The 700+ hedge funds and money managers tracked by Insider Monkey have already compiled and submitted their 13F filings for the second quarter, which unveil their equity positions as of June 30. We went through these filings, fixed typos and other more significant errors and identified the changes in hedge fund positions. Our extensive review of these public filings is finally over, so this article is set to reveal the smart money sentiment towards Berkshire Hathaway Inc. (NYSE:BRK-B).

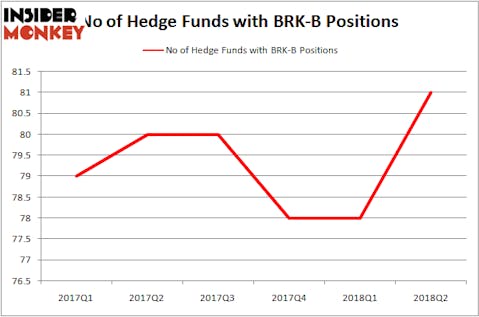

Berkshire Hathaway Inc. (NYSE:BRK-B) shareholders have witnessed an increase in activity from the world’s largest hedge funds in recent months. BRK-B was in 81 hedge funds’ portfolios at the end of June. There were 78 hedge funds in our database with BRK-B positions at the end of the previous quarter. Moreover Berkshire Hathaway is also the 19th most popular stock among hedge funds at the end of the second quarter (see the list of 25 most popular stocks among hedge funds).

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 17.4% year to date and outperformed the market by more than 14 percentage points this year. This strategy also outperformed the market by 3 percentage points in the fourth quarter despite the market volatility (see the details here).

As part of our routine, we analyze the performance of each fund manager every quarter and Warren Buffett is among these fund managers. We shared a glimpse of our Warren Buffett analysis at the end of this article. The main question Berkshire Hathaway investors have to answer is posed in the image below.

Let’s review the fresh hedge fund action surrounding Berkshire Hathaway Inc. (NYSE:BRK-B).

What does the smart money think about Berkshire Hathaway Inc. (NYSE:BRK.B)?

At Q3’s end, a total of 81 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 4% from the previous quarter. On the other hand, there were a total of 80 hedge funds with a bullish position in BRK-B at the beginning of this year. With the smart money’s capital changing hands, there exists a select group of notable hedge fund managers who were boosting their holdings meaningfully (or already accumulated large positions).

More specifically, Bill & Melinda Gates Foundation Trust was the largest shareholder of Berkshire Hathaway Inc. (NYSE:BRK.B), with a stake worth $9998.8 millions reported as of the end of June. Trailing Bill & Melinda Gates Foundation Trust was Eagle Capital Management, which amassed a stake valued at $1788.7 millions. Punch Card Capital, Pacifica Capital Investments, and Giverny Capital were also very fond of the stock, giving the stock large weights in their portfolios.

Consequently, key hedge funds have been driving this bullishness. Magnolia Capital Fund, managed by Adam Peterson, initiated the largest position in Berkshire Hathaway Inc. (NYSE:BRK.B). Magnolia Capital Fund had $62.7 million invested in the company at the end of the quarter. Tim Mullen’s Swift Run Capital Management also made a $0.3 million investment in the stock during the quarter. The other funds with new positions in the stock are Greg Poole’s Echo Street Capital Management, George Hall’s Clinton Group, and Michael Platt and William Reeves’s BlueCrest Capital Mgmt..

Let’s check out hedge fund activity in other stocks similar to Berkshire Hathaway Inc. (NYSE:BRK.B). We will take a look at JPMorgan Chase & Co. (NYSE:JPM), Exxon Mobil Corporation (NYSE:XOM), Johnson & Johnson (NYSE:JNJ), and Royal Dutch Shell plc (ADR) (NYSE:RDS). All of these stocks’ market caps resemble BRK-B’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| JPM | 92 | 7011260 | -8 |

| XOM | 50 | 2222523 | -7 |

| JNJ | 66 | 5711736 | -2 |

| RDS | 39 | 2329498 | 3 |

As you can see these stocks had an average of 61.75 hedge funds with bullish positions and the average amount invested in these stocks was $4319 million. That figure was $20251 million in BRK-B’s case. JPMorgan Chase & Co. (NYSE:JPM) is the most popular stock in this table. On the other hand Royal Dutch Shell plc (ADR) (NYSE:RDS) is the least popular one with only 39 bullish hedge fund positions. Berkshire Hathaway Inc. (NYSE:BRK.B) is not the most popular stock in this group but hedge fund interest is still above average.

We just finished a detailed quantitative analysis of Warren Buffett’s historical stock picks and shared the results in a free report (you can download it on our site). According to our analysis Warren Buffett’s large-cap stock picks underperformed the market over the last 4 years by a significant margin. His average returns over the last 18 years don’t look very appetizing either. That’s why we think investors who are looking to invest in large-cap stocks should consider other more popular stocks among hedge funds.

Disclosure: None. This article was originally published at Insider Monkey.