A whopping number of 13F filings filed with U.S. Securities and Exchange Commission has been processed by Insider Monkey so that individual investors can look at the overall hedge fund sentiment towards the stocks included in their watchlists. These freshly-submitted public filings disclose money managers’ equity positions as of the end of the three-month period that ended September 30, so let’s proceed with the discussion of the hedge fund sentiment on BioDelivery Sciences International, Inc. (NASDAQ:BDSI).

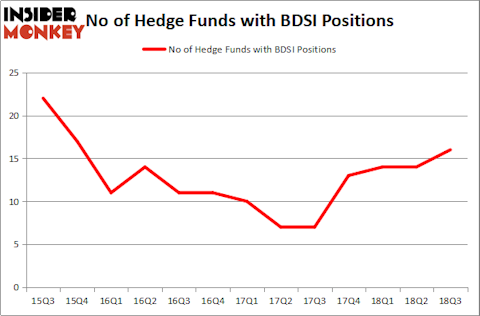

Is BioDelivery Sciences International, Inc. (NASDAQ:BDSI) undervalued? Hedge funds are becoming more confident. The number of long hedge fund positions advanced by 2 lately. Our calculations also showed that BDSI isn’t among the 30 most popular stocks among hedge funds.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the market by 18 percentage points since May 2014 through December 3, 2018 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter.

We’re going to take a look at the latest hedge fund action regarding BioDelivery Sciences International, Inc. (NASDAQ:BDSI).

Hedge fund activity in BioDelivery Sciences International, Inc. (NASDAQ:BDSI)

Heading into the fourth quarter of 2018, a total of 16 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 14% from the second quarter of 2018. By comparison, 13 hedge funds held shares or bullish call options in BDSI heading into this year. With hedgies’ positions undergoing their usual ebb and flow, there exists a few noteworthy hedge fund managers who were adding to their holdings substantially (or already accumulated large positions).

More specifically, venBio Select Advisor was the largest shareholder of BioDelivery Sciences International, Inc. (NASDAQ:BDSI), with a stake worth $15.2 million reported as of the end of September. Trailing venBio Select Advisor was Broadfin Capital, which amassed a stake valued at $12.3 million. Armistice Capital, Nantahala Capital Management, and Ghost Tree Capital were also very fond of the stock, giving the stock large weights in their portfolios.

As one would reasonably expect, key money managers were leading the bulls’ herd. Nantahala Capital Management, managed by Wilmot B. Harkey and Daniel Mack, established the largest position in BioDelivery Sciences International, Inc. (NASDAQ:BDSI). Nantahala Capital Management had $4.7 million invested in the company at the end of the quarter. Jerome Pfund and Michael Sjostrom’s Sectoral Asset Management also initiated a $0.2 million position during the quarter. The only other fund with a brand new BDSI position is Gavin Saitowitz and Cisco J. del Valle’s Springbok Capital.

Let’s check out hedge fund activity in other stocks similar to BioDelivery Sciences International, Inc. (NASDAQ:BDSI). These stocks are County Bancorp, Inc. (NASDAQ:ICBK), New Home Company Inc (NYSE:NWHM), SI Financial Group, Inc. (NASDAQ:SIFI), and USA Truck, Inc. (NASDAQ:USAK). This group of stocks’ market valuations are similar to BDSI’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| ICBK | 2 | 3260 | 0 |

| NWHM | 4 | 22728 | -2 |

| SIFI | 6 | 17530 | -1 |

| USAK | 11 | 19629 | -4 |

| Average | 5.75 | 15787 | -1.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 5.75 hedge funds with bullish positions and the average amount invested in these stocks was $16 million. That figure was $56 million in BDSI’s case. USA Truck, Inc. (NASDAQ:USAK) is the most popular stock in this table. On the other hand County Bancorp, Inc. (NASDAQ:ICBK) is the least popular one with only 2 bullish hedge fund positions. Compared to these stocks BioDelivery Sciences International, Inc. (NASDAQ:BDSI) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio.

Disclosure: None. This article was originally published at Insider Monkey.