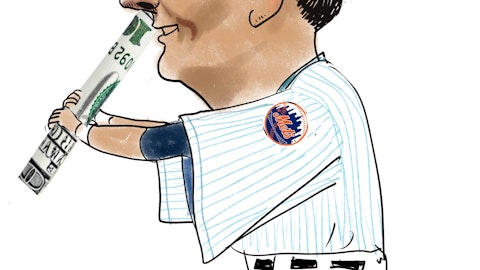

David Einhorn, the billionaire from Cornell University, known for exceptional bets such as the large short position he took in Lehman Brothers just a year before that company’s collapse. A different kind of betting went just as well when Mr. Einhorn played in the World Series of Poker in Las Vegas, winning more than four times his original investment, a $4.35 million reward. Einhorn was educated in the hedge fund business by two giants in the industry. Gary Siegler, tutored under Carl Icahn, and Peter Collery, both of whom managed of the SC Fundamental Value Fund.

For the second quarter, Greenlight had a couple of winning positions with high payouts. The biggest was Green Mountain Coffee Roasters (GMCR), which fell from $46.84 to $21.78 per share. The company announced disappointing quarterly results and lowered its guidance. Investors are beginning to consider the ramification of the coming K-cup patent expirations. On September 16, 2012, GMCR will no longer have the exclusive right to produce or license use of all K-cups. Other firms will have no barrier to produce their own K-cups for use in the machines. Retailers looking for a piece of the pie have indicated they will take shelf space away from GMCR to offer their own lower cost, private label versions. Adding insult to injury, GMCR will actually be supplying some of the private label cups that will cannibalize its own brands.

At the Value Investing Congress in October of last year, Einhorn announced this short position in GMCR during a presentation he called “GAAP-uccino”, Einhorn provided numerous reasons to support his thesis for shorting GMCR. The company’s machines are expensive compared to alternatives. The K-cups also made the cost per cup high, pricing out many consumers. Criticizing management, he complained about the lack off transparency and refusal to report actual numbers of shipped products.

Einhorn biggest losing positions during the second quarter were French company Arkema, General Motors (NYSE:GM) and Marvell Technology Group (NASDAQ:MRVL). Marvell’s shares fell from $15.73 to $11.28 during the quarter. MRVL gave tepid guidance and Wall Street has modestly reduced its estimates of earnings per share from $1.25 to $1.15 this year and from $1.45 to $1.40 for next year. MRVL has about $4 per share in cash and now trades at roughly 5x next year’s earnings net of the cash on the balance sheet. Most of the cash is excess, and the company has commenced a share repurchase program. Greenlight has used the low prices as an opportunity to add to its position.

During the second quarter, Einhorn established several new positions in the managed care sector, most notably Cigna (NYSE:CI) and Coventry Health Care (NYSE:CVH). Mentioning that this entire sector has dropped in anticipation of Obamacare, Einhorn praised other factors which should prove positive. “For the most part, these companies have unlevered balance sheets and trade at single-digit P/E multiples on earnings that should continue to grow. They have no exposure to the European currency crisis, a possible Chinese slowdown or other cyclical headwinds. While the stocks are already cheap, there is the additional unpriced upside in the possibility that the election changes the political landscape, resulting in a possible modification or repeal of Obamacare.”

Greenlight closed several positions in the second quarter. Among them were Dell, Inc. (NASDAQ:DELL) and Best Buy, Inc. (NYSE:BBY). With DELL, the growth in the non-PC business was slower than expected and the deterioration of the PC business was worse than expected. Einhorn believes that DELL will use the cash it has to “buy its way into better businesses.” Seeing that as a possibility and the erosion of the cash cushion, Greenlight sold DELL for a loss.

Best Buy provided three unexpected problems. First, BBY depleted $1.3 billion of its cash resources by paying a double-digit multiple for Carphone Warehouse’s share of the Best Buy Mobile profit stream. The market promptly revalued those earnings to BBY’s

mid-single digit multiple. Second, in the most recent quarter, BBY’s international profits collapsed. In particular, comparable sales in its Chinese business fell 28 percent as the Chinese economy appears to have hit a wall. Einhorn didn’t want to stick around anymore and cut his losses.

Einhorn disclosed that Apple (NASDAQ:AAPL) is still his largest position at the end of the second quarter followed by General Motors, gold, Marvell Technology, and Seagate (NASDAQ:STX). Greenlight Capital had an average exposure of 107 percent long and 56 percent short.