter. It bested the S&P 500 Index ETFs by delivering a solid 39% vs. 22% gain for its benchmarks.

schegi/Shutterstock.com

How are hedge funds trading BIOLASE Inc (NASDAQ:BIOL)?

Heading into the fourth quarter of 2016, a total of 7 of the hedge funds tracked by Insider Monkey were bullish on this stock, unchanged from one quarter earlier. On the other hand, there were a total of 6 hedge funds with a bullish position in BIOL at the beginning of this year, so hedge fund sentiment has improved slightly in 2016. With hedge funds’ positions undergoing their usual ebb and flow, there exists a few noteworthy hedge fund managers who were boosting their holdings significantly (or already accumulated large positions).

When looking at the institutional investors followed by Insider Monkey, Mitchell Blutt’s Consonance Capital Management has the largest position in BIOLASE Inc (NASDAQ:BIOL), worth close to $3.1 million. Sitting at the No. 2 spot is Birchview Capital, led by Matthew Strobeck, which holds a $2.3 million position; 1.3% of its 13F portfolio is allocated to the stock. Remaining professional money managers that are bullish contain D E Shaw, one of the biggest hedge funds in the world, Mario Gabelli’s GAMCO Investors, and Adam Usdan’s Trellus Management Company. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds, which is based on the performance of their 13F long positions in non-micro-cap stocks.