Is Beacon Roofing Supply, Inc. (NASDAQ:BECN) a good stock to buy right now? We at Insider Monkey like to examine what billionaires and hedge funds think of a company before doing days of research on it. Given their 2 and 20 payment structure, hedge funds have more resources than the average investor. The funds have access to expert networks and get tips from industry insiders. They also have numerous Ivy League graduates and MBAs. Like everyone else, hedge funds perform miserably at times, but their consensus picks have historically outperformed the market after risk adjustments.

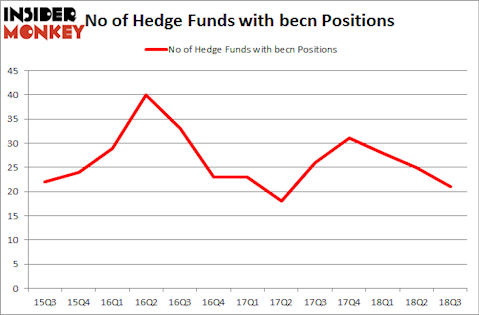

Beacon Roofing Supply, Inc. (NASDAQ:BECN) investors should pay attention to a decrease in hedge fund interest in recent months. Our calculations also showed that becn isn’t among the 30 most popular stocks among hedge funds.

In the eyes of most stock holders, hedge funds are assumed to be underperforming, old financial tools of years past. While there are more than 8,000 funds in operation today, Our researchers hone in on the moguls of this group, around 700 funds. It is estimated that this group of investors control the lion’s share of the smart money’s total capital, and by observing their unrivaled equity investments, Insider Monkey has determined several investment strategies that have historically outstripped Mr. Market. Insider Monkey’s flagship hedge fund strategy outperformed the S&P 500 index by 6 percentage points annually since its inception in May 2014 through early November 2018. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 24% since February 2017 (through December 3rd) even though the market was up nearly 23% during the same period. We just shared a list of 11 short targets in our latest quarterly update.

We’re going to view the latest hedge fund action regarding Beacon Roofing Supply, Inc. (NASDAQ:BECN).

What does the smart money think about Beacon Roofing Supply, Inc. (NASDAQ:BECN)?

At the end of the third quarter, a total of 21 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -16% from the second quarter of 2018. By comparison, 31 hedge funds held shares or bullish call options in BECN heading into this year. With hedge funds’ capital changing hands, there exists a few noteworthy hedge fund managers who were adding to their holdings considerably (or already accumulated large positions).

The largest stake in Beacon Roofing Supply, Inc. (NASDAQ:BECN) was held by Southpoint Capital Advisors, which reported holding $72.4 million worth of stock at the end of September. It was followed by Adage Capital Management with a $71.7 million position. Other investors bullish on the company included Fisher Asset Management, Daruma Asset Management, and Eminence Capital.

Due to the fact that Beacon Roofing Supply, Inc. (NASDAQ:BECN) has faced falling interest from the entirety of the hedge funds we track, we can see that there lies a certain “tier” of hedge funds that slashed their entire stakes last quarter. Interestingly, David Cohen and Harold Levy’s Iridian Asset Management cut the largest position of the “upper crust” of funds followed by Insider Monkey, valued at an estimated $57.8 million in stock, and Daniel S. Och’s OZ Management was right behind this move, as the fund said goodbye to about $48.8 million worth. These moves are intriguing to say the least, as aggregate hedge fund interest dropped by 4 funds last quarter.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as Beacon Roofing Supply, Inc. (NASDAQ:BECN) but similarly valued. We will take a look at Heron Therapeutics Inc (NASDAQ:HRTX), Tandem Diabetes Care Inc (NASDAQ:TNDM), The Cheesecake Factory Incorporated (NASDAQ:CAKE), and Mallinckrodt Public Limited Company (NYSE:MNK). This group of stocks’ market caps match BECN’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| HRTX | 31 | 785278 | 6 |

| TNDM | 22 | 308343 | 9 |

| CAKE | 21 | 152122 | 2 |

| MNK | 20 | 490595 | -1 |

| Average | 23.5 | 434085 | 4 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 23.5 hedge funds with bullish positions and the average amount invested in these stocks was $434 million. That figure was $382 million in BECN’s case. Heron Therapeutics Inc (NASDAQ:HRTX) is the most popular stock in this table. On the other hand Mallinckrodt Public Limited Company (NYSE:MNK) is the least popular one with only 20 bullish hedge fund positions. Beacon Roofing Supply, Inc. (NASDAQ:BECN) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. In this regard HRTX might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.