Bentley Systems, Incorporated (NASDAQ:BSY) Q4 2023 Earnings Call Transcript February 27, 2024

Bentley Systems, Incorporated beats earnings expectations. Reported EPS is $0.2, expectations were $0.19. Bentley Systems, Incorporated isn’t one of the 30 most popular stocks among hedge funds at the end of the third quarter (see the details here).

Eric Boyer: Good morning and thank you for joining Bentley Systems’ Q4 2023 Results and 2024 Outlook Webcast. I’m Eric Boyer, Bentley’s Investor Relations Officer. On the webcast today, we have Bentley Systems’ Chief Executive Officer, Greg Bentley; Chief Operating Officer, Nicholas Cumins; and Chief Financial Officer, Werner Andre. This webcast includes forward-looking statements made as of February 27th, 2024, regarding the future results of operations and financial position business strategy and plans and objectives for future operations of Bentley Systems Inc. All such statements made in or contained during this webcast, other than statements of historical fact, are forward-looking statements. This webcast will be available for replay on Bentley Systems Investor Relations website at investors.bentley.com on February 27th, 2024. After our presentation, we will conclude with Q&A. And with that, let me introduce the CEO of Bentley Systems, Greg Bentley.

Greg Bentley: Good morning and as always thanks to each of you for your continued interest and investments in BSY. I will start by relating the directions reflected in our 2023 results to our consistent expectations for 2024 and then some developing aspects, which also have a bearing on our outlook. Nicholas will cover operational highlights of the quarter, including soundings of the current tone of business on every front, and Werner will review financial details for both years, all the way through cash generation and its planned allocation. Most significantly, I must emphasize our overall satisfaction with Q4 and the full year 2023. In keeping with this, Nicholas and his operating teams are to be enthusiastically congratulated for performance, which while surpassing our established annual hurdle of 100 basis points improvement in operating margin including stock-based compensation, earned 100% of their new business-based incentive pool.

Although this entailed resourceful rebalancing after new mining investment unexpectedly slowed down in midyear, we have ended the year with historically high momentum in our fundamental ARR growth. A quarter ago a key question about ARR growth for 2023 Q4 was the degree to which accelerating progress in transitioning our China commercial model to be less directly subscription-oriented could perversely offset overall ARR growth. Otherwise, always our best performance gauge across the remaining 97% of our world. Indeed China, which previously was an ARR growth contributor, has been the significant detractor from our ARR growth as shown here ever since sanctions on Russia coincided with geopolitical apprehension about American software subscriptions for Chinese state-owned infrastructure enterprises.

In 2023 Q4, our purposeful structural changes in China did seem to be making progress. When Chinese developed products of our first joint venture cannibalized project-wise installations, we lose ARR in exchange for approximately equivalent one-time net proceeds of the license sale for our underlying platform. But with no American stigma, hopefully, volume expands so that we can come out ahead. In fact, we concluded 2023 by growing our revenues in China for the year by 3% as such licenses more than offset the inevitable decline 7% in China ARR. To quantify the increasing impact on ARR of this intentional China market change, our overall ARR year-over-year growth rate of 12.5% is increasingly diverging from our high of 13.5% in the quarter for the world excluding China.

And given the acceleration in our business benefiting the ARR detracting transitions in China, the baseline ARR growth rate for our 2024 outlook must reflect this gap prevailing foreseeable. To further consider how the other directions within our growth momentum exiting 2023 should inform our 2024 financial outlook, let’s review in turn each of the underlying factors that we portray notionally in our introductory materials as layers within ARR growth. Starting at the top with new business from new logos, in 2023 Q4 for the fifth straight quarter this accounted for about 3% in ARR growth, led by our SMB initiative and ongoing digital experience investments towards self-service automation. Reinforcing confidence in continued such momentum in 2023 Q4 Virtuoso subscriptions attracted over 700 further new logos for the eighth straight quarter of over 600, in addition to over 400 separate new logo SMB accounts where in 2023 Q4 we achieved what I suspect was a competitive displacement through a perpetual license sale.

See also 17 European Countries that Allow Dual Citizenship and 14 Best Software Stocks To Buy According To Hedge Funds.

Q&A Session

Follow Bentley Systems Inc (NASDAQ:BSY)

Follow Bentley Systems Inc (NASDAQ:BSY)

Receive real-time insider trading and news alerts

The other layers of growth are those which aggregate to our net revenue retention for existing accounts. Because NRR takes into account only recurring revenue and not license sales, the mix change in China from subscriptions to licenses, is increasingly impinging on this measure. So while NRR declined in 2023 Q4 to 109%, excluding China and Russia, which is also a factor now, as this looks back over the full trailing two years, NRR would have remained at 110%. Our most significant initiative to sustain NRR accretion is our E365 consumption subscription program for enterprise accounts. You see here in green the incremental magnitude and proportion of ARR reached through E365 accretion and expansion in 2023 Q4. Although, it being a fourth quarter with its greater concentration of E365 prospect renewals, we upgrade relatively more ARR to 365 than in other quarters.

In 2023 Q4, it remained the case that a relatively small portion of E365 growth was from our next largest accounts upgrading to the program with the majority of E365 growth representing NRR within accounts already on E365. E365 renewal negotiations for the largest accounts, now almost always entail resetting the individualized floors and ceilings, which serve to bound what we can charge for the accounts consumption. Increasingly, we and they have preferred to allocate our respective risks of consumption upside and downside proactively progressing over multiple future contract years rather than to renegotiate every year. Our own priority is to maintain floor and ceiling parameters, which in each case enable and incentivize double-digit ARR growth when effectively combining consumption volume, mix and annual pricing escalation.

During 2023 Q4, one negotiation resulted for our first time in a total contract value in nine figures USD. Such multiyear E365 arrangement, reinforce our accounts commitment to BSI and to going digital for mutual long-term growth. However, the contract length has no barring on E365’s straightforward ratable revenue accounting and annually recurring cash flow. And while much of our non-E365 subscription revenue is subject to 606 vagaries across the quarters of a contract year, we have almost none of the multiyear bookings and/or billings, which caused confounding obscurity for many other peer companies. By contrast over and above the compelling transparency of E365 ratable consumption accounting multiyear floors and ceilings work out to everyone’s advantage including investors, because they preserve our incentives and upside while improving and extending the visibility of our ARR, revenue and cash conversion.

Back to the outlook for each accretion layer. Our annual price escalation, which can vary by country and product mindful of competitive conditions is on average more or less calibrated to stay ahead of inflation in our own costs, which are primarily for colleague compensation. For each of 2022 and 2023, we realized on weighted average escalation in mid-single digits. For 2024, it must be acknowledged that peak inflation in the world seems behind us, so escalation will contribute less ARR growth going forward. As to consumption volume, we faced another putative headwind with the demographics of retirement tending to reduce the infrastructure engineering workforce. And in theory, increasing productivity through going digital can even be at the expense of usage volume.

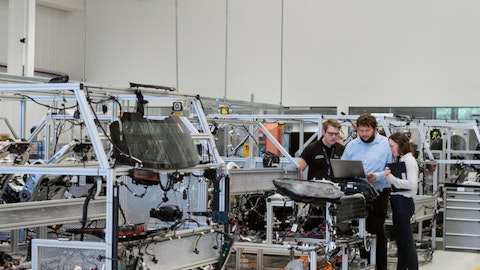

The only offsetting gains in application usage volume could come from competitive displacement opportunities on the margin. On balance, we cannot now expect nor rely upon net increases in user volume. However, the widening engineering resource capacity gap between a static number at best of infrastructure engineering professionals and the burgeoning demand for world resilience and adaptation is in fact the greatest and most durable driver of our ARR growth, because going digital is the compelling key. Recall that the 2023 year in infrastructure going digital award finalist documented an average of 18% savings in engineering time through the digital advances we enabled for them. Quite noticeably, our enterprise accounts are now explicitly prioritizing E365 blueprint, which most deliver savings and man hours and usage days to our ultimate mutual benefit.

And accordingly application mix accretion, which measures the pace of our users upgrading to our more specialized and relatively more costly applications to increase their productivity continues to more than offset demographically constrained usage volume. And accelerating application mix accretion, which is our average revenue per application usage day holding pricing constant for the calculation. Our user success functions especially, by way of E365 digital workflow blueprints are literally leading the way. So, I’m pleased to report accelerating annual progress, with annual application mix accretion having grown from about 4.5% for 2022 to about 6% for 2023. This also captures the usage of ProjectWise attached to these application user days.

So, this measure closely corresponds to what we’ve shown that the ENR top engineering firms, a representative quarter of our business, spend with us. Since that spending only averages about 1% of the amount that they build to their clients for the usage time, I believe there’s lots of headroom for application mix accretion to continue to expand indefinitely. And looking to what’s new, although we’re confident in this long runway ahead for our strong and consistent consumption per user base business, I believe that here in 2024, we’re finally at the point where our third aspiring growth initiative after E365 for the enterprise market and virtuosity for SMBs have become firmly established, will finally take off after having been promised in our intro deck as you see here for years.

This third growth initiative leverages Digital Twin opportunities to be incrementally monetized, through cloud subscriptions charged per asset. While I think that by rights, this can grow to become larger than the provision of software per user, the challenge has been that scaling Digital Twins takes a surrounding ecosystem of digital integrates to provide the related services around data quality and engineering proficiencies, which complete the use cases. To that end, we along with others have been determinedly evangelizing the infrastructure Digital Twin potential, spanning delivery and performance to thus both the infrastructure project delivery supply chain and of course to owner operators directly. Frankly, institutionalized conservatism has made this a slow sales cycle, with success by the ones and primarily in Asia Pacific.

To gain experience in the meantime, we have assembled our own cohesive digital integrator to show the way. It’s now nearly $100 million services business is opportunistically anchored by being the leading global implementer and emerging cloud hosting provider of IBM’s Maximo, the primary incumbent choice of infrastructure owner operators for enterprise asset management. Thus, over time, cohesive can open doors for our iTwin platform to integrate engineering technology ET and operational technology OT with Maximo’s IT for Digital Twins to optimize operations and maintenance. This represents the extreme of an enterprise approach to Digital Twins from the top down. But because that takes so long, we are trying also to widely catalyze Digital Twin opportunities from the bottom up.

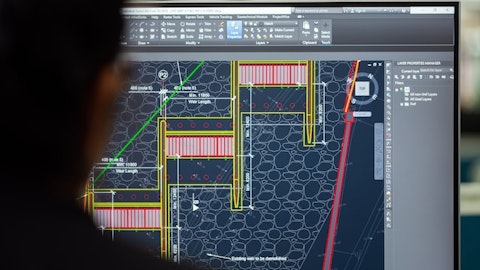

Hence, our priority to infuse and connect all of our existing offerings with our iTwin platform, starting with our Bentley Infrastructure cloud, ProjectWise and SYNCHRO for delivery and AssetWise for performance, and this year with natively hybrid capabilities in our modeling and simulation applications. However, even this is, at best, an evolution toward Digital Twin workflows. So, I am very pleased to say that we have now validated a breakthrough bottoms-up entry point for Digital Twin monetization that is, by contrast, instant on both technically and commercially. Accordingly, our main departure for 2024 will be a focus on this asset analytics opportunity. It leverages AI with our iTwin platform to generate discrete and actionable insights from enlivened reality modeling of infrastructure assets with the Digital Twin OT uniquely enhanced by ET and IT.

Our learning curve in asset analytics was initiated with OpenTower, which we developed around a small acquisition of cell tower specific AI for our structural modeling and iTwin platform. Since I showed this with operating results almost two years ago, the AI value to communications operators for CapEx provisioning and OpEx inspection and maintenance has grown exponentially. What is new are the global household names in the broadband infrastructure ecosystem looking to join forces to institutionalize cell tower Digital Twins. Our other foray to-date in asset analytics Blyncsy, acquired and described late last year where the monetized asset is a mile of roadway and what we charge depends on how frequently the AI is run on fresh crowdsourced imagery to detect actionable maintenance conditions.

Because its crowdsourcing is ubiquitous, Blyncsy asset analytics can be literally instant on in a blink. In each asset analytics case, our role can be behind the scenes providing the iTwin experience cloud services, our AI-as-a-Service, and all of the automated processing at scale and at standard volume-based pricing. Ecosystem partners can variously bundle and provide the survey imagery, their own proprietary asset-specific engineering analytics, and enterprise integration with the owner-operators environment. The financial opportunity is here and now. Our ARR for Asset Analytics Cloud service is in three digits per cell tower. In 2023, Q4 OpenTower won procurements including for new business ARR in seven digits. And in 2024, we are competing for eight-digit subscriptions.

And with our go-to-market coverage of transportation owner operators, Blyncsy is now also pursuing procurements that can exceed seven figures of ARR. In each of the cell tower and roadway verticals, it is thus already clear that there is an asset analytics TAM in nine figures. And on our existing global footprint gives us the pole position with both the owner-operators and the required ecosystem partners. So, for 2024 our investment focus will be to organizationally consolidate OpenTower and Blyncsy with further potential such acquisitions for growth and operational synergies and to leverage and expand our asset analytics head start. This will have a higher priority than continuing either our iTwin venture program or fractional investments or even our traditional programmatic acquisitions of known mature companies to fill white space in modeling or simulation.

As there don’t tend to be potential asset analytics acquisitions beyond early-stage companies, the capital requirement should fit well within what would have otherwise been the magnitude of our historical programmatic acquisitions. And while OpenTower and Blyncsy themselves merit rapid investment to add capacity within their ripening markets, this is already sufficiently accommodated in our 2024 outlook for operating margin, including stock-based compensation, which continues our consistent annual improvement target of 100 basis points. Moreover, to the extent, we succeed in making further acquisitions and asset analytics and thus presumably end up actually for accounting, consolidating early-stage losses, which would have been below the line had we been merely DC investing to fund them, we will commit to corresponding increases in our ARR growth rate, so that BSY’s literal Rule of 40, if you do the math for 2024 is not significantly in jeopardy this year.

So while I have been generally emphasizing, maintaining into our 2024 outlook, our favorable overall operational and market consistency and momentum from 2023, this significant change to our acquisition priorities will make a difference. As you see here, the contribution to our business performance of ARR acquired with programmatic acquisitions had already been declining to a new loan in ’23 Q4. But since in 2024, we will be targeting Asset Analytics acquisitions, which will necessarily be in early stages, this layer will probably end up more ARR right than ever before. This is reflected in our 2024 outlook for ARR growth business performance, which is in the range of 10.5% to 13%. Nominally, that appears below what was our outlook for 2023 a year ago and at the midrange below our 2023 actual outcome.

But in fact, we plan for a quite consistent underlying robust ARR growth, especially ex-China, but subject as measured though to these effects of the accelerating China subscription transition of somewhat moderated escalation and have lowered expectations for ARR from programmatic acquisitions. Finally, the wider range than 2023 reflects the greater variability in the emerging Asset Analytics business model. To summarize, we are responding to very healthy end markets with appropriate and by now proven initiatives to sustain 2023’s performance with incremental upside now including Asset Analytics. And any case, I think you can take away confidence in our principal demonstrated investment premise, consistently delivering profitability after stock-based compensation, which has grown at a compounded rate remaining on the order of 16% per year since 2018, with distinctively transparent cash conversion.

And now, over to Nicholas, for operational perspectives behind these directions and development. Thank you.

Nicholas Cumins: Thank you, Greg. First, I also want to congratulate our teams around the world, who worked tirelessly to deliver another great quarter and year. We accomplished a tremendous amount that positions us even better to take advantage of the favorable dynamics for infrastructure and I will see continuing into the foreseeable future. In fact, in Q4, we saw no major changes to the macro trends we have discussed throughout the year and we expect these trends to continue in 2024. The engineering resources capacity gap to fulfill the demand for infrastructure is widening. In the most recent ACEC quarterly survey, US engineering firms across all sectors continue to expect a higher backlog of projects 12 months from now.

This fits what we are hearing from users around the world. They are struggling to find the people and skills necessary to fulfill the demand. All of these is fueling the need for infrastructure organizations large and small to go digital and leverage software to be able to do more with less in better ways. Moving to our performance in Q4. It was also very consistent with previous quarters. Starting with our infrastructure sectors. Our largest sector public works and utilities continues to be the main growth driver for the company benefiting from infrastructure investments around the world whether in transportation, water utilities or the electric grid. In this context, Power line systems or applications for analysis and simulation of overhead transmission infrastructure continue to perform very well.

In terms of resources we are seeing consistent trends to last quarter. Seequent performed as expected given the slowdown of new mine investments continuing to weigh on its growth rate. Industrial remained mixed as growth with EPCs continue to slow down especially in Asia Pacific. The commercial and facility sector remained relatively flat. Moving on to regions. North America continued its strong performance. The Infrastructure Investment and Jobs Act remains a tailwind. To-date about 35% of the $1.2 trillion five-year total has been announced for projects elected to receive funding. The majority of funding has been for transportation. Last call we discussed how we help state departments of transportation in their efforts to win federal advanced digital construction management system grants.

I’m happy to report that many of those DOTs were successful in winning grants. We also supported DOTs in their federal smart grant applications which will fund technology projects to improve transportation efficiency and safety. Beyond transportation, IIJA investments have started in water infrastructure and for the electric grid as well. Most of the activities have been around improving the current grid but we expect more growth to come from the much needed expansion of the electric grid to transmit electricity from renewable sources of energy with the US permitting process as the main limiting factor. EMEA had another strong quarter led by public works and utilities across the region. We continue to see investments in transportation in particular rail as well as water and energy.

In Asia Pacific we had solid growth in Southeast Asia driven by outsourcing to local engineering talent. Australia and New Zealand continue to have strength in resources. Within India, the growth continued to normalize after many quarters of rapid growth. Regarding, China I was able to visit the country in December. On one hand they are making huge investments in the energy transition and the government is now mandating the use of 3D modeling for new road projects both of which create opportunities for us. On the other hand the preference for local software is real and growing as well as the preference for perpetual licenses in case the geopolitical situation worsens. The overall takeaway being that we expect China to continue to weight on broader AR growth in the foreseeable future.

But we continue to believe in the substantial longer-term opportunity. I would like to take a couple of minutes to talk specifically about our subsurface software company, Seequent. Their core business is mining, but we are seeing increased momentum with their software in civil engineering, which was obviously one of the main strategic objectives for the acquisition of the company back in 2021. Understanding the subsurface is critical for infrastructure. The largest element of technical and financial risk lies in the ground, according to the Institution of Civil Engineers. More than one-third of project overruns are related to unexpected ground conditions. Using technology to help reveal what lies beneath can help reduce risk, cost, and the environmental impact of infrastructure projects.

A great example is HS2, the high-speed rail line that will connect London to Birmingham, and which requires a massive amount of earthworks. Approximately 21 million cubic meters of material was earmarked for excavation along the 19-kilometer rail route. The project team needed to identify efficiencies that could minimize waste and help HS2 meet its environmental commitments. By combining bending infrastructure cloud and Seequent geoprofessional applications, Mark McDonnell was able to optimize mass haul movements during construction, which provided critical insight into material reuse across the project. It helped the team cut 400,000 tons of carbon emissions and saved the use of a quarter of a billion liters of water. The 3D models also provide a foundation for the development of a digital twin to support future earthworks projects.

We are seeing more of these subsurface civil projects. For example, the Gelnhausen and Fulda rail line in Germany. Two-thirds of the route options run through tunnels. The firm Professor Quick und Kollegen was hired to perform the subsurface investigation to determine an optimal route option using Seequent geoprofessional applications. Projects like these, which bring together engineering and subsurface data to support the full life cycle of infrastructure assets, demonstrate both the value of integrated digital twins and the opportunity for Bentley. I will now hand over to Werner for details of our financial results.

Werner Andre: Thank you, Nicolas. We are pleased with another strong quarter to finish out a great year. Total revenues for the fourth quarter were $311 million, up 8% year-over-year, or 7% in constant currency. Our fourth quarter revenues were impacted by timing from the continued upgrades of our accounts from traditional annual subscriptions with upfront revenue recognition to our E365 commercial model, where revenues are recognized on a more radial basis. Such E365 upgrades and the associated timing impact on revenue recognition were slightly higher than what we modeled. Otherwise, the quarter was in line with our expectations. For the full year, total revenues were $1.228 billion and grew 12% on a reported and constant currency basis.

Subscription revenues for the quarter grew 8% year-over-year, or 7% in constant currency, and represented 88% of our total revenues. As just mentioned, subscription revenues were impacted by the timing aspects from our continued E365 upgrades. E365 now reflects 38% of our 2023 subscription revenues, up from 32% in 2022. For the year, subscription revenues grew 13% on a reported and constant currency basis. Our E365 and SMB initiatives continue to be solid contributors to our subscription revenues growth. Perpetual license revenues for the fourth quarter grew 6% year-over-year in reported and constant currency. For the full year, perpetual licenses revenues grew 6% in reported and 7% in constant currency. Even though, perpetual license make up only 4% of total revenues and will certainly remain small relative to our recurring revenues, they have grown in significance to us and we expect the relative importance to our commercial offerings to continue, particularly for SMB and in China due to local preferences.

Our professional services revenues for the quarter grew 9% year-over-year in reported and 7% in constant currency. For the year, services revenues grew 7% on a reported and constant currency basis, and benefited from the acquisition of Vetasi, which we acquired within our Cohesive Digital Integrator Group in 2022 Q4. Now before moving to our recurring revenue performance, I want to highlight our change in methodology for calculating constant currency growth rates. Starting this quarter, we transitioned to the transactional methodology from the previous functional methodology in reporting constant currency growth rates. The transactional methodology aligns with how we manage our business and how we have historically provided guidance. For us historically, both approaches typically delivered similar results.

However, the increased significance of Seequent’s US dollar-based international billings out of Bentley Island combined with increased FX volatility period-over-period, created bigger differences between the two methodologies. We provided our constant currency results under both methodologies in our Q4 results release and you will see further comparisons and reconciliations within the MD&A of our 2023 Form 10-K filing. On a prospective basis, starting with Q1 2024, we will report constant currency results on a transactional basis only. Our GAAP results as reported are of course, not impacted by this change. Moving on to our recurring revenue performance. Our last 12 months recurring revenues increased by 12% year-over-year in reported and constant currency, and represent 89% of our total revenues.

Our last 12 months constant currency account retention rate is back at 98% and our constant currency recurring revenues net retention rate was 109% led by continued accretion within our E365 consumption-based commercial model. All of our recurring revenue measures are on a trailing 12 months basis with 2022 as the comparative period. As a result, they are all impacted by our exit from Russia mid-2022, when Russia represented approximately 1% of our subscription revenues run rate. We ended Q4 with ARR of $1.175 billion at quarter end spot rates with our E365 and SMB growth initiatives remaining the key growth drivers. On a constant currency basis, our trailing 12 months ARR growth rate was 12.5% year-over-year and 3.2% on a sequential quarterly basis.

Q4 continued to be impacted by headwinds in China and a greater preference there for perpetual licenses. Overall, as Q4 is our biggest contract renewal quarter and thereby represents the quarter with our biggest ARR growth opportunity, we are pleased with the finish of the year. Now moving to profitability performance. Our GAAP operating income was $38 million for the fourth quarter and $231 million for the year. We have previously explained the impact on our GAAP operating results from amortization of purchased intangibles, deferred compensation plan liability revaluations and acquisition expenses. There are two other items, I would like to highlight this quarter. During the fourth quarter, we initiated a strategic realignment program, our first since 2020, to better align our resources with our strategy, address market opportunities and to support our growth.

We incurred a realignment charge of $12 million, mainly for severance, which we expect to be fully accounted for in our operating cash flows during the first half of 2024. We expect to fully reinvest run rate savings into priority areas such as AI in product development and marketing. Secondly, during the fourth quarter, we recognized a net discrete income tax benefit of $171 million, relating to an internal legal entity restructuring and continued alignment of our Seequent’s IP ownership with our operating model. The associated deferred tax assets represent the anticipated undiscounted future cash tax benefits, which we expect to realize through tax amortization over the next 13 years. Moving on to adjusted operating income with stock-based compensation expense, our primary profitability and margin performance measure.

Adjusted operating income with stock-based compensation expense was $75 million for the quarter, up $11 million or 16% year-over-year, with a margin of 24%, up 150 basis points. In line with our plan and as discussed on our last call, our Q4 margin was impacted by relatively higher OpEx compared to Q3, mainly caused by incremental promotional activities and IT system implementation costs associated with our new financial systems. For the full year, our adjusted operating income with stock-based compensation expense was $325 million, up $51 million or 19% with a margin of 26.4% also up 150 basis points year-over-year. With respect to liquidity, our operating cash flow was $87 million for the quarter and $417 million for the year, up $143 million or 52%.

Our conversion from adjusted EBITDA was 100% for the full year and benefited from timing of collections at the beginning and at the end of the year, and our increased focus on working capital management. As previously discussed, our business model produces reliable and efficient cash flows over a trailing 12 month period, but with some variability between quarters due to timing. For 2024, we estimate that our conversion rate of adjusted EBITDA to cash flow from operations will be approximately 80%. Based on the expected seasonality of collections and expenditures, we expect that approximately 55% to 60% of our catalog from operations will be generated during the first half of 2024. For 2024, our cash flow expectations include a number of puts and takes, including approximately $12 million of severance payments relating to a strategic realignment program, around $15 million to $20 million of cash expenditures associated with our IT systems upgrades which we expect to be amortized into OpEx, starting in 2025 and incremental estimated cash taxes of approximately $8 million which does reflect the cash tax benefits from the legal entity restructuring I mentioned before.