Nicholas Cumins: It very top of mind is on their side, how much demand there is for infrastructure? And how important is the role, by the way, in designing, building, delivering that infrastructure and to address so many of the world’s problems but at the same time, how much constrained they are in terms of engineering resource capacity. By the way, we heard it from the CEO of the top engineering firms we met a couple of weeks ago in Arizona. But we hear it across the regions the engineering resource capacity gap is just getting deeper. I heard that, for example, in India now, we’re starting to be constrained in terms of engineering capacity when it comes to very advanced engineering for offshore platform, for example, or high speed rail.

So this is a global problem. And they all understand that the way for them to be able to bridge the capacity gap is by going digital. So of course, software plays a big role. And in that context, indeed, they are very interested in AI. I was surprised that in every conversation we had with infrastructure engineering firms, CEOs two weeks ago, AI came up as a topic every conversation. So, it is very much top of mind. They’re looking at it as an opportunity to increase the productivity, the efficiency, the effectiveness of their engineers as a step function.

Eric Boyer: The next question comes from Joshua. Joshua Tilton from Wolfe Research.

Joshua Tilton: You guys, can you hear me?

Greg Bentley: Yes.

Joshua Tilton: All right. Great. I actually want to just kind of sneak in a two-parter on the infrastructure build bundling. The first is kind of a follow-up to an earlier question. And it’s — you talked about funding for a wider array of projects that’s coming online, like we had transportation now we’re going to have water and other things coming. So the question is, is it fair to assume that the tailwind to growth from the infrastructure bill will just be greater next year than it was this year because you have more projects. And the second part is on the other side of that, are you guys maybe seeing a dynamic where the current interest rate environment is maybe eating away at some of the excitement around the infrastructure bill relative to when it was passed initially?

Greg Bentley: Well, I think it is the case that there not only is the expansion of the IIJA to the other areas beyond transportation grid and broadband and water. There also are now a variety of these grant programs, Nicholas mentioned one, which is another vehicle to get some funding. But the base load in transportation is going to continue, and these others will come on. I want to go to the interest rate question because fundamentally, while not much of our work in the scheme of things is a privately financed. That is the case with new mine exploration and new mine exploration does turn out to be sensitive to capital market constraints to do with interest rates and other aspects. And that has turned down during this year in a way that couldn’t have been anticipated.

The thing is that, on the other hand, existing mines need to run at full capacity. There’s no lack of demand that and where the costs are sunk for the new infrastructure and so forth, it makes economic sense to go full tilt there and we have a lot to help with in respect of that. I’ll mention also in terms of private funding its industrial sector. And we do talk about that having gotten a little softer. But again, I don’t — I think we can’t say that, that’s a trend because it might have to do with the number of days of the quarter and the consumption aspect of that, which, by the way, is even more pronounced in India, where they had more holidays during Q3. So, we’re not calling that a trend yet necessarily. Something very interesting, it isn’t quite to do with interest rates, but is purchasing behavior where monitoring is preference for perpetual licenses and would say, how does that make sense to lay out money upfront when interest rates are higher.

Well, there could be concern about future economic conditions and some SMB businesses apparently anecdotally say, while things are going well and we can fund it, let’s buy the perpetual license. In China, I’m afraid it’s a different phenomenon. It probably is geopolitical anxiety that’s leading to some bigger deals than we’ve seen ever before become perpetual license deals because they don’t want to take a chance with continued subscriptions perhaps under threats of possible sanctions. So it’s a complicated world in that in that respect. So we see on the margin, these impacts of interest rates, but it doesn’t affect very much public works and utilities and our other domains.

Eric Boyer: Next question comes from Warren Meyers from Griffin Securities.

Warren Meyers: Can you hear me now? Thank you, guys, for having me. I’m obviously in for Jay. Just a quick one with respect to the multiple industry solutions you announced at your recent infrastructure conference. How would you rank those in terms of potential materiality to product and/or services, revenues or margins in 2024 and beyond kind of a multi-part question here?

Greg Bentley: I’m going to ask — I’m sorry, go ahead, you had another part to it. Go ahead.

Warren Meyers: No, no. That’s basically it.

Greg Bentley: Well, I’m willing to ask Nicolas to help quantify, but this notion that the bulk of our opportunity is doing is for operations and maintenance. So, infrastructure intelligence compounding the value, that is where the economic value occurs and the opportunity for analytics for AI generally. And one of the earlier questions referred to that in what BP is doing. So, we’re — so go ahead, Nicholas.

Nicholas Cumins: Yes. The — as you know, our business is roughly half-half between engineering firms, owner operators. But when we look at what owner operators are using for the most part, it is also software related to the design phase of the infrastructure life cycle. So, we think one of the big growth opportunities for the Company is the software for the operations phase of the infrastructure lifecycle. And this is why the industry solutions are all about. Now there are a bit of a dimension that cuts across because what we’re doing with these industry solutions is combining different products that we already have and then adding some additional capabilities when it’s be. For the most part, these industry solutions are focused on giving more intelligence around infrastructure assets themselves.

So being able to inspect remotely being able to sense through IoT devices, If anything is wrong with that infrastructure asset and triggering some preemptive actions if necessary. Obviously, this is also a good use case for AI. This is why we’re already using quite a bit of AI capabilities for asset analytics. So this is not discrete product opportunity, if you want, it’s more of a long-term growth opportunity for Bentley.

Eric Boyer: Our next question comes from Blair Abernethy from Rosenblatt Securities.

Blair Abernethy: Thank you. Good morning. Trying to get the mute button off there. Just wanted to follow up on some of Nicholas’ comments and maybe partially for a word or two the concept of copilots as a way to help increase the productivity of design infrastructure design engineers. Where do you see yourselves sort of first implementing that? What kind of monetization schemes are you considering? And so what’s the timing of this? Is this — are you in preproduction at this stage or private previews? Or is this a year or two out? Just give us a sense of when you can sort of see this in the market?

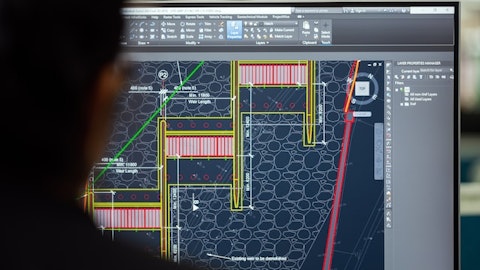

Nicholas Cumins: We are already with AI when it comes to asset operations, as I just explained, we’ve had capabilities there for a couple of years now, which also made the acquisition of Blyncsy, which is also leveraging AI in order to detect what’s going on around the transportation network. We are absolutely excited about the potential of AI when it comes to helping engineers in the design phase. This is very early stage as an industry overall. We are in exploration phase and we previewed what we’re working on, which is when relevant for some of the engineering firms, leveraging AI as a copilot when it comes to evaluating different site layout options, leveraging AI in order to automate some production of drawings that is really just a sync of time for them right now.