We started seeing tectonic shifts in the market during the third quarter. Small-cap stocks underperformed the large-cap stocks by more than 10 percentage points between the end of June 2015 and the end of June 2016. A mean reversion in trends bumped small-cap stocks’ return to almost 9% in Q3, outperforming their large-cap peers by 5 percentage points. The momentum in small-cap space hasn’t subsided during this quarter either. Small-cap stocks beat large-cap stocks by another 5 percentage points during the first 7 weeks of this quarter. Hedge funds and institutional investors tracked by Insider Monkey usually invest a disproportionate amount of their portfolios in smaller cap stocks. We have been receiving indications that hedge funds were boosting their overall exposure and this is one of the factors behind the recent movements in major indices. In this article, we will take a closer look at hedge fund sentiment towards BB&T Corporation (NYSE:BBT).

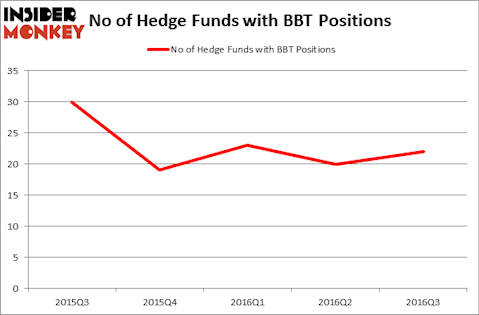

BB&T Corporation (NYSE:BBT) investors should be aware of an increase in hedge fund interest lately. BBT was in 22 hedge funds’ portfolios at the end of the third quarter of 2016. There were 20 hedge funds in our database with BBT holdings at the end of the previous quarter. At the end of this article we will also compare BBT to other stocks including PPG Industries, Inc. (NYSE:PPG), Liberty Global Inc. (NASDAQ:LBTYA), and Royal Bank of Scotland Group plc (ADR) (NYSE:RBS) to get a better sense of its popularity.

Follow Truist Financial Corp (NYSE:TFC)

Follow Truist Financial Corp (NYSE:TFC)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

violetkaipa/Shutterstock.com

Hedge fund activity in BB&T Corporation (NYSE:BBT)

At Q3’s end, a total of 22 of the hedge funds tracked by Insider Monkey were long this stock, a fall of 10% from one quarter earlier, as smart money ownership fails to rebound to Q3 2015 levels. With hedge funds’ positions undergoing their usual ebb and flow, there exists an “upper tier” of noteworthy hedge fund managers who were upping their stakes substantially (or already accumulated large positions).

Of the funds tracked by Insider Monkey, Jim Simons’ Renaissance Technologies has the number one position in BB&T Corporation (NYSE:BBT), worth close to $59.5 million. Sitting at the No. 2 spot is Cliff Asness of AQR Capital Management, with a $33.1 million position. Remaining professional money managers with similar optimism contain Richard S. Pzena’s Pzena Investment Management and Matthew Hulsizer’s PEAK6 Capital Management.