When you couple those qualities with the fact that both stocks are trading close to their 2009 recession lows, they may sound very enticing indeed. Even so, there is a better way for investors seeking to buy gold to get a better deal, something that will feed their portfolios much better than simply buying individual companies. Yes, and as the title of this article suggests, that entity pays a rich 13% dividend.

I am talking about the Gamco Global Gold Ntrl Rsrcs&Incm Tr BY (NYSEMKT:GGN). Before I further elaborate, here is some background information about the fund. Gamco Global Gold Ntrl Rsrcs&Incm Tr BY (NYSEMKT:GGN) is a closed-end mutual fund with $1.09 billion in total net assets. The fund makes investments in equity securities of firms operating in gold and natural resources industries, and the primary investment objective of the fund is to provide a high level of current income. In addition, it earns income through an option strategy of writing covered call options on equity securities in its portfolio. This allows the fund to support its sky high dividend.

The positive points

GGN pays a dividend of 13.55%, which equates to a payment of $0.12 every month. Although the fund’s dividends had been decreased from $0.14 per month to its current $0.12, the dividends are still comfortably high. In addition, the company offers a DRIP (Dividend Reinvestment Plan), which may suit some investors with the habit of reinvesting dividends.

Why does this fund make a good investment for investors who like gold now? Although as its name suggests- it also invests in Natural Resources companies (a few examples are Total SA, Halliburton and Anadarco), its portfolio is mainly focused on Gold mining companies. Out of its top 10 holdings, 8 are gold miners, and out of its top 20 holdings, 13 are gold miners. Some of its largest holdings include big names Barrick Gold Corporation (USA) (NYSE:ABX), Newmont Mining Corp (NYSE:NEM), Goldcorp, Eldorado Gold and AngloGold Ashanti, making the fund an ideal one for a gold-centered investment, although it is not exactly a pure gold play. The table below shows more information on its holdings.

| Type of Holdings | % Of Portfolio |

| Gold | 45.6 |

| Natural Resources | 37.9 |

| Cash | 18.3 |

| Bonds | 0.2 |

| Others (incl. Short Positions) | -2.0 |

So instead of buying Barrick Gold Corporation (USA) (NYSE:ABX) itself, which is trading attractively at 2008-2009 recession lows (as shown in the chart below), one could pick this more diversified and higher yielding fund. In my opinion, such a move can allow investors the both capitalize on Barrick’s low valuation, and receive an impressive monthly dividend at the same time.

A few words about why Barrick Gold Corporation (USA) (NYSE:ABX) is such an attractive investment at current prices: First, Barrick has one of the largest reserves in the industry with 140.2 million ounces of proven gold reserves. Thus, the company has the potential to make large profits if the price of gold rebounds. In addition, Barrick Gold Corporation (USA) (NYSE:ABX) is also very geographically diversified, with gold mines all over the world. For example, 47% of Barrick’s gold production came from North America, 22% from South America, 25% from Australia Pacific and 6% from Africa, as of 2012.

Besides this, this high-yielding fund is trading below NAV (Net Asset Value) currently, which essentially means that it is trading at an attractive valuation, with its price at $10.63 and NAV at $10.74. THis implies a discount of 1.02% to its NAV. It normally trades at a premium of around 6% to its NAV. This could be due to the unpopularity of Gold now, as supply does not balance out demand, and investors could utilize this fabulous opportunity to pick up some of these really high-yielding shares that would also give them exposure to gold miners like Barrick Gold Corporation (USA) (NYSE:ABX)

The negative points

This fund undoubtedly has some negative points too.

Firstly, it has a high management fee of 1.09%, which may be unacceptable to some investors. Although this is the case, the main reason why I still like it is due to it’s high dividend, which pretty much makes up for this hefty fee.

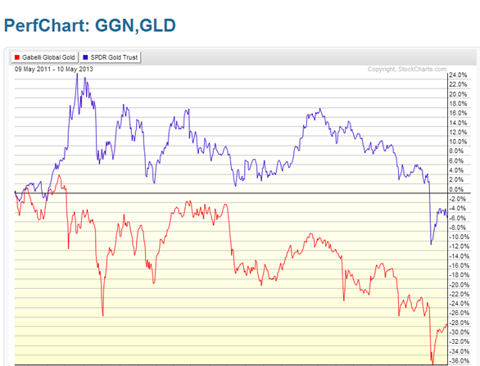

Secondly, one must note its underperformance as compared to the price of Gold over the past few years. Most would expect its price to follow the price of gold, but due to the underperformance of miners mainly due to rising mining costs, the fund does not track the price of gold well, although it does somewhat follow the general trend of gold. This can be seen through comparing the Gamco Global Gold Ntrl Rsrcs&Incm Tr BY (NYSEMKT:GGN) and SPDR Gold ETF charts, as shown below. SPDR Gold is an ETF that tracks the price of gold, and it does that very well, so its price movements can be taken for that of gold’s.

This chart is courtesy of stockcharts.com. Note that dividends were not factored in

Conclusion

This fund, with its high yield and heavy exposure to gold miners, can serve as a great fund for enterprising gold investors, but please fully understand the risks before making any purchase, especially with such a fund that can be deemed to be of higher risk.

The article A 13.5% Payer That Will Feed Any Portfolio Well originally appeared on Fool.com and is written by Ong Kang.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.