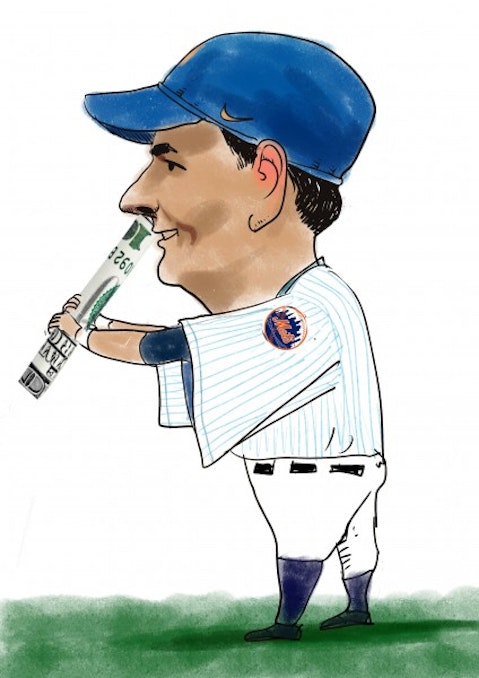

Hedge funds are known to be fast traders who go in and out of stocks very quickly. However, a large number of equity hedge funds have core positions that they don’t much over several quarters. The equity portfolio of billionaire David Einhorn’s Greenlight Capital has expanded greatly over just the past six quarters. From a mere $5.33 billion at the end of the second quarter of 2013, the portfolio has swelled to $7.52 billion, an increase of more than 40%. During that time, there has been a quite a large amount of turnover among Einhorn’s top positions, with only five of his top 20 positions from the middle of 2013 remaining in the top 20 at the end of 2014.

We’ll run through these five important positions of Einhorn in this piece. Unsurprisingly, the majority of them are technology stocks, as the technology sector accounted for 56% of Einhorn’s equity portfolio at the end of 2014. Also unsurprisingly, the majority of them are large-cap stocks, with a couple being mid-cap stocks. These highly valuable companies are the perfect investment vehicles for wealthy billionaires with a lot of capital to invest in, without exposing themselves to too much risk.

On the other hand, they’re not necessarily the best choices for less wealthy investors seeking larger returns from the limited amount of capital they can pour into stocks. In that scenario, the top small-cap stock picks of hedge fund managers prove to be an ideal investment option, as their top 15 collective picks managed to outperform the market by 76.7 percentage points from the end of August of 2012 through March 10th, 2015.

Nonetheless, Einhorn’s top pick in the middle of 2013 is a mega-cap company popular among investors of all brackets of wealth because of its iconic stature and legions of devotees. I speak of none other than Apple Inc. (NASDAQ:AAPL) of course, which remained Einhorn’s top pick until the middle of 2014 when it was overtaken by Micron Technology, Inc. (NASDAQ:MU). His stake in Apple Inc. (NASDAQ:AAPL) remains Einhorn’s second–most valuable position with 8.61 million shares valued at $949.88 million. However that’s a large decrease from the 16.78 million shares he held in the middle of 2013, though they were only worth slightly more at the time, $950.76 million.

The reason for that of course is Apple Inc. (NASDAQ:AAPL)’s meteoric rise over those six quarters, as it gained 101.22%. Flush with tens of billions of dollars in cash, Apple Inc. (NASDAQ:AAPL) is preparing to take a major step into a large and potentially very lucrative market, as they begin the process of building an electric car. Though CEO Tim Cook recently downplayed the rumors, there has been a strong rumbling among investors and the tech world that a purchase of Tesla Motors Inc (NASDAQ:TSLA) could suit Apple perfectly and makes a world of sense for both companies.

Einhorn had 44.29 million shares of Marvell Technology Group Ltd (NASDAQ:MRVL) in the middle of 2013, making it his third-most valuable position at the time worth $518.63 million, and it remained his fifth-most valuable position at the end of 2014, though he has also slashed his stake in the semiconductor maker over the past six quarters. His stake has been cut to 24.73 million shares, while the value has fallen to $358.63 million. Over that span, shares are up a solid 22.72%, and have had a good start to 2015, up another 11.93%.

Einhorn had the largest position in Marvell Technology Group Ltd (NASDAQ:MRVL) both then and now, by a wide margin. While overall fund ownership of Marvell Technology Group Ltd (NASDAQ:MRVL) feel to 32 from 38, invested capital increased to $940.96 million from $830.46 million. A large new position of 9.50 million shares in the fourth quarter worth $137.71 million by Cliff Asness’ AQR Management accounted for the spike in capital.

From there, we move to Voya Financial Inc (NYSE:VOYA), which had its IPO in the second quarter of 2013. By the end of that quarter the investment and insurance company represented the 15th-most valuable stake in Einhorn’s portfolio, with his 3.71 million shares being worth $100.32 million. Fast forward six quarters and the position has been increased to 5.54 million shares worth $234.84 million, with Voya Financial Inc (NYSE:VOYA) up 56.61% during that time. Voya Financial Inc (NYSE:VOYA) has had a number of other large, long-term investors since its IPO, including Richard S. Pzena’s Pzena Investment Management, and Christian Leone’s Luxor Capital Group.

Liberty Global plc (NASDAQ:LBTYA) represented the 16th-most valuable position in Einhorn’s portfolio in the middle of 2013, and by the end of 2014 it had…remained in 16th position. He did increase the position during that time however, to 3.11 million shares worth $150.20 million from 2.44 million shares worth $91.64 million. Liberty Global plc (NASDAQ:LBTYA), an international provider of television and broadband internet services is up by 35.32% since the launch of its class A shares in the second quarter of 2013, until the end of 2014. Boykin Curry’s Eagle Capital Management, and John H. Scully’s SPO Advisory Corp have been its top shareholders among tracked funds since then.

Lastly we come to IAC/InterActiveCorp (NASDAQ:IACI), which owns more than 150 different media and web properties, including Match.com, the largest online dating site in the world, Vimeo, Ask.com, The Daily Beast, and About.com. Einhorn held 1.79 million shares of IAC/InterActiveCorp (NASDAQ:IACI) in the middle of 2013 worth $85.12 million, making them his 17th-most valuable position. The position now ranks as his 12-most valuable, consisting of 2.99 million shares worth $182.06 million. Despite ending 2014 well off its highs from earlier in the year, IAC/InterActiveCorp (NASDAQ:IACI) was up by 31.08% from mid-2013 through the end of 2014.

Disclosure: None