We are still in an overall bull market and many stocks that smart money investors were piling into surged in 2019. Among them, Facebook and Microsoft ranked among the top 3 picks and these stocks gained more than 57% each. Hedge funds’ top 3 stock picks returned 44.6% this year and beat the S&P 500 ETFs by almost 14 percentage points. That’s a big deal. This is why following the smart money sentiment is a useful tool at identifying the next stock to invest in.

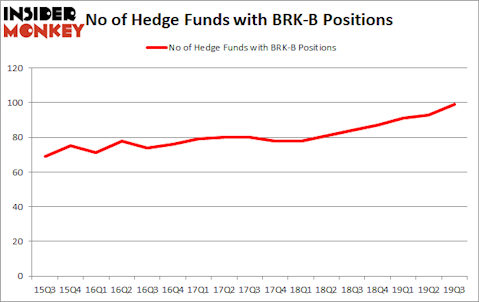

Berkshire Hathaway Inc. (NYSE:BRK-B) investors should pay attention to an increase in support from the world’s most elite money managers in recent months. Our calculations also showed that BRK-B currently ranks 12th among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video at the end of this article for Q2 rankings).

Frank Brosens of Taconic Capital

In the financial world, there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best-performing hedge funds strategy returned 91% since May 2014 and outperformed the Russell 2000 ETFs by nearly 40 percentage points. Our short strategy outperformed the S&P 500 short ETFs by 20 percentage points annually (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

We leave no stone unturned when looking for the next great investment idea. For example, Discover is offering this insane cashback card, so we look into shorting the stock. One of the most bullish analysts in America just put his money where his mouth is. He says, “I’m investing more today than I did back in early 2009.” So we check out his pitch. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. We even check out this option genius’ weekly trade ideas. This December, we recommended Adams Energy as a one-way bet based on an under-the-radar fund manager’s investor letter and the stock already gained 20 percent. With all of this in mind let’s take a gander at the recent hedge fund action encompassing Berkshire Hathaway Inc. (NYSE:BRK-B).

How are hedge funds trading Berkshire Hathaway Inc. (NYSE:BRK.B)?

At Q3’s end, a total of 99 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 6% from the second quarter of 2019. The graph below displays the number of hedge funds with bullish position in BRK-B over the last 17 quarters. With hedgies’ sentiment swirling, there exists an “upper tier” of noteworthy hedge fund managers who were adding to their stakes significantly (or already accumulated large positions).

Among these funds, Bill & Melinda Gates Foundation Trust held the most valuable stake in Berkshire Hathaway Inc. (NYSE:BRK.B), which was worth $11422.9 million at the end of the third quarter. On the second spot was Eagle Capital Management which amassed $2127.2 million worth of shares. Gardner Russo & Gardner, Pershing Square, and Arlington Value Capital were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position, Punch Card Capital allocated the biggest weight to Berkshire Hathaway Inc. (NYSE:BRK.B), around 57.53% of its 13F portfolio. Bill & Melinda Gates Foundation Trust is also relatively very bullish on the stock, setting aside 53.82 percent of its 13F equity portfolio to BRK-B.

Now, specific money managers were leading the bulls’ herd. Wexford Capital, managed by Charles Davidson and Joseph Jacobs, created the largest position in Berkshire Hathaway Inc. (NYSE:BRK.B). Wexford Capital had $29.5 million invested in the company at the end of the quarter. Daniel Gold’s QVT Financial also initiated a $10 million position during the quarter. The following funds were also among the new BRK-B investors: Perella Weinberg Partners, Peter Seuss’s Prana Capital Management, and Donald Sussman’s Paloma Partners.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as Berkshire Hathaway Inc. (NYSE:BRK.B) but similarly valued. These stocks are Facebook Inc (NASDAQ:FB), Alibaba Group Holding Limited (NYSE:BABA), Visa Inc (NYSE:V), and JPMorgan Chase & Co. (NYSE:JPM). This group of stocks’ market values resembles BRK-B’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| FB | 179 | 20837470 | -3 |

| BABA | 149 | 19197070 | 22 |

| V | 132 | 15686359 | 15 |

| JPM | 84 | 11167465 | -6 |

| Average | 136 | 16722091 | 7 |

View the table here if you experience formatting issues.

As you can see these stocks had an average of 136 hedge funds with bullish positions and the average amount invested in these stocks was $16722 million. That figure was $22272 million in BRK-B’s case. Facebook Inc (NASDAQ:FB) is the most popular stock in this table. On the other hand, JPMorgan Chase & Co. (NYSE:JPM) is the least popular one with only 84 bullish hedge fund positions. Berkshire Hathaway Inc. (NYSE:BRK.B) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 20 most popular stocks among hedge funds returned 41.1% in 2019 through December 23rd and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. Unfortunately, BRK-B wasn’t nearly as successful as these 20 stocks (hedge fund sentiment was quite bearish); BRK-B investors were disappointed as the stock returned 10.4% in 2019 (as of 12/23) and trailed the market. If you are interested in investing in large-cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 70 percent of these stocks already outperformed the market in Q4.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Disclosure: None. This article was originally published at Insider Monkey.