AVITA Medical, Inc. (NASDAQ:RCEL) Q4 2022 Earnings Call Transcript February 23, 2023

Operator: Good day and thank you for standing by. Welcome to AVITA Medical Fourth Quarter 2022 Earnings Conference Call. At this time, all participants are in a listen-only mode. After the speakers’ presentation, there’ll be a question-and-answer session. Please be advised that today’s conference is being recorded. I would now like to hand the conference over to your speaker today, Caroline Corner Please go ahead.

Caroline Corner: Thank you, operator. Welcome to AVITA Medical fourth quarter 2022 earnings call. Before we begin, let me remind you that this call will include forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. All statements made on this call that do not relate to matters of historical facts should be considered forward-looking statements, including statements regarding the markets in which AVITA Medical operates, trends, demand and expectations for its products and technology, its expected financial performance, expenses and position in the market. These statements are neither promises nor guarantees and involve known and unknown risks and uncertainties that could cause actual results, performance or achievements to differ materially from any results, performance or achievements expressed or implied by the forward-looking statements.

Please review AVITA Medical’s most recent filings with the SEC, particularly the risk described in AVITA Medical’s annual report on Form 10-K for the year ended December 31, 2022 for additional information. Any forward-looking statements provided during this call, including projections for future performance are based on management’s expectations as of today. AVITA Medical undertakes no obligation to update these statements, except as required by applicable law. AVITA Medical’s press release for fourth quarter 2022 results is available on its website, www.avitamedical.com under the Investors section and includes additional details about its financial results. AVITA Medical’s website also has the latest SEC filings, which you’re encouraged to review.

Recording of today’s call will be available on AVITA Medical’s website by 5:00 PM Pacific Time today. Joining me on today’s call are Jim Corbett, Chief Executive Officer; and Sean Ekins, Acting Chief Financial Officer. I’ll now turn the call over to Jim for his comments.

Jim Corbett: Thank you, Caroline. Good afternoon, everyone, and thank you for joining us today. I will begin today’s call by discussing highlights for the fourth quarter and full year as well as our expectations and guidance for 2023. Sean will then provide more detailed commentary on our financial performance before opening the call to Q&A. To begin with we had a strong top line commercial revenue performance with $9.4 million in Q4 2022, which is a 37% increase over the same period in the prior year. For the full year 2022, our commercial revenue was $34.1 million, which was a 36% increase over the prior year. As a reminder commercial revenue includes all global revenue and excludes the $100,000 BARDA revenue recognized in the quarter and $400,000 for the year.

I’d like to personally congratulate our field sales team for their successful 2022. I’d like to provide an update on the initial priorities I discussed on our third quarter call. With respect to our two pending applications with the FDA, our PMA supplement for soft tissue was submitted on the 9th of December and our PMA application for vitiligo was submitted on the 16th. Both submissions independently have breakthrough device designation. As such we have expedited review for both programs, which have each met or exceeded the primary endpoints in their respective studies used to support the applications. The 180-day review cycle would imply June approvals. Notably, the soft tissue PMA supplement which significantly broaden our existing burns market and allow us to leverage our existing burns infrastructure.

Our team has developed the commercial plans to maximize the soft tissue opportunity and to drive synergies between burns and soft tissue repair which will drive our growth over the next three-plus years. These synergies are significant and important. First, soft tissue repair utilizes the same inpatient reimbursement and outpatient codes as burns. As such both in-hospital reimbursement through a DRG and outpatient reimbursement through a transitional pass-through code will be effective immediately upon FDA approval for soft tissue indications. Second of the nearly 150 burn centers that we are presently approved to sell in approximately half are also either Level 1 or Level 2 trauma centers, which means that these hospitals will have immediate access to the expanded label upon approval.

Additionally, we will be adding approximately 1,000 hospital call points that are Level 1 and Level 2 trauma centers to our current 150 or so hospital call points. Third within the US inpatient burn market we are configured to only call on the US burn centers where 70% of the RECELL eligible cases are treated. The expansion into Level 1 and Level 2 trauma centers positions our sales force to capture the remaining 30% of the burn market. In the second quarter, we will begin calling on these trauma centers. We will use this opportunity to begin promoting RECELL for burns in these Level 1 and Level 2 trauma centers and begin seeking value analysis committee approval that will allow for a more rapid soft tissue repair launch in July. Together these synergies offer us the unique opportunity to prepare for the full commercial launch of soft tissue on July 1, 2023 as we should have immediate access to our expanded indications and that approvals in many of these hospitals already upon PMA supplement approval.

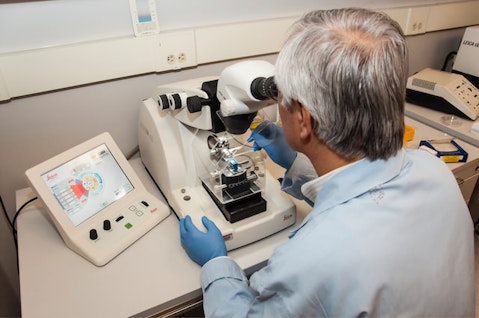

Photo by National Cancer Institute on Unsplash

Further during the second quarter, we will initiate the planned expansion of our US field sales organization. Currently, we have 30 field salespeople that we will be expanding to approximately 70 field sales people, which includes both direct sales and clinical roles. This is ahead of the expected June approval of our PMA supplement for soft tissue repair such that the team is in place and trained at launch. This will result in a peak operating expense as a percent of revenue in Q3 2023. I emphasize that our contribution margin on new field sales professional is breakeven with approximately five RECELL kits sold per month per individual. Currently, the average productivity of a direct sales rep exceeds 20 kits per month. This is what I like to call weaponizing our gross profit to enhance market adoption and penetration where the sales force expansion pays for itself quickly.

For the Vitiligo indication, we expect PMA approval in June 2023 as well. We are in process of pursuing in-office reimbursement through the AMA CPT code process. It is our goal to secure Medicare reimbursement by January 2025. During the interim period, we will be implementing cash pay for Vitiligo patients and physician-sponsored studies to build our podium presence for an intended commercial launch in January 2025. During our last call, I also commit to providing an update on our automation program. By way of background currently the disaggregation of cells from the autologous sample is done manually and requires frequent training by our field sales team. Our automation device is designed to automate that disaggregation, which will require less training by our sales team and operating room staff and will allow us to better leverage selling time by our field organization.

We plan to submit our PMA supplement application to the FDA by June 30 of this year. Just like with soft tissue, we will be subject to the 180-day review cycle, and we have project approval by January 2024. As reported in Q4, we have begun our launch in Japan through our partner, COSMOTEC. Early returns are very positive. These sales are recognized in US dollars, and we will report Japan revenues in our footnotes in the foreign revenue line. During 2023, we expect that Japan will account for over 90% of those international revenues. With respect to our broader international strategy, it remains on our agenda to communicate our strategy during the November Q3 earnings call. With respect to 2023 guidance, as communicated, we will be providing updated annual and quarterly guidance every quarter.

Our annual revenue guidance for 2023 is expected to be in the range of $49 million to $51 million, which would be at midpoint of guidance, 47% growth over 2022. For the first quarter of 2023, we expect commercial revenues to be between $10 million and $11 million. At the midpoint of this guidance, we would be up over 40% over the prior year. As I have outlined, 2023 will be the year of inflection for AVITA Medical, transforming our business to encompass multiple indications and dramatically expanding our growth trajectory. Our regulatory and commercial teams are making great strides and I look forward to updating you on our progress on future calls. With that, I’d like to turn it over to Sean Ekins, Acting Chief Financial Officer.

Sean Ekins: Thank you, Jim. In the three months ended December 31, 2022, our commercial revenue, which excludes BARDA revenue increased by 37% to $9.4 million, compared to $6.8 million in the same period in 2021. Total revenue which includes BARDA revenue increased by 36% to $9.5 million, compared to $6.9 million in the same period in 2021. Gross profit margin was 86%, compared to 88% for the fourth quarter of 2021. Total operating expenses for the quarter increased by 2% to $15 million, compared to $14.8 million in the same period in 2021. The increase in operating expenses is attributable to increased selling expenses, pre-commercialization costs and salaries and benefits, partially offset by lower research and development and share-based compensation expenses.

Higher selling costs are attributable to increased commissions, travel costs and training events associated with increased sales activity, increased pre-commercialization costs are driven by activities related to future resale launches in soft tissue repair and vitiligo. Higher salaries and benefits are driven by the expansion of our workforce to support the overall operation. Research and development costs were lower due to the following. The pediatric burn study was closed for enrollment. Soft tissue repair and vitiligo trial participants were in a less costly fall phases this period, compared to more costly recruitment and treatment phases in the prior period, along with lower expenses for sponsored research agreements toward pipeline development.

In addition, we had lower development expenses in the current year from ongoing development of next-generation devices for automated preparation of Spray-On Skin cells, as we are currently in a lower-cost project phase compared to the prior year. Share-based compensation expenses were lower due to reversal in the current period of a previously recognized expense for unvested awards related to the termination of a former Executive Officer. Net loss decreased by 37% to $5.4 million or $0.21 per share compared to a net loss of $8.5 million or $0.34 per share in the same period in 2021. Adjusted EBITDA loss decreased by 39% to $4 million compared to a loss of $6.5 million in the same period in 2021. For the full year ended December 31, 2022, our commercial revenue increased by 36% to $34.1 million compared to $25.1 million in the same period in 2021.

The growth in commercial revenues was largely driven by deeper penetration within individual customer accounts along with the commencement of commercial sales with our partner COSMOTEC in Japan. Total revenue increased by 4% to $34.4 million compared to $33 million in the same period in 2021. Gross profit margin was 82% relatively flat compared to the same period in 2021. Total operating expenses increased by 10% to $59.1 million compared to $53.6 million in the same period in 2021. The increase in operating expenses is attributable to higher salaries and benefits, pre-commercialization costs, selling costs, share-based compensation expenses, partially offset by lower research and development expenses. Higher salaries and benefits were primarily a result of the expansion of our commercial team, along with an increase in our workforce to support the overall operations.

In addition, we incurred severance costs in the current year associated with the termination of a former Executive Officer. Higher pre-commercialization costs are driven by activities related to future reset launches in soft tissue repair and vitiligo. Higher selling costs are attributable to increased commissions, travel costs and training events due to increased sales activity. Share-based compensation expenses were higher in the current year driven by new equity grants partially offset by a reversal of a previously recognized expense from vested awards related to the termination of a former Executive Officer. Research and development costs were lower due to the following. The pediatric burn study was closed for enrollment, soft tissue repair and vitiligo trial participants were in less costly follow-up phases in this period compared to more costly recruitment and treatment phases in the prior period and a lower expense for sponsored research towards pipeline development in the current period.

This is partially offset by higher development expenses in the current year from ongoing development of next-generation devices for an automated preparation of Spray-On Skin sales, as compared to the prior year due to early prototype development and testing. Net loss was $26.7 million or $1.07 per share, compared to a net loss of $25.1 million or $1.03 per share in the same period in 2021. Adjusted EBITDA loss was $19 million, compared to a loss of $18.1 million in the same period in 2021. A table reconciling non-GAAP measures is included in today’s press release for reference. With that, we thank you for your time. And now I’ll turn the call back to the operator for your questions.

See also David Tepper’s Top 10 Dividend Stock Picks and 15 Most Valuable Hungarian Companies.

Q&A Session

Follow Avita Medical Inc. (NASDAQ:RCEL)

Follow Avita Medical Inc. (NASDAQ:RCEL)

Receive real-time insider trading and news alerts

Operator: Thank you. At this time, we will conduct the question-and-answer session. Our first question comes from the line of Joshua Jennings of Cowen. Your line is now open.

Joshua Jennings: Thank you. Good afternoon. Congrats on the strong finish to confidence in the outlook and the call for inflection in 2023. Jim and Sean. One was hoping to ask about guidance full year and first quarter to start. And if there’s any way you can maybe help us think through your outlook for the core burn business, RECELL burn business and the growth you anticipate and then maybe any assumptions for soft tissue contributions for the full year. And then for the first quarter just it’s a nice sequential step up. If you can just remind us about seasonality trends in the burn market in the United States. And is there some seasonality tailwinds, or is this just momentum from Q4 carrying into these first two months of 2023 already and giving the counter strict issue that nice sequential step-up in Q1. And I would follow up.

Jim Corbett: Thanks, Josh. That was a very distinct single question. Let me take it on. I’m just teasing. So first of all with regard to the burn business, let’s start with that. We saw sequential growth Q4 to Q1 clearly. And that does not reflect seasonality. I’ll just give you some data. And if you look at claims data for the last three years by quarter contribution to the year and you average them, the average burn admits that are RECELL eligible sound like this 25 25 26 24. So the very minor changes between Q4 and Q3 and its one-point in terms of annual admit. So there’s really not a seasonality reality that we can define from the claims data. So what we’re therefore seeing is growth and penetration. So that’s the first element I think to your question.

What we expect to see through the course of the year Q1 and Q2 is continued adoption and the number of users who use it multiple times per month increasing as we €“ as our evidence continues to grow the experience with burn surgeons continues to get validated in terms of tissue sparing and healing and early exit from the hospital. That’s really taking its own €“ its course and our field sales team has done a really terrific job. What happens as we move and I’m staying on burns for a second €“ into the second half depending on your math 30% of the burns market, which is about 10,000 of the 35,000 admits are in soft tissue repair. And they are in €“ excuse me, one-third of them are in level one and two trauma centers okay? That 10,000 cases we have not been comparing to call on.

So one of our expectations as we move through the year is that adoption will come our way because of course, our sales team will be calling on those physicians with the very strong accumulated evidence and commercial experience we’ve had focusing only on burn centers. So that’s a really big driver for the year in the burns market. We’re feeling increasingly comfortable with our soft tissue repair PMA supplement in terms of timing, we’re having a very productive interaction with the FDA. We’re not getting surprises of any type. As you know, are on the Breakthrough Device designation path. And that is, of course, giving us expedited review and we don’t stop the clock unless there’s a material deficiency. So that has caused us to bet, so to speak, on that June approval and July 1 readiness.