It’s a fact that hedge funds are underperforming the market for years in aggregate, but if we dig deeper and conduct a thorough analysis of the performance of the $3 trillion industry, there is an interesting flipside to the apparently gloomy picture. Insider Monkey’s research has consistently proved that actual returns of hedge funds tend to lag the market indices due to two reasons: hedged returns and losses that mainly come from short positions. Paying attention to the right areas of the smart money’s portfolios reveal that money managers do have great stock picking abilities. For example, the S&P 500 Index gained 7.6% in the 12 month-period ended on November 21, while less than 49% of its stocks beat the benchmark. In contrast, the 30 most popular mid-cap stocks among the top hedge fund investors tracked by the Insider Monkey returned 18% over the same period.

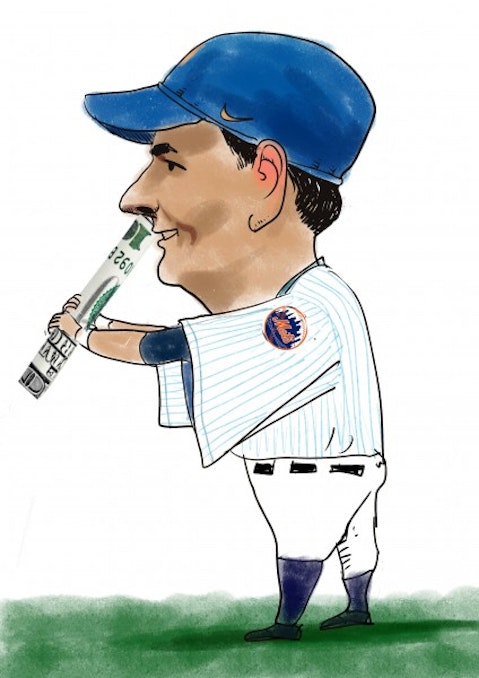

Another glaring example of hedge funds’ sterling performances is billionaire David Einhorn‘s Greenlight Capital beating the market by a complete 13 percentage points a year for certain categories. We at Insider Monkey have performed comprehensive back-tests on Greenlight Capital’s returns to compare the fund’s performance with S&P 500 Index. The results of our tests show that Greenlight Capital’s top 5 mid-cap picks returned 1.45% per month between 2008 to 2012, compared to S&P 500’s return of 0.29% per month for the same period. This means the hedge fund outperformed the index by 1.16% per month in the said period, or by over 13% on an annualized basis.

With that said, let’s take a closer look at some of Einhorn’s favorite mid-cap picks in Q3.

AerCap Holdings N.V. (NYSE:AER)

Greenlight Capital upped its stake in AerCap Holdings N.V. (NYSE:AER) by 12% in the third quarter, and concluded the period with 12.77 million shares of the company, with a total value of $491.38 million. The stock is up 0.88% year-to-date. The Ireland-based aircraft leasing company earned $1.68 a share on $1.23 billion revenue in the third quarter, better than the analysts’ projections of $1.44 EPS and $1.2 billion revenue. On December 2, the company announced the delivery of the first Boeing 787 Dreamliner for Air France. The plane will be deployed for the Paris to Cairo route, starting in January 2017. A total of 32 hedge funds tracked by Insider Monkey were bullish on AerCap Holdings N.V. (NYSE:AER), as of the end of the third quarter.

Follow Aercap Holdings N.v. (NYSE:AER)

Follow Aercap Holdings N.v. (NYSE:AER)

Receive real-time insider trading and news alerts

Michael Kors Holdings Ltd (NYSE:KORS)

David Einhorn’s fund sold about 36% of its stake in Michael Kors Holdings Ltd (NYSE:KORS) in the third quarter, and moved into the fourth quarter with $143.50 million worth of stake in the London-based apparel and accessories company. Michael Kors Holdings Ltd (NYSE:KORS) is up over 20% year-to-date. Last month, several reports suggested that the European conglomerate Moet Hennessy Louis Vuitton SE was in talks to acquire Michael Kors, but the rumors fizzled out quickly. Michael Kors is facing a slowdown in growth and sales. The company expects fiscal 2017 revenue to come in at $4.55 billion, versus the consensus estimate of $4.64 billion. Cliff Asness’ AQR Capital Management was another noteworthy stakeholder of Michael Kors Holdings Ltd (NYSE:KORS) with 3.89 million shares of the company at the end of the third quarter.

Follow Capri Holdings Ltd (NYSE:CPRI)

Follow Capri Holdings Ltd (NYSE:CPRI)

Receive real-time insider trading and news alerts

On the next page, we will discuss some other mid-cap picks of David Einhorn.