Is Alliance Data Systems Corporation (NYSE:ADS) a good investment right now? We check hedge fund and billionaire investor sentiment before delving into hours of research. Hedge funds spend millions of dollars on Ivy League graduates, expert networks, and get tips from industry insiders. They sometimes fail miserably but historically their consensus stock picks outperformed the market after adjusting for known risk factors.

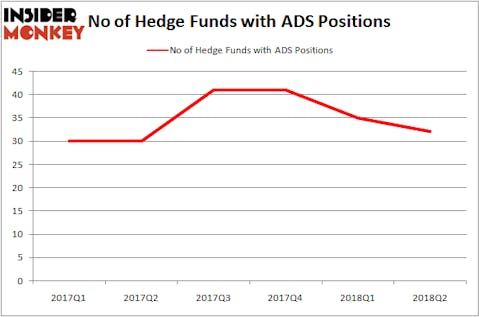

The hedge funds tracked by Insider Monkey’s database are very bullish on Alliance Data Systems, owning over 20% of the company’s common stock on June 30, though the number of hedge fund shareholders dipped by 9% to 32 in Q2. Hedge funds managed or founded by billionaires are especially big fans, with ADS ranking 14th on our countdown of the 25 Stocks Billionaires Are Piling On. Ray Dalio’s Bridgewater Associates (91,869 shares) and Ken Griffin’s Citadel Investment (207,881 shares) were among the billionaire-lead investment vehicles that were shareholders of Alliance Data Systems Corporation (NYSE:ADS) at the end of June. The company is looking to undergo a strategic review after a disappointing third quarter.

If you’d ask most shareholders, hedge funds are perceived as worthless, outdated investment tools of years past. While there are over 8,000 funds with their doors open at the moment, our experts hone in on the leaders of this group, around 700 funds. These money managers manage bulk of all hedge funds’ total capital, and by keeping track of their first-class stock picks, Insider Monkey has formulated a few investment strategies that have historically beaten the market. Insider Monkey’s small-cap hedge fund strategy outpaced the S&P 500 index by 12 percentage points per annum for a decade in their back tests.

Let’s take a gander at the key hedge fund action surrounding Alliance Data Systems Corporation (NYSE:ADS).

What does the smart money think about Alliance Data Systems Corporation (NYSE:ADS)?

At the end of the third quarter, a total of 32 of the hedge funds tracked by Insider Monkey held long positions in this stock, a dip of 9% from the previous quarter. Below, you can check out the change in hedge fund sentiment towards ADS over the last 6 quarters. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to Insider Monkey’s hedge fund database, Jeffrey Ubben’s ValueAct Capital has the biggest position in Alliance Data Systems Corporation (NYSE:ADS), worth close to $1.42 billion, amounting to 12.8% of its total 13F portfolio. The second-largest stake is held by Glenn Greenberg of Brave Warrior Capital, with a $403.6 million position; 16.5% of its 13F portfolio is allocated to the stock. Some other members of the smart money with similar optimism encompass Allan Mecham and Ben Raybould’s Arlington Value Capital, Ferdinand Groos’s Cryder Capital and Edward Goodnow’s Goodnow Investment Group.

Due to the fact that Alliance Data Systems Corporation (NYSE:ADS) has experienced declining sentiment from the entirety of the hedge funds we track, it’s easy to see that there were a few money managers that elected to cut their entire stakes by the end of the second quarter. Interestingly, Andreas Halvorsen’s Viking Global cut the biggest stake of the 700 funds tracked by Insider Monkey, valued at an estimated $388.4 million in stock. Joel Greenblatt’s fund, Gotham Asset Management, also sold off its stock, about $19.3 million worth. These transactions are important to note, as total hedge fund interest was cut by 3 funds during the second quarter.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as Alliance Data Systems Corporation (NYSE:ADS) but similarly valued. We will take a look at CarMax, Inc (NYSE:KMX), Symantec Corporation (NASDAQ:SYMC), Expeditors International of Washington (NASDAQ:EXPD), and IAC/InterActiveCorp (NASDAQ:IAC). All of these stocks’ market caps match ADS’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| KMX | 31 | 1734563 | 1 |

| SYMC | 25 | 1271392 | 1 |

| EXPD | 28 | 817239 | 2 |

| IAC | 51 | 2659934 | 0 |

As you can see these stocks had an average of 34 hedge funds with bullish positions and the average amount invested in these stocks was $1.62 billion. That figure was $2.61 billion in ADS’s case. IAC/InterActiveCorp (NASDAQ:IAC) is the most popular stock in this table. On the other hand Symantec Corporation (NASDAQ:SYMC) is the least popular one with only 25 bullish hedge fund positions. Alliance Data Systems Corporation (NYSE:ADS) is not the least popular stock in this group but hedge fund interest is still below average. However, there is nearly as much money invested in it as the much more heavily owned IAC, and billionaires love it as well. Given the potential catalyst of an upcoming asset sale or other strategic initiative to unlock value, it might be a good candidate to consider a long position in.

Disclosure: None. This article was originally published at Insider Monkey.