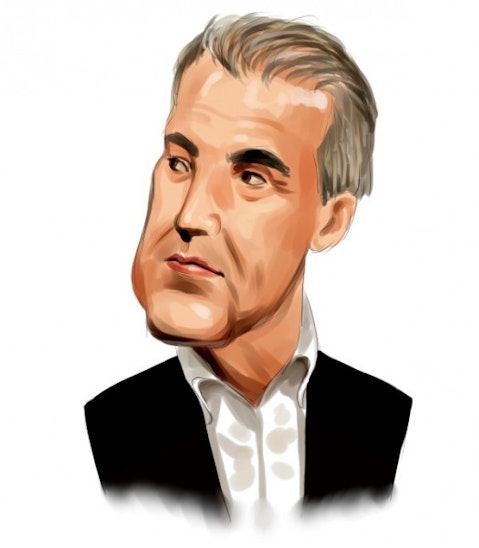

Debt securities maverick and billionaire Marc Lasry might be performing well on the basketball court lately, but his performance in the markets has taken a hit in the past few years. Mr. Lasry’s hedge fund, Avenue Capital, which he founded in 1995 along with his sister Sonia Gardner and which is counted among one of the largest multi-strategy funds in the world, has lost sizeable amount of assets under management in the last four years. The New York-based that at its peak managed over $14 billion in assets was down to $10.4 billion in AUM, as of January 31, 2017. This decline has also affected Mr. Lasry’s personal fortune, which has fallen considerably in the last two years.

According to Avenue Capital’s latest 13F filing, the value of its long US equity portfolio stood at $342.9 million at the end of 2016, 37.63% lower over the quarter. Moreover, during the fourth quarter the fund sold out its entire stake in 10 stocks, but initiated stakes in only six stocks. The filing also revealed that the fund’s equity portfolio experienced a high quarterly turnover of 100% during the October-December period. In this post, we will take a look at two major positions that Avenue Capital liquidated during the fourth quarter and its top-3 equity holdings going into 2017.

We follow over 700 hedge funds and other institutional investors and by analyzing their quarterly 13F filings, we identify stocks that they are collectively bullish on and develop investment strategies based on this data. One strategy that outperformed the market over the last year involves selecting the 100 best-performing funds and identifying the 30 mid-cap stocks that they are collectively the most bullish on. Over the past year, this strategy generated returns of 39.7%, topping the 24.1% gain registered by S&P 500 ETFs. Insider Monkey’s enhanced small-cap strategy registered gains of more than 45% over the last 12 months and outperformed SPY by more than 30 percentage points in the last 4.5 years (see details here).

General Motors Company (NYSE:GM)

– Shares Held By Avenue Capital (as of December 31): 0

– Value of The Holding (as of December 31): 0

General Motors Company (NYSE:GM), which had represented Avenue Capital’s seventh-largest position at the end of September, was sold entirely during the following three months, as the fund unloaded 803,000 shares. The reason for the fund’s sudden change in the sentiment towards the stock is hard to decipher considering that it had upped its stake in General Motors Company (NYSE:GM) by 35% during the third quarter itself. One of the reasons could be the over 15% rally that GM’s stock during the fourth quarter, which Avenue probably saw as an opportunity to liquidate the position. Shares of the auto maker have been trading in a range for more than three years now. However, since the company has hiked its quarterly dividend every year during that time, the stock currently sports an attractive forward yield of 4.12%. General Motors Company (NYSE:GM) recently has revealed that it’s in talks with France-based PSA Group to sell its European car division, Opel. The PSA Group hopes to save between $1.6 billion to $2.1 billion in shared R&D costs and architecture synergies through this merger. During the fourth quarter, hedge funds covered by us that reported owning a stake in GM went up by three to 65 and the aggregate value of their holdings in it jumped by $1.13 billion to $4.66 billion.

Follow General Motors Co (NYSE:GM)

Follow General Motors Co (NYSE:GM)

Receive real-time insider trading and news alerts

Meritor Inc (NYSE:MTOR)

– Shares Held By Avenue Capital (as of December 31): 0

– Value of The Holding (as of December 31): 0

Meritor Inc (NYSE:MTOR) was another stock in which Avenue Capital sold its entire stake, comprising 4.85 million shares, during the fourth quarter. The fund had initiated a stake in the trucking component supplier during the second quarter of 2013. Although Meritor Inc (NYSE:MTOR)’s stock more than doubled in the next one and half years after Avenue initiated its stake, it gave up all of those gains in 2015. It was only in the second-half of 2016, when the stock once again started rallying, providing an opportunity to trapped bulls to get out of their positions. Since the start of 2017, the stock has further appreciated by over 30%. Despite such a strong bull run, several analysts remain bullish on the company citing the improvement it has made in its operating margins and cost structure. Moreover, they expect the company to benefit immensely from an expected recovery in the truck market. On February 21, analysts at KeyCorp upgraded the stock to ‘Overweight’ from ‘Sector Weight’ while keeping their price target on it intact at $20, suggesting a 23.8% upside. The number of investors tracked by us who were long Meritor increased by four to 24 during the fourth quarter. However, during the same time the aggregate value of their holdings in it fell marginally by 0.27% to $231.24 million.

Follow Meritor Inc. (NYSE:MTOR)

Follow Meritor Inc. (NYSE:MTOR)

Receive real-time insider trading and news alerts