American International Group, Inc. (NYSE:AIG) has been one the central players in the 2008/2009 financial crisis, during the credit bubble the company made what was perhaps the worst kind of bet it could possibly make: insuring investors against losses in subprime mortgage assets. Needless to say, when the bubble exploded AIG was left in a seriously fragile position.

A collapse of AIG could have carried dramatic consequences all over the world, as it would have left other investors – including big banks – unprotected from their losses. The company was effectively declared “too big to fail” and received a $182 billion bailout from the federal government in order to backstop a crisis that could have produced ripple effects all over the global financial system. In some sense, the AIG bailout could be considered an indirect way to help many other investors who had purchased insurance from the company.

But that seems to be already in the past, the government owns no more stakes in AIG, and the company has been materially improving its financial position over the last years. Although the insurer is not completely out of the woods, the worse is likely over for AIG investors, and the stock is offering some attractive upside potential for those willing to ride the recovery.

New Management, New Company

Robert Benmosche was appointed as chairman and CEO of AIG in August 2009, and he has been responsible for the company´s turnaround since them. Benmosche had a successful experience as CEO of Met Life from 1998 to 2006; during his tenure he oversaw MetLife’s successful transition from mutual company to publicly traded firm. His experience at Met Life was probably one of the reasons why he was chosen to lead AIG ´s transition back to private ownership.

Benmosche is famous for being frontal and outspoken, saying he was planning to avoid “those crazies down in Washington” in his first meeting with employees after being appointed for the job. Under his leadership, AIG has reduced its workforce from 116,000 to around 60,000 employees; the company sold its Asian life insurance business and is also planning to dispose its aircraft leasing operations.

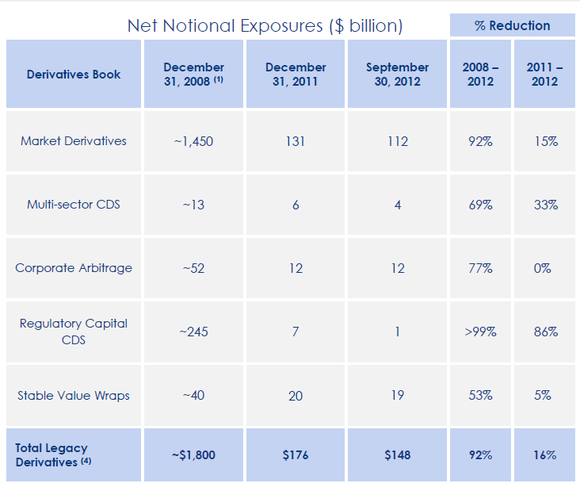

More importantly, AIG has materially reduced its exposure to credit derivatives and low quality investment securities on its balance sheet. The company is clearly much sounder in terms of risk exposure.

AIG has remarkably reduced its risks over the last years, and the company looks ready to focus on growth by implementing measures like concentrating in the more profitable property-casualty business, which has higher margins than life insurance, consolidating data centers to cut costs and applying better data analysis to improve product pricing.

Big Upside Potential

Price to book value ratio has been traditionally considered a good tool to analyze insurance companies. As we can see, AIG used to trade at a considerable premium to competitors like The Travelers Companies, Inc. (NYSE:TRV) and The Allstate Corporation (NYSE:ALL) due to its higher profitability and international growth prospects. The situation is now reversed, as AIG trades at a big discount to book value in the area of 0.6.

Not only is AIG comparably cheap versus other companies in the industry, but the whole insurance sector is trading well below pre-crisis valuation levels. If the economy in general and real estate sector in particular continue improving, insurers like Travelers and Allstate have room for valuation expansion, as investors start pricing in a more optimistic scenario. Needless to say, this should be bullish for AIG too.

Besides, the company has been aggressively repurchasing stock over the last year. Since those repurchases are done at a price to book value ratio below 1, they increase book value per share. The company gets more than $1 in accounting equity value for each dollar it uses to buy its own stock, so as long as the purchase price is so low a buyback will be very positive in terms of book value per share.

In addition to strengthening its balance sheet and refocusing on business profitability, AIG has been capitalizing the opportunity to repurchase shares at depressed levels, and that’s a smart move that has the potential to benefit shareholders in a big way in the middle term.

Bottom Line

AIG has made a remarkable recovery over the last years, and the company is now focusing on business profitability and rewarding shareholders with stock buybacks at conveniently low prices. Considering that they are still trading at bargain valuation levels, shares of AIG are offering an attractive upside potential for investors.

The article Big Upside Potential for AIG originally appeared on Fool.com and is written by Andrés Cardenal.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.