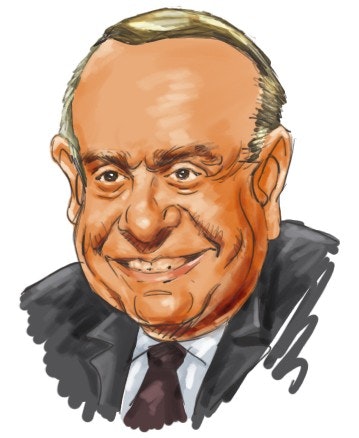

Billionaire Leon Cooperman grew up the son of a plumber living in the South Bronx. He worked his way through Hunter College, working as a Xerox quality control engineer. After getting his MBA from Columbia, Cooperman worked at Goldman Sachs for twenty five years before leaving in 1991 to start his hedge fund, Omega Advisors.

Omega is now a multi-billion dollar hedge fund focused on value investing. The fund uses a top-down approach to investing, selecting sectors and then finding undervalued companies using fundamental analysis. During the fourth quarter, Cooperman and his hedge fund sold off a couple large-cap stocks, while making a big bet on a mid-cap oil and gas play. Let’s check out his top moves.

Cooperman dumped these stocks

A couple of big sell offs for Cooperman during the fourth quarter included Apple Inc. (NASDAQ:AAPL) and Walgreen Company (NYSE:WAG). Apple was previously Cooperman’s fifth largest holding, while Walgreen was thirty-first. At a time when a number of hedge funds are dumping their Apple stock, on concerns that growth could be slowing, Cooperman joined the crowd and sold off all of his shares during the fourth quarter. From my perspective, although Apple Inc. (NASDAQ:AAPL) has a leading position in the iPhone and iPad markets, these products carry too much weight for the tech stock, making up over 70% of 2012 revenue. What’s more is that its mobile operating system, iOS, continues to be dominated by Google’s Android, and even its iPad appears to be losing market share. The pressure in both segments, mobile and tablet, are robust, with major tech companies gunning for Apple, including Samsung, Google, Blackberry, Nokia, and Sony; as a result, I believe Apple Inc. (NASDAQ:AAPL) is still a “wait and see” story.

Another big sell-off for Cooperman was Walgreen Company (NYSE:WAG). This comes after the company saw revenue and earnings weakness during the fourth quarter due to its mishap with Express Scripts. The company saw its major segment, prescription sales (60% of revenue) down 7% last quarter on a year over year basis, and prescription comp sales down 11%, this was on the back of a 4% decline in customer traffic.

Although Walgreen did indeed re-sign a multi-year deal with Express Scripts, the damage may already be done, with major peer CVS expected to have picked up some 30% of the customers switching pharmacies after the Walgreen-Express fallout. Meanwhile, Walgreen Company (NYSE:WAG) is seeing market share infringement from major retailers Wal-Mart Stores, Inc. (NYSE:WMT) and Target Corporation (NYSE:TGT). I tend to agree with Cooperman, that perhaps Walgreen is no longer a stock to own.

Cooperman’s big buy

Cooperman’s big increases

Although Sprint’s position in the mobile market (third in the U.S. with respect to subscriber count) forces a lower valuation on its shares, the question is; is it too low? I think so.

Sprint 0.5 times slaes

AT&T 1.6 times sales

Verizon 1.2 times sales

Don’t be fooled

The article Billionaire Leon Cooperman Shakes Things Up originally appeared on Fool.com and is written by Marshall Hargrave.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.