We at Insider Monkey have gone over 821 13F filings that hedge funds and prominent investors are required to file by the SEC The 13F filings show the funds’ and investors’ portfolio positions as of March 31st, near the height of the coronavirus market crash. In this article, we look at what those funds think of Bioceres Crop Solutions Corp. (NYSE:BIOX) based on that data.

Hedge fund interest in Bioceres Crop Solutions Corp. (NYSE:BIOX) shares was flat at the end of last quarter. This is usually a negative indicator. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Marinus Pharmaceuticals Inc (NASDAQ:MRNS), Western New England Bancorp, Inc. (NASDAQ:WNEB), and Penns Woods Bancorp, Inc. (NASDAQ:PWOD) to gather more data points. Our calculations also showed that BIOX isn’t among the 30 most popular stocks among hedge funds (click for Q1 rankings and see the video for a quick look at the top 5 stocks).

Video: Watch our video about the top 5 most popular hedge fund stocks.

To the average investor there are tons of indicators investors have at their disposal to evaluate their holdings. Two of the best indicators are hedge fund and insider trading sentiment. We have shown that, historically, those who follow the best picks of the top investment managers can outperform their index-focused peers by a solid margin (see the details here).

Chuck Royce of Royce & Associates

At Insider Monkey we leave no stone unturned when looking for the next great investment idea. For example, 2020’s unprecedented market conditions provide us with the highest number of trading opportunities in a decade. So we are checking out stocks recommended/scorned by legendary Bill Miller. We interview hedge fund managers and ask them about their best ideas. If you want to find out the best healthcare stock to buy right now, you can watch our latest hedge fund manager interview here. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. Our best call in 2020 was shorting the market when the S&P 500 was trading at 3150 after realizing the coronavirus pandemic’s significance before most investors. Now we’re going to review the key hedge fund action encompassing Bioceres Crop Solutions Corp. (NYSE:BIOX).

How have hedgies been trading Bioceres Crop Solutions Corp. (NYSE:BIOX)?

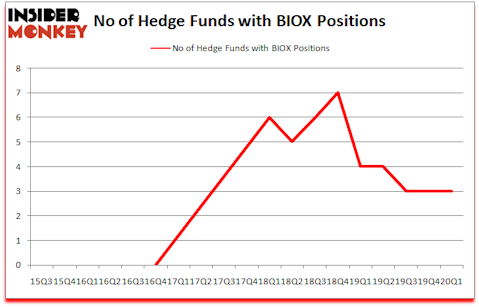

At the end of the first quarter, a total of 3 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 0% from the fourth quarter of 2019. The graph below displays the number of hedge funds with bullish position in BIOX over the last 18 quarters. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in Bioceres Crop Solutions Corp. (NYSE:BIOX) was held by Royce & Associates, which reported holding $0.2 million worth of stock at the end of September. It was followed by Ionic Capital Management with a $0.1 million position. The only other hedge fund that is bullish on the company was 683 Capital Partners.

Judging by the fact that Bioceres Crop Solutions Corp. (NYSE:BIOX) has faced declining sentiment from the entirety of the hedge funds we track, we can see that there were a few hedge funds that slashed their entire stakes heading into Q4. Intriguingly, Sander Gerber’s Hudson Bay Capital Management dropped the largest position of all the hedgies watched by Insider Monkey, comprising an estimated $0.1 million in stock, and Phillip Goldstein, Andrew Dakos and Steven Samuels’s Bulldog Investors was right behind this move, as the fund dumped about $0 million worth. These bearish behaviors are interesting, as total hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as Bioceres Crop Solutions Corp. (NYSE:BIOX) but similarly valued. We will take a look at Marinus Pharmaceuticals Inc (NASDAQ:MRNS), Western New England Bancorp, Inc. (NASDAQ:WNEB), Penns Woods Bancorp, Inc. (NASDAQ:PWOD), and First Choice Bancorp (NASDAQ:FCBP). This group of stocks’ market caps match BIOX’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| MRNS | 12 | 52863 | -2 |

| WNEB | 5 | 16705 | -1 |

| PWOD | 1 | 4410 | 0 |

| FCBP | 1 | 761 | 0 |

| Average | 4.75 | 18685 | -0.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 4.75 hedge funds with bullish positions and the average amount invested in these stocks was $19 million. That figure was $0 million in BIOX’s case. Marinus Pharmaceuticals Inc (NASDAQ:MRNS) is the most popular stock in this table. On the other hand Penns Woods Bancorp, Inc. (NASDAQ:PWOD) is the least popular one with only 1 bullish hedge fund positions. Bioceres Crop Solutions Corp. (NYSE:BIOX) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 10 most popular stocks among hedge funds returned 41.4% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks gained 8.3% in 2020 through the end of May and still beat the market by 13.2 percentage points. A small number of hedge funds were also right about betting on BIOX as the stock returned 36.5% during the second quarter and outperformed the market by an even larger margin.

Follow Bioceres Crop Solutions Corp. (NASDAQ:BIOX)

Follow Bioceres Crop Solutions Corp. (NASDAQ:BIOX)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.