The hedge fund investors monitored by the Insider Monkey team have now filed their quarterly 13Fs, data which we continue to sift through to reveal high-potential stocks. Although some tend to believe that because these public filings offer delayed insights about hedge funds’ stances on different companies and do not disclose the full picture of their portfolios, that their usefulness is limited. However, our research has shown that 13F filings can be used as a verified stock picking selection tool (more on that later). The following article will discuss the top-five stock picks of value-focused hedge fund manager ESL Investments, which was established by Edward S. Lampert back in 1988 after he worked in the risk arbitrage department at Goldman Sachs. ESL Investments categorizes itself as an aggressive conservative hedge fund, and generally acquires sizable stakes in seemingly undervalued and highly-researched companies. With this in mind, let’s proceed with the discussion of billionaire Edward Lampert’s largest equity holdings at the end of the September quarter.

At Insider Monkey, we track hedge funds’ moves in order to identify actionable patterns and profit from them. Our research has shown that hedge funds’ large-cap stock picks historically underperformed the S&P 500 Total Return Index by an average of seven basis points per month between 1999 and 2012. On the other hand, the 15 most popular small-cap stocks among hedge funds outperformed the S&P 500 Index by an average of 95 basis points per month (read the details here). Since the official launch of our small-cap strategy in August 2012, it has performed just as predicted, returning 102% and beating the market by more than 53 percentage points. We believe the data is clear: investors will be better off by focusing on small-cap stocks utilizing hedge fund expertise (while avoiding their high fees at the same time) rather than large-cap stocks.

Follow Edward Lampert's ESL Investments

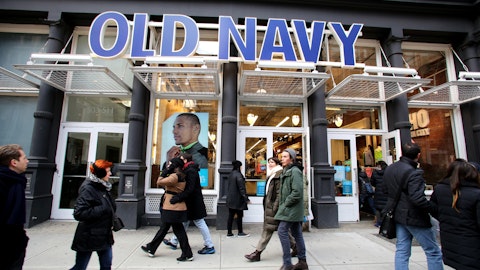

#5 Gap Inc. (NYSE:GPS)

– Shares Owned by ESL Investments (as of September 30): 3.93 Million

– Value of Holding (as of September 30): $111.92 Million

Billionaire Edward Lampert upped his position in Gap Inc. (NYSE:GPS) by a whopping 1.87 million shares during the turbulent third quarter. The global retailer of apparel, accessories, and personal care products has seen its shares decline by nearly 40% this year, as the company has been struggling to turn around its Gap brand. Earlier this month, Gap announced third quarter net sales of $3.86 billion, compared with $3.97 billion reported for the same quarter of last year. The foreign exchange rate fluctuations negatively affected the company’s top-line, especially at its largest foreign subsidiaries in Canada and Japan. However, the stock is currently trading at a trailing price-to-earnings ratio of 9.49, which is substantially below the average of 22.70 for the S&P 500 Index. Larry Robbins’ Glenview Capital reduced its exposure to Gap Inc. (NYSE:GPS) by 700,000 shares during the latest quarter, ending the three-month period with 5.29 million shares.

Follow Gap Inc (NYSE:GAP)

Follow Gap Inc (NYSE:GAP)

Receive real-time insider trading and news alerts

#4 Sears Canada Inc. (NASDAQ:SRSC)

– Shares Owned by ESL Investments (as of September 30): 26.21 Million

– Value of Holding (as of September 30): $171.13 Million

ESL Investments stood pat with its stake in Sears Canada Inc. (NASDAQ:SRSC) during the September quarter, owning nearly 26.21 million shares. In November 2012, Sears Holdings Corp (NASDAQ:SHLD), which Edward Lampert has been CEO of since 2013, spun-off a portion of its interest in Sears Canada by distributing roughly 44.5% of the outstanding common shares of Sears Canada on a pro rata basis to shareholders of Sears Holdings’ common stock. The Canadian department store chain has been struggling quite seriously over the past several years. It has shut stores and reduced its workforce in an effort to enhance profitability, which has been hurt by fast-growing competition. The company’s second quarter comparable sales dropped by 3.8% year-over-year, after declining by 6.8% in the same period last year. Jim Simons’ Renaissance Technologies reported owning 43,000 shares of Sears Canada Inc. (NASDAQ:SRSC) through its latest 13F filing.