In this article, we discuss billionaire Lee Ainslie’s top 5 stock picks. To read about Ainslie’s journey from being a tiger cub to hedge fund manager, his investment philosophy and some interesting bits from his investor letters, go to Billionaire Lee Ainslie’s Top 10 Stock Picks.

5. Applied Materials, Inc. (NASDAQ: AMAT)

Value: $268,853,000

Percent of Lee Ainslie’s 13F Portfolio: 4.3%

Number of Hedge Fund Holders: 61

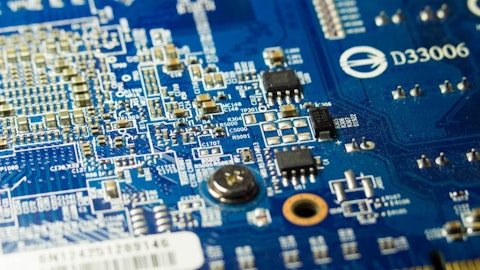

Lee Ainslie’s top 10 stock picks include Applied Materials Inc, a semiconductor company with a market cap of about $104 billion. The stock is up by 117% over the last 12 months. RBC recently upped its price target for Applied Materials from $95 to $140, citing upbeat quarterly results and the company’s bullish guidance of $70 billion value for the wafer front-end market. Financial services firm KeyBanc also increased its price target for the company from $104 to $144.

As of the end of the fourth quarter, 61 hedge funds in Insider Monkey’s database of 887 funds held stakes in Applied Materials Inc., compared to 59 funds in the third quarter. Generation Investment Management is the biggest stakeholder in the company, with 5.2 million shares, worth $452 million.

4. Seer, Inc. (NASDAQ: SEER)

Value: $279,201,000

Percent of Lee Ainslie’s 13F Portfolio: 4.5%

Number of Hedge Fund Holders: 14

Seer is a new arrival in Lee Ainslie’s portfolio. It is a California-based company that is working on innovative technologies in the field of genomics. The company went public in December 2020. It raised $175 million on IPO day by offering 9.2 million shares at $19, above the estimated range of $16 to $18.

As of the end of the fourth quarter, there were 14 hedge funds in Insider Monkey’s database that held stakes in Seer Inc.

3. Microsoft Corporation (NASDAQ: MSFT)

Value: $320,131,000

Percent of Lee Ainslie’s 13F Portfolio: 5.1%

Number of Hedge Fund Holders: 258

Microsoft ranks 3rd on the list of Lee Ainslie’s top 10 stock picks. The stock has gained 52% over the last 12 months. The company recently completed its $7.5 billion acquisition of ZeniMax Media, a gaming company behind the developer of famous games like Doom, Quake and Rage series. It also owns Arkane Studios, MachineGames and Bethesda Game Studios.

With a $5.2 billion stake in Microsoft, Fisher Asset Management owns 23.4 million shares of the company as of the end of the fourth quarter of 2020. Our database shows that 258 hedge funds held stakes in Microsoft as of the end of the fourth quarter, versus 234 funds in the third quarter.

2. DuPont de Nemours, Inc. (NYSE: DD)

Value: $346,036,000

Percent of Lee Ainslie’s 13F Portfolio: 5.5%

Number of Hedge Fund Holders: 60

Dupont ranks 2nd on the list of Maverick Capital’s top 10 stock picks. The chemical company recently approved a $1.5 billion share buyback program with an expiry date of June 30, 2022. DuPont shares are up 106% over the last 12 months. The company was listed in our 10 best chemical stocks to buy for 2021 article.

According to our database, the number of DD’s long hedge funds positions decreased at the end of the fourth quarter of 2020. There were 60 hedge funds that hold a position in DuPont de Nemours compared to 61 funds in the third quarter. The biggest stakeholder of the company is 40 North Management, with 20.3 million shares, worth $1.4 billion.

Rhizome Partners, in their Q4 2020 Investor Letter, said that DuPont de Nemours, Inc. (NYSE: DD) will likely execute better results in 2021.

Here is what Rhizome Partners has to say about DuPont de Nemours, Inc. in their Q4 2020 investor letter:

“DuPont is expected to merge its Nutrition and Bioscience business with International Flavors and Fragrances in early 2021. Auto sales and industrials, an area of weakness for DuPont earlier in 2020 will likely emerge much stronger in 2021. We believe these two factors have helped drive shares to over $71 at the end of Q4. Dupont has also been shedding non-core businesses with lower ROIC and growth prospects. The remaining segments are more pure-play and focused. Corteva, the previous DuPont agricultural focused spinoff, was recently targeted by activist investor Starboard Value which led to year-end price gains.”

1. Facebook, Inc. (NASDAQ: FB)

Value: $442,777,000

Percent of Lee Ainslie’s 13F Portfolio: 7.1%

Number of Hedge Fund Holders: 242

Facebook tops the list of Lee Ainslie’s top 10 stock picks. Maverick Capital increased its hold in the company by 20% in the fourth quarter. The social media company’s stock accounts for 7% of the fund’s portfolio. Another notable hedge fund having stakes in Facebook is Cathie Wood’s ARK Investment Management. See Cathie Wood’s top 10 stock picks.

As of the end of the fourth quarter, 242 hedge funds in Insider Monkey’s database of 887 funds held stakes in Facebook Inc., compared to 230 funds in the third quarter. SB Management is the biggest stakeholder in the company, with 12 million shares, worth $3.3 billion. FB ranks 3rd in our list of the 30 Most Popular Stocks Among Hedge Funds: 2020 Q4 Rankings.

You can also take a peek at Cathie Wood’s Top 10 Stock Picks and Chris Hohn’s Top 10 Stock Picks.