Merion Road Capital Management, an investment advisor, released its fourth-quarter 2024 investor letter. A copy of the letter can be downloaded here. In the fourth quarter, Merion Road Small Cap Fund had a good performance and returned 5.5% bringing 2024 returns to +17.4%. This compared to 0.3% return for the Russell 2000 Index in the quarter and an 11.4% return in 2024. The long-only portfolio of Merion Road rose 9.0% during the quarter, bringing the 2024 returns to 32.4%. This compared to S&P 500’s 2.5% and 24.9% returns for the same periods. In addition, you can check the fund’s top 5 holdings to determine its best picks for 2024.

Merion Road Capital Management highlighted stocks like Bel Fuse Inc. (NASDAQ:BELFB) in its Q4 2024 investor letter. Bel Fuse Inc. (NASDAQ:BELFB) designs, manufactures, markets, and sells products that power, protect, and connect electronic circuits. The one-month return of Bel Fuse Inc. (NASDAQ:BELFB) was 0.45%, and its shares gained 21.86% of their value over the last 52 weeks. On January 31, 2024, Bel Fuse Inc. (NASDAQ:BELFB) stock closed at $81.10 per share with a market capitalization of $1.021 billion.

Merion Road Capital Management stated the following regarding Bel Fuse Inc. (NASDAQ:BELFB) in its Q4 2024 investor letter:

“Bel Fuse Inc. (NASDAQ:BELFB): I began buying BELFB in February of this year after the stock plunged due to a disappointing quarterly release. BELFB designs and manufactures an array of electronic components used primarily in networking / cloud, industrial, aerospace, and military applications. Prior to our ownership, the stock had had a strong run with the company bringing in an outside CFO to improve operations. Specifically, the revamped management team identified a path to bring margins in-line with their peers through a series of initiatives such as analyzing profitability by SKU, repricing business when appropriate, and incentivizing profits over sales. These efforts were incredibly effective, with EBITDA margins increasing from mid-single digits to mid-teens. The stock fell on their Q4 2023 earnings, however, as it became apparent that most of the low-hanging fruit had been extracted. I found the move to be excessive and used it as an opportunity to build our stake. Simply put, I believed the stock was experiencing transition pains as it moved from a margin enhancement play to a capital return story (BELFB had a large percentage of its market cap in cash / a cheap multiple, and had begun repurchasing stock).

Though this thesis has played out, a new one has emerged. In September the company announced that they would acquire Enercon, an Israeli-based electronic component manufacturer that predominately serves the aerospace and defense market. While the multiple paid was higher than BELFB’s trading multiple, it appears deservedly so. Enercon is predominately a sole source provider of complex products (i.e. minimum order quantity of 1). This specialization leads to premium margins relative to both BELFB and other publicly traded peers. Furthermore, given the on-going turmoil in the Middle East, the demand for this regional military spending is only going to increase. Lastly, BELFB has the opportunity to achieve some cross selling – this includes BELFB selling some of their products into Enercon’s customer base and opening up Enercon’s products to BELFB’s European customers that require local manufacturing…” (Click here to read the full text)

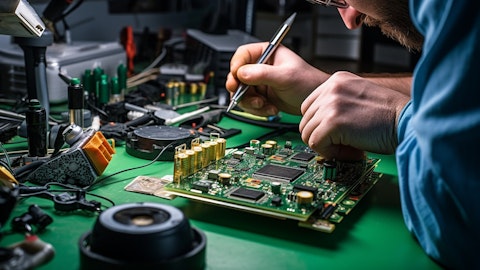

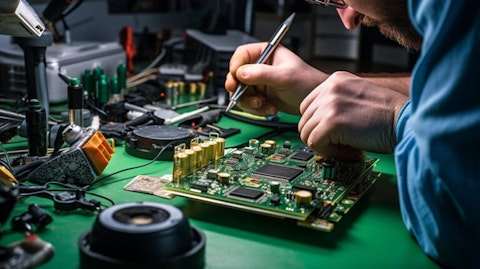

A close-up of a technician’s hands assembling electronic components on a circuit board.

Bel Fuse Inc. (NASDAQ:BELFB) is not on our list of 30 Most Popular Stocks Among Hedge Funds. As per our database, 14 hedge fund portfolios held Bel Fuse Inc. (NASDAQ:BELFB) at the end of the third quarter which was 13 in the previous quarter. In the third quarter, Bel Fuse Inc’s. (NASDAQ:BELFB) sales declined 22.1% year-over-year to $123.6 million. While we acknowledge the potential of Bel Fuse Inc. (NASDAQ:BELFB) as an investment, our conviction lies in the belief that AI stocks hold greater promise for delivering higher returns, and doing so within a shorter timeframe. If you are looking for an AI stock that is as promising as NVIDIA but that trades at less than 5 times its earnings, check out our report about the cheapest AI stock.

In another article, we discussed Bel Fuse Inc. (NASDAQ:BELFB) and shared Greystone Capital Management’s views on the company. In addition, please check out our hedge fund investor letters Q3 2024 page for more investor letters from hedge funds and other leading investors.

READ NEXT: Michael Burry Is Selling These Stocks and A New Dawn Is Coming to US Stocks.

Disclosure: None. This article is originally published at Insider Monkey.