Are Bristol Myers Squibb Co. (NYSE:BMY) and Eli Lilly & Co. (NYSE:LLY) the pharmaceutical equivalent of the Olsen twins? The two companies have nearly identical market caps of a little over $60 billion. Both pay similar dividend yields — 3.8% for Bristol and 3.7% for Lilly. Several of the companies’ drugs compete in the same markets.

The similarities only go so far, though. And even though those dividends appear to be basically the same, could one actually be the better choice for investors? Let’s find out.

Bristol-Myers Squibb has outperformed Lilly in terms of dividend yield for much of the past decade. However, Lilly took the lead more often than not over the last three years.

BMY Dividend Yield data by YCharts.

Looking at the yield history only presents one view. Dividend investors particularly like companies that consistently sustain and increase dividend payments. How do Bristol and Lilly compare in this respect?

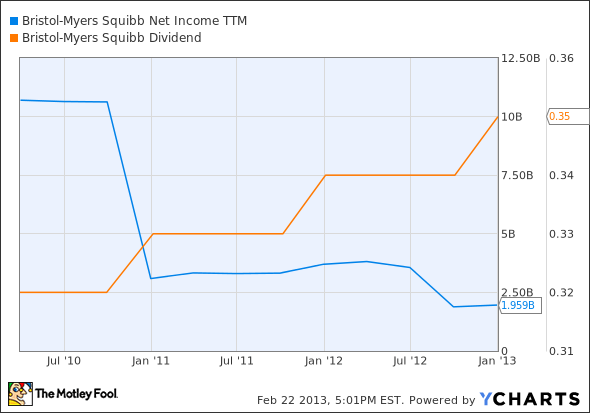

BMY Dividend data by YCharts.

Over the past 10 years, both companies showed consistency in paying dividends. Through 2009, Lilly rapidly grew its dividends. However, the tables have been turned since then. Bristol has been slowly increasing dividends, while Lilly has been in a holding pattern.

The rest of the story

So far, we know that Lilly is paying higher yields as of late, but Bristol-Myers Squibb is increasing its dividends more. These are good to know, but what they don’t tell us is the likelihood of either company encountering problems ahead in paying those dividends.

One important factor to evaluate is the dividend payout ratio, which represents the dividend divided by net income. The higher the ratio, the more concerned we should be about a given company’s ability to continue paying dividends at current levels. Some investors like to see this ratio below 50%, although the industry norms should be considered. I looked at ten large pharmas, including Bristol and Lilly, to calculate an average payout ratio of 63%.

Lilly looks to be in good shape with a dividend payout ratio of 54%, well below the average for the pharmas included. However, Bristol’s ratio currently stands at 117% — more than twice the average. It also was by far the highest payout ratio of the group. That’s concerning. The problem stems from Bristol’s increasing dividends at the same that it’s earnings were plummeting.

BMY Net Income TTM data by YCharts.

Meanwhile, Lilly’s net income was also going down for most of the last three years. Unlike Bristol, though, Lilly’s management team kept dividends steady rather than raising them in the face of lower earnings.

LLY Net Income TTM data by YCharts.

Danger ahead

Are there dangers ahead for either company in paying dividends at current levels? There could be, particularly for Bristol. It can’t sustain dividend payments that are higher than earnings indefinitely. Either earnings must grow or dividends must be cut at some point.

The bad news for Bristol is that it faces loss of patent protection for several key drugs that make earnings growth quite challenging. The company already experienced a huge dent in sales last year with Plavix and Avapro going off patent in the U.S. Other blockbuster drugs losing patent protection within the next three years include Abilify, Baraclude, and Sustiva. These three drugs combined for $5.7 billion in sales during 2012.

There is some good news. Several drugs are showing strong sales growth and have several years of patent protection remaining, particularly Sprycel, Orencia, and Onglyza. Eliquis, the blood thinner developed with Pfizer Inc. (NYSE:PFE), was recently approved by the Food and Drug Administration and should also be a big winner.

Lilly isn’t immune from these same challenges. The company already experienced big sales declines due to loss of U.S. patent protection for Zyprexa. Two of its current top revenue-generating drugs, Cymbalta and Humalog, go off-patent this year. The drugs combined for $7.4 billion in sales for 2012. Evista, which garnered over $1 billion in sales last year, loses patent exclusivity in 2014.

One key area in Lilly’s favor is its animal health business, which grew revenue by 21% last year. Unlike Pfizer, which spun off its animal health unit, Lilly intends to hold on to this growing segment. The company also has several drugs in the pipeline that could be solid contributors, particularly diabetes drug dulaglutide and cancer drug ramucirumab.

The better pick

Actually, I’m skeptical about going with either stock as a dividend play. I would recommend Pfizer or Sanofi SA (ADR) (NYSE:SNY) ahead of Bristol-Myers Squibb or Lilly. Both pay a 3.5% forward yield with reasonable payout ratios. The two companies face some effects from the patent cliff but should be able to navigate those challenges relatively well. But we’re looking at a head-to-head battle here between Bristol and Lilly and need a winner.

I would give the nod to Lilly. My view is that Lilly will maintain dividends at current levels and will manage earnings relatively well despite loss of revenue as key drugs go off patent. It’s a tough call, though. I suspect picking which Olsen twin is my favorite would be an easier task.

The article Battle of the Pharma Dividends: Bristol vs. Lilly originally appeared on Fool.com and is written by Keith Speights.

Fool contributor Keith Speights has no position in any stocks mentioned. The Motley Fool has no position in any of the stocks mentioned.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.