According to two recent filings with the SEC, Mason Hawkins‘ Southeastern Asset Management has significantly added to its stakes in Triangle Petroleum Corporation (NYSEMKT:TPLM) and Deltic Timber Corp (NYSE:DEL). Some 2.85 million shares of energy company Triangle Petroleum were acquired to lift the total stake at 8.59 million shares. The holding represents 11.4% of the company’s outstanding common stock. Hawkins also increased his firm’s exposure to Deltic Timber Corp (NYSE:DEL) by adding another 437,000 shares to the holding which now amounts to 1.30 million shares and represents 10.3% of the company’s outstanding shares. The above positions are held in part by Southeastern’s affiliated fund, Longleaf Partners Small-Cap Fund.

Professional investors like Hawkins spend considerable time and money conducting due diligence on each company they invest in, which makes them the perfect investors to emulate. However, we also know that the returns of hedge funds on the whole have not been good for several years, underperforming the market. We analyzed the historical stock picks of these investors and our research revealed that the small-cap picks of these funds performed far better than their large-cap picks, which is where most of their money is invested and why their performances as a whole have been poor. Why pay fees to invest in both the best and worst ideas of a particular hedge fund when you can simply mimic the best ideas of the best fund managers on your own? A portfolio consisting of the 15 most popular small-cap stock picks among the funds we track has returned more than 142% and beaten the market by more than 84 percentage points since the end of August 2012, and by 4.6 percentage points in the first quarter of this year (see the details).

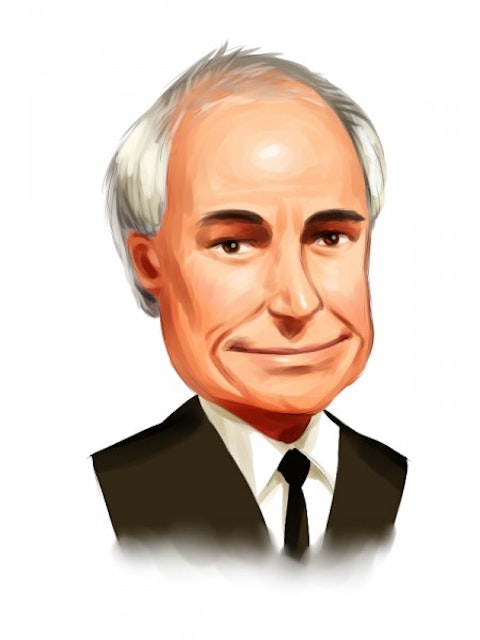

Mason Hawkins launched his Tennessee-based investment firm in 1975 along with two other partners, who left the firm in the 1980’s. The fund manager completed his MBA in finance in 1971 from the University of Georgia. Before launching Southeastern, Mason served as Director of Research at both Atlantic National Bank and First Tennessee Investment Management. Southeastern currently has $28.8 billion under its management and the market value of its public equity portfolio stood at $15.93 billion at the end of March, down from $17.38 billion at the end of the previous quarter. The finance and energy sectors represent most of the fund’s holdings, with the largest equity pick being Level 3 Communications, Inc. (NYSE:LVLT).

Follow Mason Hawkins's Southeastern Asset Management

Of the 8.59 million shares of Triangle Petroleum Corporation (NYSEMKT:TPLM) that Southeastern now holds, 8.50 million have a shared voting power while 91,100 do not have voting power. The $401.05 million energy holding company operates in three key areas in the Williston Basin of North Dakota and Montana, namely oil and gas exploration, development, and production, oilfield services, and thirdly, midstream services. The stock price of Triangle Petroleum Corporation (NYSEMKT:TPLM) is up by over 10% so far this year. In contrast the oil & gas E&P industry has only gained 2.45% during the same period. After Southeastern, Peter Adam Hochfelder‘s Brahman Capital is the largest stockholder of Triangle Petroleum Corporation (NYSEMKT:TPLM) as it holds about 3.79 million shares valued at $19.07 million.