Bob Patterson: Oh, I’m sorry if I missed that latter part of that thing. So, in total there is about — if I just look at reductions in cost, there are some things that we have as inflationary costs. If I look at the net of cost reductions and some inflationary items, that’s about $24 million. As I said, that kind of really starts to play in here in the second quarter with respect to the timing of those and then through the balance of the year.

Angel Castillo: Very helpful. Thank you.

Bob Patterson: Yes, sure.

Operator: Thank you. And our next question comes from David Huang with Deutsche Bank. Your line is open.

David Huang: Hi, good morning. For ’23, what would the carryover pricing be from your prior price increase initiatives?

Bob Patterson: Yes. We have, I think, in the front half, it’s about 6%. If you look at Q1, a little bit lower than that if you get to sort of the full year assumptions.

David Huang: Okay. And then also, what’s your expectation for working capital this year?

Bob Patterson: Really, the expectation is that we kind of maintain a level of working capital commensurate with sales. So, we look at that as a percentage of sales. I don’t really see that changing meaningfully as a percentage through the course of this year. Obviously, we did generate a lot of cash here in the fourth quarter of 2022. I think our free cash flow number for the year is $200 million — sorry — for ’23. Yes. So, a little bit of working capital on that. But mostly it is EBITDA converted.

David Huang: So, would working capital be a source of cash or use of cash in ’23, I guess?

Joe Di Salvo: The model we assume is basically flat on working capital for the full year, David. So, really…

David Huang: Okay. Thanks.

Operator: One moment for our next question. We have a question from Kristen Owen from Oppenheimer. Your line is open.

Kristen Owen: Thank you. Good morning, everyone. So, really strong price cost performance all year and in particular, in the fourth quarter in Color. Just two questions around that. What’s working in the pricing playbook? And we’ve talked a lot about the cost side of the equation in 2023. Given some of the moving parts, how we should think about the spread between price and cost moving throughout 2023?

Bob Patterson: Yes. I guess the — remind me if I don’t get the second half of your question answered as I address the first. So, I think really one of the things that we did well was that we went early and often really going back to the end of 2020, the beginning of ’21. And just we’re routinely getting price. And I think that was across the board in all regions and all businesses. So, there wasn’t any moment in time where we just really raised prices in a particular quarter. I think we just did that steadily over time. In our prior quarter remarks, we really said that, I think, peaked in the third quarter, obviously, with demand coming down and changes in supply dynamics, and now you’re kind of seeing raw material deflation as a result.

So that just kind of, I think, puts things into perspective with respect to what we did over time that helped us to deliver the results that we did in ’22. So, it wasn’t necessarily just something in ’22, but things that started even before that. We do have a small, I think, positive price mix number in the model right now. And, look, as I said, that if we do better from a raw material standpoint in ’23, that could be better than what we have model today. We’re being conservative in that regard.

Kristen Owen: You touched on sort of the moving pieces, which is the back half of the question, what’s the spread throughout the year. But, I guess, if I could ask then just my follow-up is your ability to maintain that degree of pricing capability in a deflationary environment, obviously, from your own cost perspective, you’re going to manage what you can, but just how you view that pricing capability in this type of environment?

Bob Patterson: Yes. I mean, look, it’s — when demand is down, I think that’s when you see the most pressure on price. And I think that historically, we have made accommodations where we have needed to or felt like that was prudent to do. We’ve also visited formulations with our customers to look at lower cost alternatives if that is an option for them as well, which can sometimes maybe a lower price but better mix or a change in mix anyway. So, look, historically, I think we’ve done very well in periods of deflation in terms of maintaining and/or lowering prices at a slower pace than what we see from a deflationary standpoint. It really does very greatly by end market and application. It’s kind of hard to paint a broad sweeping generalization around it, but that’s the best thing I can probably say in that regard.

Kristen Owen: That’s very helpful. Thank you so much.

Operator: Our next question comes from Laurence Alexander with Jefferies. Your line is open.

Laurence Alexander: Good morning. I have two questions. First, on the kind of longer-term 20% target, do you think your current portfolio can get there? Or do you need scale or a further shift in mix? Just can you give us a sense of kind of what you think is most likely available path? And secondly, to what degree have you screened your products for PFAS content, particularly with respect to, for example, the EU potential ban on PFAS, how much of your products would be challenged to meet that just in terms of contamination from intermediate chemicals?

Bob Patterson: One of the things to put that 20% EBITDA target into perspective is if you went back to the initial modeling that we had in ’21 for what the business looks like pro forma with Dyneema added and with Distribution out, we were actually pretty close to 18%. That has come down, of course, in 2022 as demand declined in the second half of the year. So, I think you can go back in time and actually see something reasonably recent that actually has us about half of the way there. So, growth is obviously an important part of that characteristic. But I think improving mix now that we have these businesses and they are the fastest-growing being composites and sustainable solutions, which all have higher margins, I really believe that, that 20% is something that we can get to for the company as a whole.

Obviously, managing costs in terms of the corporate side and everything else helps in that equation too. And then, I mean, we viewed our sort of PFAS exposure as minimal and specifically in Europe. I don’t view that as a significant risk of any kind. We review that as well as a number of other regulatory changes every quarter, and that’s been one of the things that we reviewed that we’ve I think categorized as minimal.

Laurence Alexander: Thank you.

Bob Patterson: Yes.

Operator: Thank you. Our next question comes from Eric Petrie from Citi. Your line is open.

Eric Petrie: Hi. Good morning, Bob.

Bob Patterson: Good morning.

Eric Petrie: Your sustainable solutions sales increased roughly 50% year-over-year. How much of that was attributed to Dyneema? And then, can you talk about kind of the main segment drivers and how they grew on an underlying basis?

Bob Patterson: Yes. So, Dyneema, for the most part, we have, if you look at the business recall that about half of that is human health and safety for personal protection, then maybe 25% to 30% is in sustainable infrastructure. So largely, we’re capturing that as part of the sustainability portfolio, some of the consumer applications that are in consumer products and such may not be in there. And then, if you just look at ’23 over ’22, sustainable solutions were up about 3.5% on a constant dollar basis. And really, what that reflects is the decline in demand in the second half of the year for even things like food and beverage packaging, which I didn’t read through as a direct pull through from consumers so much as I think it was destocking. So, not a lack of interest in those particular applications, but just the overall level of, I think, inventory reduction that was taking place at the time.

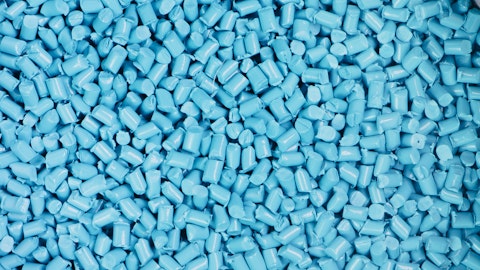

Eric Petrie: Helpful. On masterbatch operations, can you just give us an update in terms of how utilization fared particularly in Europe for the quarter and what you’re expecting in the first half?

Bob Patterson: Could you give me that timeframe or did you say fourth quarter?

Eric Petrie: Yes. During the quarter, how utilization declined and then what you’re expecting for first half from masterbatch operating rates?

Bob Patterson: Yes. I mean, look, typically, we don’t cite utilization rates. One of the reasons for that is that look, if you were to visit our Color facilities, you’d actually see that they’re all relatively small. We’ve got small lines largely for a myriad of niche batch processing applications, often which that have a fair amount of turnover time. So, I don’t really look at it so much per nameplate capacity in that respect. Obviously, with demand being down as much as it was in the fourth quarter, you can assume that we had more capacity as a result. I do think that there is opportunity for some capacity reduction in Europe. That’s not news to anybody. That’s just part of what we had been modeling all along with respect to some of the Clariant synergies. Those are in process right now, but don’t really expect to see cost benefit from those until the second half of the year.

Eric Petrie: Thank you.

Bob Patterson: Yes.