Baron Funds, an investment management company, released its “Baron Fifth Avenue Growth Fund” fourth quarter 2023 investor letter. A copy of the same can be downloaded here. The fund increased 17.6% (Institutional Shares) in the fourth quarter compared to a 14.2% gain for the Russell 1000 Growth Index and an 11.7% increase for the S&P 500 Index. For the full year, the fund appreciated 57.6% compared to 42.7% and 26.3% returns for the indexes, respectively. In addition, please check the fund’s top five holdings to know its best picks in 2023.

Baron Fifth Avenue Growth Fund featured stocks such as NVIDIA Corporation (NASDAQ:NVDA) in its Q4 2023 investor letter. Headquartered in Santa Clara, California, NVIDIA Corporation (NASDAQ:NVDA) provides computer graphics processors, chipsets, and related multimedia software. On February 22, 2024, NVIDIA Corporation (NASDAQ:NVDA) stock closed at $785.38 per share. One-month return of NVIDIA Corporation (NASDAQ:NVDA) was 28.69%, and its shares gained 237.28% of their value over the last 52 weeks. NVIDIA Corporation (NASDAQ:NVDA) has a market capitalization of $1.963 trillion.

Baron Fifth Avenue Growth Fund stated the following regarding NVIDIA Corporation (NASDAQ:NVDA) in its fourth quarter 2023 investor letter:

“Most of our portfolio companies have seen stabilization and modest improvements in short-term business fundamentals as the year progressed. More importantly in our view, many have been able to drive significant improvement in long-term Key Performance Indicators (KPIs) such as share gains, meaningful expansion of their total addressable market, and improvement in unit economics. These KPIs are significantly more important in driving the intrinsic values of our businesses, which we believe have increased noticeably during 2023. In the meantime, disruptive changes that we expect will benefit many of our businesses have also continued to pick up steam. Some examples include: • The inflection in GenAI: While a company like NVIDIA Corporation (NASDAQ:NVDA) is a clear beneficiary of GenAI, as its hardware and software solutions are used to train and run GenAI models, we believe that GenAI has the potential to benefit many of our other businesses as well.”

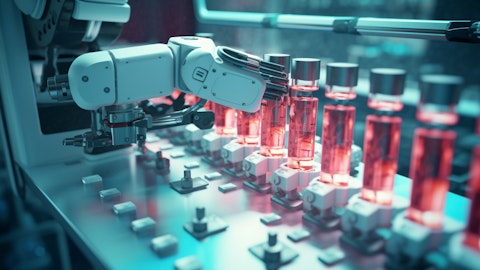

Photo by Javier Esteban on Unsplash

NVIDIA Corporation (NASDAQ:NVDA) is in fifth position on our list of 30 Most Popular Stocks Among Hedge Funds. At the end of the fourth quarter, NVIDIA Corporation (NASDAQ:NVDA) was held by 173 hedge fund portfolios, down from 180 in the previous quarter, according to our database.

We discussed NVIDIA Corporation (NASDAQ:NVDA) in another article and shared latest stock picks from Jim Cramer’s 2024 portfolio. In addition, please check out our hedge fund investor letters Q4 2023 page for more investor letters from hedge funds and other leading investors.

Suggested Articles:

- 25 Best Zoos in the US

- 20 States Where Tax Filers Are Paying the Highest Percentage of Their Income

- 25 Fastest Growing Economies in the Last 50 Years

Disclosure: None. This article is originally published at Insider Monkey.