Fred Alger Management, an investment management company, released its “Alger Weatherbie Specialized Growth Fund” second quarter 2024 investor letter. A copy of the letter can be downloaded here. In the second quarter of 2024, U.S. equities performed well, with the S&P 500 rising 4.28%. Against this backdrop, Class A shares of the fund outperformed the Russell 2500 Growth Index in the quarter. In addition, you can check the top 5 holdings of the fund to know its best picks in 2024.

Alger Weatherbie Specialized Growth Fund highlighted stocks like Glaukos Corporation (NYSE:GKOS) in the second quarter 2024 investor letter. Glaukos Corporation (NYSE:GKOS) is an ophthalmic pharmaceutical and medical technology company. The one-month return of Glaukos Corporation (NYSE:GKOS) was 15.39%, and its shares gained 78.78% of their value over the last 52 weeks. On August 30, 2024, Glaukos Corporation (NYSE:GKOS) stock closed at $133.89 per share with a market capitalization of $7.357 billion.

Alger Weatherbie Specialized Growth Fund stated the following regarding Glaukos Corporation (NYSE:GKOS) in its Q2 2024 investor letter:

“Glaukos Corporation (NYSE:GKOS) is an ophthalmic medical technology and pharmaceutical company targeting the large glaucoma market. As an early pioneer in minimally invasive glaucoma surgery (MIGS) with its iStent devices, Glaukos recently launched the innovative iDose technology. This device delivers medication directly to the eye over an extended period of up to three years, offering a significant advance in glaucoma treatment. During the quarter, shares contributed to performance after the company reported better-than-expected fiscal first quarter earnings. Management also raised their full-year revenue guidance, fueled by the growing adoption of the iStent products and iDose by physicians. In our view, iDose could be a transformational product in the glaucoma treatment landscape, potentially reducing the need for topical eye drops and delaying or avoiding more invasive surgeries due to its safety and effectiveness.”

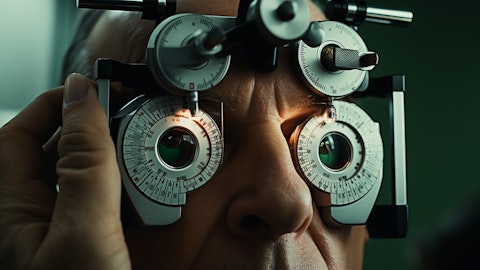

A doctor examining a patient’s eyes with an ophthalmic medical device.

Glaukos Corporation (NYSE:GKOS) is not on our list of 31 Most Popular Stocks Among Hedge Funds. As per our database, 26 hedge fund portfolios held Glaukos Corporation (NYSE:GKOS) at the end of the first quarter which was 27 in the previous quarter. In the second quarter, Glaukos Corporation (NYSE:GKOS) reported net sales of $95.7 million, up 19% on a reported basis and 20% on a constant currency basis compared to Q2 2023. The outstanding performance led the company to increase its full-year 2024 net sales guidance range. While we acknowledge the potential of Glaukos Corporation (NYSE:GKOS) as an investment, our conviction lies in the belief that AI stocks hold greater promise for delivering higher returns, and doing so within a shorter timeframe. If you are looking for an AI stock that is as promising as NVIDIA but that trades at less than 5 times its earnings, check out our report about the cheapest AI stock.

In another article, we discussed Glaukos Corporation (NYSE:GKOS) and shared Baron Health Care Fund’s views on the company. In addition, please check out our hedge fund investor letters Q2 2024 page for more investor letters from hedge funds and other leading investors.

READ NEXT: Michael Burry Is Selling These Stocks and A New Dawn Is Coming to US Stocks.

Disclosure: None. This article is originally published at Insider Monkey.