Bentley Systems, Incorporated (NASDAQ:BSY) Q3 2023 Earnings Call Transcript November 7, 2023

Bentley Systems, Incorporated beats earnings expectations. Reported EPS is $0.22, expectations were $0.19.

Eric Boyer: Good morning and thank you for joining Bentley Systems’ Q3 2023 Operating Results. I’m Eric Boyer, Bentley’s Investor Relations Officer. On the webcast today, we have Bentley Systems’ Chief Executive Officer, Greg Bentley; Chief Operating Officer, Nicholas Cummins; and Chief Financial Officer, Werner Andre. This webcast includes forward-looking statements made as of November 7, 2023, regarding the future results of operations and financial position, business strategy and plans and objectives for the future operations of Bentley Systems, Incorporated. All such statements made in or contained during this webcast other than statements of historical fact are forward-looking statements. This webcast will be available for replay on Bentley Systems Investor Relations website at investors.bentley.com on November 8, 2023. After our presentation, we’ll conclude with Q&A. And with that, let me introduce the CEO of Bentley Systems, Greg Bentley.

Greg Bentley: Good morning, and of course, thanks to each of you for your interest and investment in BSY. In our agenda, I start by interpreting directions within our quarterly operating results. Each quarter, a natural KPI headline is our ARR growth year-over-year business performance. While in ’23 Q3, that nominally ticked down to the 12.5% midpoint of our financial outlook for the year, this nonetheless, represents continuity in our strong growth momentum given puts and takes specific to this quarter, which I will explain, and we are likewise steadily tracking to our planned annual gains in operating margins and cash flows. Leading the way, even among more broadly strong market conditions this quarter is the public works/utilities infrastructure sector in the U.S. With almost half of our ARR here, this mainstay in effect serves as the governor on our underlying flywheel.

U.S. public works/utilities continues to benefit from the fundamental expansion emerging finally beyond transportation both infrastructure investment and Jobs Act funding. This quarter’s ACEC survey of U.S. engineering firms across all sectors, reports a medium current backlog of 11 months, reflecting an engineering resource capacity gap. Even more permanent for digital workflow investments, expectations for a year from now, across economic sentiment anticipate an even stronger market for engineering firms throughout next year that will result in yet higher backlog. When ACEC asked this time about the lack of qualified workers, you see there was a strong agreement that an engineering resource capacity gap is already constraining engineering firms from growing to meet this backlog of work.

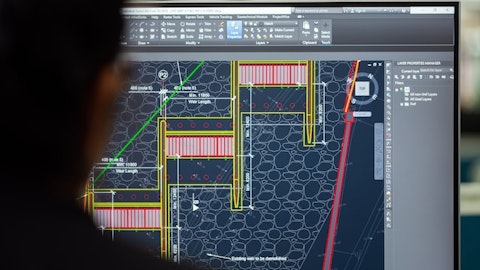

Another indicator of this engineering resource capacity gap is that the average duration that our applications are used in a workday has continually increased now by 23 minutes per day since before the pandemic. We will shortly come back to count these workdays. As Nicolas will report firsthand, the capacity gap is motivating infrastructure engineering organizations everywhere to more than ever prioritize going digital. And with the resulting demand broadly pervasive across infrastructure sectors and global regions, our net revenue retention, the trailing indicator for growth in existing accounts remains at its sustained high level. So then what’s up or rather down with year-over-year ARR growth as of this most recent quarter end? Well, a plurality of ARR is now under our E365 program for our largest accounts.

And in Q3 ’23, this E365 proportion, of course, continued to grow, both through accretion within existing E365 accounts and by accounts spend over $100,000 per year in ARR, hence, we consider to be E365 prospects rather than SMB, upgrading to E365 from our select subscription program. Under E365, we charge accounts for our ProjectWise and AssetWise enterprise collaboration systems based on the total number of users or assets, respectively, in the quarter. But the majority of our E365 charges are for daily consumption of our applications, which consumption occurs substantially on the weekday workdays during a quarter. A year ago, ’22 Q3 had a calendar with 66 weekdays, but ’23 Q3’s calendar ended with a weekend day and began with two weekend days that were followed by effectively two holidays in the U.S. rather than one holiday last year.

See also 11 Most Undervalued Solar Stocks To Buy According To Hedge Funds and 16 Best Consistent Dividend Stocks to Invest In.

Q&A Session

Follow Bentley Systems Inc (NASDAQ:BSY)

Follow Bentley Systems Inc (NASDAQ:BSY)

Receive real-time insider trading and news alerts

Now even though half of our business is in the U.S., holidays aren’t universal. So even setting aside the comparative effect of that four-day weekend, if we just count all weekdays as workdays, ’23 Q3’s E365 consumption year-over-year comparison, suffers as a result of having had one less weekday workday than 2022 Q3. Moreover, because we annualize E365 ARR by multiplying the trailing quarters’ consumption by 4, ’23 Q3’s year-over-year ARR growth was negatively four weekday workdays of E365 consumption. But as you can also see here, this phenomenon will normalize here during ’23 Q4 as both years fourth quarters and the full year have the same weekday count. Now our overall ARR growth, of course, comes not only from net retention and accretion for our existing accounts, increasingly through E365 as we have been discussing, but also from new logos, which for ’23 Q3, again accounted for 3% of our ARR growth.

New logos, of course, tend to start as SMB. We have become confident in being able to grow our SMB business, at least as fast as we grow E365 for our enterprise accounts. And in Q3, SMB growth was faster. By virtue of our own investments in going digital, our virtuosity inside sales group focused on SMB is continually getting better at digital engagement. The net quarterly ARR additions from our Virtuoso subscriptions continue to compound. In ’23 Q3, Virtuoso subscriptions again attracted over 700 further new logos. But in addition to subscriptions, our SMB sales group also offers perpetual licenses, largely for differentiation and appealing to prospects who don’t have that choice from our principal competitor, this strategy is succeeding. During Q3, we added almost 300 incremental new logos through perpetual license sales.

And as you see, overall, we saw in ’23 Q3 an unprecedented year-over-year upsurge in purchasers who chose perpetual licenses rather than subscriptions. We have generally expected this in China here broken out as we pivot there intentionally towards localization. As a result, while our overall new business and revenue in China did increase sequentially and year-over-year, ARR there continued its expected result in decline. In fact, the 97% of our business, excluding China, did maintain its highest level of year-over-year ARR growth. To summarize the business directions of ’23 Q3, in light of these puts and takes, I was pleased with our strong year-over-year ARR growth rate notwithstanding its slight decline compared to last quarter in light of the combination of the E365 consumption workday anomaly and the observed transition to license purchases.

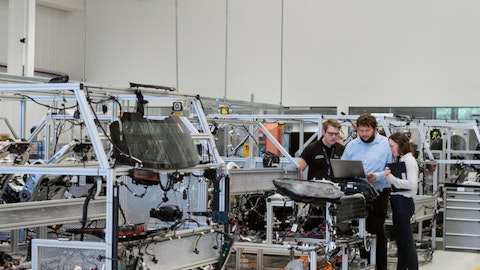

For significant corporate development, I start with our annual Year in Infrastructure conference where I entitled my keynote presentation, Going Digital Towards Infrastructure Intelligence. We gathered physically in Singapore last month with our Going Digital Awards competition finalists chosen by juries of independent professionals and we had there over 120 members of the world’s infrastructure media, and we live stream from there. I think Year in Infrastructure is the best available means to understand the fundamentals of our business on the ground. But the time zone made even virtual attendance is difficult. So Investor Relations Officer, Eric Boyer, attended and has compiled a video of the two edited keynotes and other conference highlights which is now available for you on our Investor Relations website.

The global nature of the Year in Infrastructure was signified by the provenance of the 36 finalists chosen from the 300-plus nominees in 51 countries. Once again, this year, the region with the most finalists was Asia ex-China with a prolific concentration of digital advancements. I’ve referenced many examples from our host country, Singapore, leading a way to Infrastructure Intelligence. In a world with a widening infrastructure engineering resource capacity gap, to me, the most significant headline comes from our having asked each nominee this year for the first time to quantify their project engineering savings from going digital. For those finalists where this could be calculated as a percentage, the median was 18%. This underscores the importance and potential of our BSY busy work and of the Year in Infrastructure conference to help promulgate these digital workflow advancements, which can make a difference of such magnitude, as an indication of good traction from such efforts toward making all projects as good as the best projects.

While in the past, we have reported on Digital Twin progress among the finalists only, I find it encouraging that this year, among all the 300-plus nominated projects, fully 28% credit reality modeling, our iTwin capture software for creating engineering grade as operated 3D models generally from drone surveying as the context for Digital Twins. And likewise, our SYNCHRO for construction modeling is now credited by fully 17% of all 300-plus nominated projects. Given that virtually all design, modeling and simulation is already performed in 3D, we believe that seamlessly incorporating 4D simulation, inevitably underlies the future of construction while also delivering the Digital Twin building blocks for infrastructure intelligence during the lifecycle of resilient asset operations.

And while it is encouraging that this year, 64% of finalists credit our iTwin platform for any or all of such Digital Twin advancements I think it’s even more significant for iTwin now to be credited by fully 35% of all 300-plus nominated projects. Indeed, the iTwin platform and schema commonality across our Bentley Infrastructure Cloud enables infrastructure engineering data to compound in value throughout project and asset life cycles. As to the extent of this potential value, we estimate that our ProjectWise users are currently accumulating over 100 million new unique digital components per month for their future benefit. While Nicholas will next talk about how generative AI will yet further compound the value for an account of their data in ProjectWise, for instance, through copilot training and reuse of their data across their new projects.

At Year in Infrastructure, I highlighted several infrastructure intelligence strategies already being showcased by finalists there. In the forefront of compounding value from accumulating data is BP, subject of this press release last week. To our knowledge, BP’s deployment of asset-wise asset life cycle information management, now underway globally after its 2019 implementation in the North Sea becomes the industrial infrastructure sectors only initiative to leverage the same cloud-based central information store across all projects and operations, where otherwise, the unfortunate norm is for separate enterprise systems to remain disconnected. BP’s infrastructure engineering data can compound in value from projects through operations with asset-wise reliability working to optimize inspections, minimize maintenance costs, increase availability and to improve safety and risk management.