Instead of building a complex earnings model using the reams of data provided in a bank’s 10-Ks, long-term investors can get away with using a handy shortcut. Since the value of a bank — or any company — is derived from the amount of cash it earns for shareholders, looking at long-term historical return on equity gives investors a sense of how well the company has met its objective in the past — and how likely it is to do so in the future.

Return on equity tells quite a story

This article only discusses the largest U.S. banks by assets — Bank of America Corp (NYSE:BAC), JPMorgan Chase & Co. (NYSE:JPM), Wells Fargo & Co (NYSE:WFC), and Citigroup Inc (NYSE:C) — but the method can be applied to any bank.

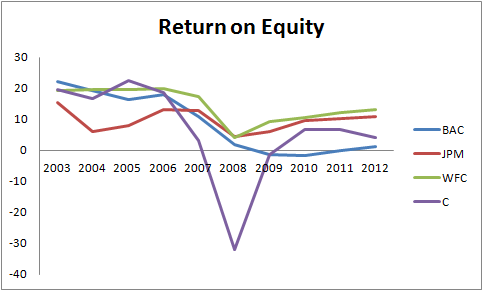

First, let’s look at each bank’s return on equity over the last 10 years. All four had high returns on equity before the financial crisis, but only two remained positive throughout the crisis and ensuing recession.

That JPMorgan Chase & Co. (NYSE:JPM) and Wells Fargo & Co (NYSE:WFC) maintained profitability during the financial crisis should come as no surprise to close followers of these companies. Chase’s rock-star CEO, Jamie Dimon, limited his bank’s exposure to the sub-prime loans and related securities that dragged other institutions into the red. Dimon has instilled a culture of prudent capital allocation that is reflected in the bank’s out-performance.

The same is true at Wells Fargo & Co (NYSE:WFC), only Wells Fargo’s culture runs deeper. Not only does the bank have a reputation as the most conservative among its mega-bank peers, its unique focus on customer service and cross-selling enables it to generate out-sized returns with less leverage than other banks. This enables the company to earn consistently higher returns on equity than any other major bank.

Not as simple as looking at ROE

The most important attribute to key in on is consistency. A high return on equity is valuable only if it is maintained. Looking at the last 10 years, it is clear that Bank of America Corp (NYSE:BAC) and Citigroup Inc (NYSE:C) are not nearly as consistent as JPMorgan Chase & Co. (NYSE:JPM) and Wells Fargo & Co (NYSE:WFC).

*Average divided by standard deviation equals variation coefficient (lower is better)

While Bank of America Corp (NYSE:BAC) averaged only a slightly lower return on equity than Chase, the measure varied widely from year to year. This is because the bank took out-sized risks during the credit boom and made several poor acquisitions in the resulting credit crunch.

Citigroup Inc (NYSE:C) not only under-performed its peers based on average return on equity, it also significantly under-performed on consistency. Citigroup Inc (NYSE:C) is the epitome of Wall Street risk-taking, with its massive bet on sub-prime mortgages triggering a bailout that plucked it from insolvency. Moreover, the bank is currently betting heavily on emerging markets, which are starting to see capital outflows. It is clear that Citigroup Inc (NYSE:C)’s high-beta earnings are here to stay.