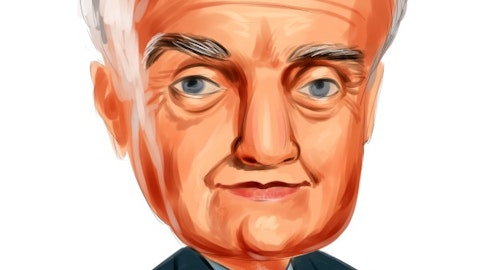

Billionaire John Griffin, one of the most closely-watched hedge fund managers, founded his equity long/short fund Blue Ridge Capital LLC in 1996. Mr. Griffin is a former protégé of renowned investor Julian Robertson, and served for a time as president of Tiger Management LLC. The “Tiger Cub” follows a value-oriented style of investing, which has proven to be very successful over the years. Data compiled by Insider Monkey shows that Mr. Griffin’s top-five large-cap stock positions, which comprise companies with a market capitalization above $20 billion, generated a weighted average monthly return of 0.84% during the period of 1999-to-2012, compared to the return of 0.32% for the S&P 500 Index. This data suggests that the billionaire investor is particularly strong at finding undervalued, large-cap stocks, so in this article we will focus on his top-5 large-cap ideas heading into 2016.

Imitating hedge funds and other institutional investors can help identify some of the most profitable stocks on the market. However, our extensive research that covered the period between 1999 and 2012, showed that the best approach is to follow these investors into their small-cap stocks. Our backtests showed that the 15 most popular small-cap stocks among hedge funds managed to generate a monthly alpha of 81 basis points, versus an alpha of 0.7 percentage points posted by their top 50 large-cap picks (see more details here).

Follow John Griffin's Blue Ridge Capital

#5 Teva Pharmaceutical Industries Ltd (ADR) (NYSE:TEVA)

– Shares Owned by Blue Ridge (as of December 31): 4.00 Million

– Value of Blue Ridge’s Holding (as of December 31): $262.56 Million

New York-based Blue Ridge Capital LLC acquired a new stake of 4.00 million shares in Teva Pharmaceutical Industries Ltd (ADR) (NYSE:TEVA) during the fourth quarter of 2015, which was valued at $262.56 million at the end of the year. The Israel-based drugmaker has seen its shares decline by 12% this year, though they are still up by nearly 3% over the past 12 months. In July 2015, the global pharmaceutical company announced the acquisition of Allergan’s business unit Actavis Generics for $33.75 billion in cash and roughly 100 million shares of Teva. That deal is poised to assist Teva in establishing a dominant position in the generics drug market and is anticipated to be completed by early April. Similarly, Teva Pharmaceutical Industries Ltd (ADR) (NYSE:TEVA) announced the acquisition of Mexican pharmaceutical company Rimsa in October 2015 for $2.3 billion in cash, which will add a number of patent-protected drugs to its existing portfolio in Latin America. Given that the demand for Teva’s medicines is rather inelastic and stable, the stock represents an attractive investment opportunity considering its paltry forward P/E multiple of 9.25, well below the average of 15.10 for the Pharmaceuticals industry. Billionaire John Paulson of Paulson & Co. reported owning 20.41 million shares of Teva Pharmaceutical Industries Ltd (ADR) (NYSE:TEVA) through its latest 13F.

Follow Teva Pharmaceutical Industries Ltd (NYSE:TEVA)

Follow Teva Pharmaceutical Industries Ltd (NYSE:TEVA)

Receive real-time insider trading and news alerts