In a previous article, I showed why you should invest in three firms. I still won’t budge.

The business landscape is rapidly shifting, but the outlook still seems bright for those who utilize the day, fundamental, or technical trading approaches. However, if you’re a true Graham follower, then you likely have already missed the boat. Take a look.

| Firm | Date | Recommended Buy Price | % Growth to Now |

|---|---|---|---|

| Best Buy (NYSE:BBY) | March 11, 2013 | $20.08 | over 27% |

| Home Depot (NYSE:HD) | March 11, 2013 | $71.32 | around 12% |

| Wal-Mart (NYSE:WMT) | March 11, 2013 | $72.98 | around 5.5% |

Strategy pending investment

Even with the recently reported $0.24 loss per share, Best Buy Co., Inc. (NYSE:BBY) is making waves. Under the leadership of Joly, the firm continues to properly execute its “Renew Blue” strategic plan. Revenue decreases are beginning to slow, costs are being streamlined and controlled, and a light is near the end of the tunnel. Since the last quarterly announcement, for instance, Joly has cut over $175 million in annualized costs.

With a market cap of $8.69 billion and sales just over $49 billion, Best Buy Co., Inc. (NYSE:BBY) is only valued at about 0.18 times its annual revenue. Amazon.com, Inc. (NASDAQ:AMZN) and Apple Inc. (NASDAQ:AAPL) are each, respectively, valued at 1.87 and 2.45 times their revenues, indicating that Best Buy Co., Inc. (NYSE:BBY) could be undervalued compared to its competitors.

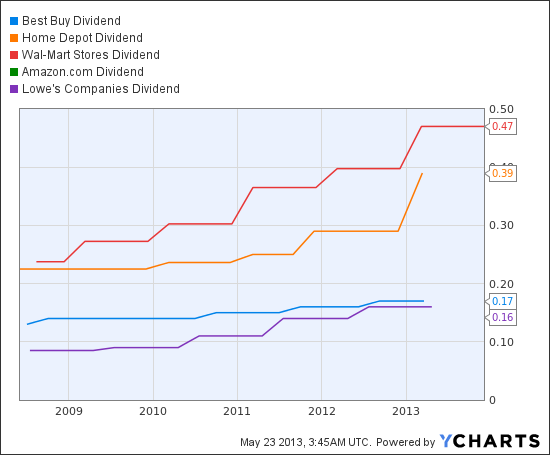

Additionally, Best Buy Co., Inc. (NYSE:BBY) recently announced a $0.17 quarterly dividend payment, leading investors to wonder one of three scenarios. Will the dividend cripple the firm’s cash position, attract new investors, or reveal that executives are preparing for long-term growth? I’m not sure.

But, because of its 120% growth thus far in 2013 and recent media coverage, I simply say, “No thank you” to this buy. But, if you’re interested in a dividend stock with upswing potential, you have yourself a winner.

BBY Dividend data by YCharts

Still worth a look

The Home Depot, Inc. (NYSE:HD) is beating Lowe’s Companies, Inc. (NYSE:LOW), posing as the sure winner as the housing market continues to climb. Why?

According to UBS analyst Michael Lasser, “The explanation is likely wrapped in a combo of the distraction that Lowe’s is experiencing from its merchandise resets, its less favorable geographic exposure and a lower penetration of commercial sales.”

Here’s the deal.

The Home Depot, Inc. (NYSE:HD) boasts a greater number of stores, especially along the Western shoreline. The additional commercial sales are a direct result from The Home Depot, Inc. (NYSE:HD)’s emphasis on acquiring relevant technology start-ups and developing contractor relationships as discussed here. Now, combine these tactical moves along with the aforementioned dividend payments and the following data.

| Profit Margin | Operating Margin | ROA | ROE | |

|---|---|---|---|---|

| Home Depot | 6.07% | 10.57% | 12.10% | 25.42% |

| Lowe’s | 3.88% | 7.22% | 6.89% | 12.89% |

Clearly, The Home Depot, Inc. (NYSE:HD)’s operating efficiency is a major benefit, further distinguishing the two firms. For example, after the most recent quarterly report, Home Depot’s SG&A expenses relevant to gross profit were 7% less than those of Lowe’s — a pretty impressive number given that The Home Depot, Inc. (NYSE:HD) has over 2x the employees and market cap of its closest competitor.

Furthermore, the unfortunate, recent, and destructive natural disasters requiring relief efforts, tools, and equipment will likely boost the retailer’s sales.

The overall result: One happy Home Depot shareholder.