We have been waiting for this for a year and finally the third quarter ended up showing a nice bump in the performance of small-cap stocks. Both the S&P 500 and Russell 2000 were up since the end of the second quarter, but small-cap stocks outperformed the large-cap stocks by double digits. This is important for hedge funds, which are big supporters of small-cap stocks, because their investors started pulling some of their capital out due to poor recent performance. It is very likely that equity hedge funds will deliver better risk adjusted returns in the second half of this year. In this article we are going to look at how this recent market trend affected the sentiment of hedge funds towards Baozun Inc (ADR) (NASDAQ:BZUN), and what that likely means for the prospects of the company and its stock.

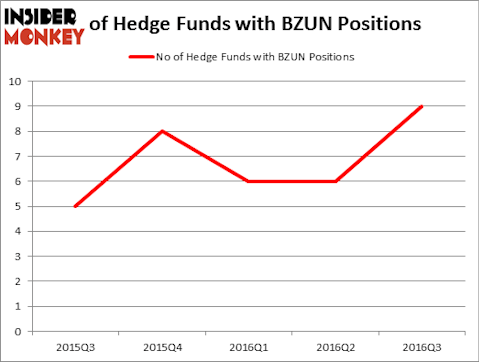

Is Baozun Inc (ADR) (NASDAQ:BZUN) a great investment at the moment? Money managers are really turning bullish. The number of bullish hedge fund positions advanced by 3 in recent months. BZUN was in 9 hedge funds’ portfolios at the end of September. There were 6 hedge funds in our database with BZUN holdings at the end of June. At the end of this article we will also compare BZUN to other stocks including Energous Corp (NASDAQ:WATT), KMG Chemicals, Inc. (NYSE:KMG), and ChannelAdvisor Corp (NYSE:ECOM) to get a better sense of its popularity.

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

gualtiero boffi/Shutterstock.com

Hedge fund activity in Baozun Inc (ADR) (NASDAQ:BZUN)

At Q3’s end, a total of 9 of the hedge funds tracked by Insider Monkey were bullish on this stock, a 50% surge from one quarter earlier. On the other hand, there were a total of 8 hedge funds with a bullish position in BZUN at the beginning of this year, so ownership is up only moderately in 2016. With the smart money’s positions undergoing their usual ebb and flow, there exists a few notable hedge fund managers who were upping their stakes substantially (or already accumulated large positions).

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Richard Driehaus’ Driehaus Capital has the most valuable position in Baozun Inc (ADR) (NASDAQ:BZUN), worth close to $7.7 million. On Driehaus Capital’s heels is Lei Zhang’s Hillhouse Capital Management, which holds a $7.5 million position. Some other professional money managers with similar optimism encompass David Kowitz and Sheldon Kasowitz’s Indus Capital, Renaissance Technologies, one of the largest hedge funds in the world, and Israel Englander’s Millennium Management. We should note that Indus Capital is among our list of the 100 best performing hedge funds, which is based on the performance of their 13F long positions in non-micro-cap stocks.

With general bullishness amongst the heavyweights, some big names were breaking ground themselves. Jim Simons’ Renaissance Technologies initiated the largest position in Baozun Inc (ADR) (NASDAQ:BZUN). Renaissance Technologies had $1.4 million invested in the company at the end of the quarter. Mike Vranos’ Ellington also initiated a $0.7 million position during the quarter. The other funds with brand new BZUN positions are Matthew Hulsizer’s PEAK6 Capital Management, John Overdeck and David Siegel’s Two Sigma Advisors, and Ken Griffin’s Citadel Investment Group.

Let’s now review hedge fund activity in other stocks similar to Baozun Inc (ADR) (NASDAQ:BZUN). We will take a look at Energous Corp (NASDAQ:WATT), KMG Chemicals, Inc. (NYSE:KMG), ChannelAdvisor Corp (NYSE:ECOM), and Pacific Continental Corporation (NASDAQ:PCBK). This group of stocks’ market caps match BZUN’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| WATT | 5 | 36916 | 3 |

| KMG | 10 | 66067 | 1 |

| ECOM | 10 | 14011 | 1 |

| PCBK | 5 | 28697 | 0 |

As you can see these stocks had an average of 7 hedge funds with bullish positions and the average amount invested in these stocks was $36 million. That figure was $22 million in BZUN’s case. KMG Chemicals, Inc. (NYSE:KMG) is the most popular stock in this table. On the other hand Energous Corp (NASDAQ:WATT) is the least popular one with only 5 bullish hedge fund positions. Baozun Inc (ADR) (NASDAQ:BZUN) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. In this regard KMG and ECOM might be better candidates to consider taking a long position in.

Disclosure: None