Is Conagra Brands Inc (NYSE:CAG) a good stock to buy right now? We at Insider Monkey like to examine what billionaires and hedge funds think of a company before doing days of research on it. Given their 2 and 20 payment structure, hedge funds have more resources than the average investor. The funds have access to expert networks and get tips from industry insiders. They also have numerous Ivy League graduates and MBAs. Like everyone else, hedge funds perform miserably at times, but their consensus picks have historically outperformed the market after risk adjustments.

Hedge fund interest in Conagra Brands Inc (NYSE:CAG) has been sluggish over the past few quarters, but did rise slightly in Q2. Ken Griffin’s Citadel Investment Group raised its Conagra position by 38% in the second quarter, to 7.91 million shares. Conagra investors can thank activist hedge fund JANA Partners (with whom it’s well acquainted) for pushing Pinnacle Foods to seek a sale, which lead to its eventual acquisition by Conagra in a deal valued at $10.9 billion. There is some concern about the sales trends of some of Pinnacle’s brands, but the deal makes sense for Conagra. Two of Conagra’s leading executives have also purchased shares of the company recently, expressing their confidence in the company’s future and landing on our list of The 25 Biggest Insider Purchases in October.

In the eyes of most market participants, hedge funds are assumed to be underperforming, old investment vehicles of yesteryear. While there are more than 8,000 funds with their doors open at the moment, our researchers look at the moguls of this club, approximately 700 funds. These hedge fund managers shepherd bulk of the hedge fund industry’s total capital, and by monitoring their best investments, Insider Monkey has unsheathed a number of investment strategies that have historically outperformed Mr. Market. Insider Monkey’s small-cap hedge fund strategy exceeded the S&P 500 index by 12 percentage points annually for a decade in their back tests.

Ken Griffin of Citadel Investment Group

Let’s view the key hedge fund action encompassing Conagra Brands Inc (NYSE:CAG).

How are hedge funds trading Conagra Brands Inc (NYSE:CAG)?

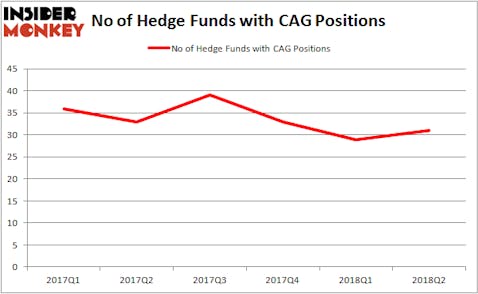

At the end of the third quarter, a total of 31 of the hedge funds tracked by Insider Monkey were bullish on this stock, a rise of 7% from the second quarter of 2018. Below, you can check out the change in hedge fund sentiment towards CAG over the last 6 quarters. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in Conagra Brands Inc (NYSE:CAG) was held by Citadel Investment Group, which reported holding $282.5 million worth of stock at the end of June. It was followed by Millennium Management with a $162.7 million position. Other investors bullish on the company included JANA Partners, Clearfield Capital, and Clinton Group.

As industry-wide interest jumped, key money managers were breaking ground themselves. Clearfield Capital, managed by Philip Hilal, initiated the most valuable position in Conagra Brands Inc (NYSE:CAG). Clearfield Capital had $10.4 million invested in the company at the end of the second quarter. Frank Brosens’ Taconic Capital also made a $3.6 million investment in the stock during the quarter. The other funds with new CAG positions are Anand Parekh’s Alyeska Investment Group, Louis Bacon’s Moore Global Investments, and Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital.

Let’s now take a look at hedge fund activity in other stocks similar to Conagra Brands Inc (NYSE:CAG). We will take a look at Martin Marietta Materials, Inc. (NYSE:MLM), Vornado Realty Trust (NYSE:VNO), Ulta Salon, Cosmetics & Fragrance, Inc. (NASDAQ:ULTA), and Westlake Chemical Corporation (NYSE:WLK). This group of stocks’ market valuations match CAG’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| MLM | 33 | 1854247 | -2 |

| VNO | 26 | 627349 | 8 |

| ULTA | 44 | 854853 | 8 |

| WLK | 24 | 430525 | -8 |

As you can see these stocks had an average of 32 hedge funds with bullish positions and the average amount invested in these stocks was $942 million. That figure was $1.11 billion in CAG’s case. Ulta Salon, Cosmetics & Fragrance, Inc. (NASDAQ:ULTA) is the most popular stock in this table. On the other hand Westlake Chemical Corporation (NYSE:WLK) is the least popular one with only 24 bullish hedge fund positions. ConAgra Foods, Inc. (NYSE:CAG) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. In this regard ULTA might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.