In this article we are going to use hedge fund sentiment as a tool and determine whether Avantor, Inc. (NYSE:AVTR) is a good investment right now. We like to analyze hedge fund sentiment before conducting days of in-depth research. We do so because hedge funds and other elite investors have numerous Ivy League graduates, expert network advisers, and supply chain tipsters working or consulting for them. There is not a shortage of news stories covering failed hedge fund investments and it is a fact that hedge funds’ picks don’t beat the market 100% of the time, but their consensus picks have historically done very well and have outperformed the market after adjusting for risk.

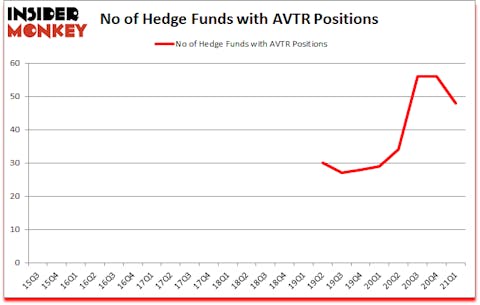

Avantor, Inc. (NYSE:AVTR) has experienced a decrease in hedge fund sentiment recently. Avantor, Inc. (NYSE:AVTR) was in 48 hedge funds’ portfolios at the end of March. The all time high for this statistic is 56. Our calculations also showed that AVTR isn’t among the 30 most popular stocks among hedge funds (click for Q1 rankings).

According to most stock holders, hedge funds are assumed to be slow, outdated investment tools of years past. While there are more than 8000 funds with their doors open today, We look at the top tier of this club, about 850 funds. It is estimated that this group of investors handle the lion’s share of the smart money’s total asset base, and by following their best investments, Insider Monkey has determined many investment strategies that have historically outperformed the S&P 500 index. Insider Monkey’s flagship short hedge fund strategy outperformed the S&P 500 short ETFs by around 20 percentage points a year since its inception in March 2017. Also, our monthly newsletter’s portfolio of long stock picks returned 206.8% since March 2017 (through May 2021) and beat the S&P 500 Index by more than 115 percentage points. You can download a sample issue of this newsletter on our website .

At Insider Monkey we leave no stone unturned when looking for the next great investment idea. For example, Federal Reserve has been creating trillions of dollars electronically to keep the interest rates near zero. We believe this will lead to inflation, which is why we are checking out this inflation play. We go through lists like 10 best gold stocks to buy to identify promising stocks. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our homepage. Keeping this in mind we’re going to go over the latest hedge fund action surrounding Avantor, Inc. (NYSE:AVTR).

Do Hedge Funds Think AVTR Is A Good Stock To Buy Now?

At Q1’s end, a total of 48 of the hedge funds tracked by Insider Monkey were long this stock, a change of -14% from one quarter earlier. On the other hand, there were a total of 29 hedge funds with a bullish position in AVTR a year ago. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Viking Global held the most valuable stake in Avantor, Inc. (NYSE:AVTR), which was worth $448.6 million at the end of the fourth quarter. On the second spot was Third Point which amassed $318.2 million worth of shares. Palestra Capital Management, Citadel Investment Group, and Schonfeld Strategic Advisors were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Highline Capital Management allocated the biggest weight to Avantor, Inc. (NYSE:AVTR), around 7.37% of its 13F portfolio. Palestra Capital Management is also relatively very bullish on the stock, dishing out 5.9 percent of its 13F equity portfolio to AVTR.

Due to the fact that Avantor, Inc. (NYSE:AVTR) has witnessed a decline in interest from hedge fund managers, it’s easy to see that there lies a certain “tier” of hedge funds that decided to sell off their entire stakes in the first quarter. It’s worth mentioning that Ricky Sandler’s Eminence Capital cut the biggest position of all the hedgies tracked by Insider Monkey, valued at close to $95.6 million in stock. Robert Pohly’s fund, Samlyn Capital, also sold off its stock, about $90.1 million worth. These bearish behaviors are intriguing to say the least, as aggregate hedge fund interest was cut by 8 funds in the first quarter.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as Avantor, Inc. (NYSE:AVTR) but similarly valued. These stocks are QuantumScape Corporation (NYSE:QS), Sun Communities Inc (NYSE:SUI), Genuine Parts Company (NYSE:GPC), The Liberty SiriusXM Group (NASDAQ:LSXMA), Smith & Nephew plc (NYSE:SNN), Brookfield Property Partners LP (NASDAQ:BPY), and Akamai Technologies, Inc. (NASDAQ:AKAM). All of these stocks’ market caps are closest to AVTR’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| QS | 29 | 534668 | -6 |

| SUI | 35 | 1007911 | 8 |

| GPC | 26 | 357245 | 1 |

| LSXMA | 38 | 1727128 | -4 |

| SNN | 11 | 42029 | -1 |

| BPY | 17 | 205102 | 8 |

| AKAM | 25 | 206922 | -8 |

| Average | 25.9 | 583001 | -0.3 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 25.9 hedge funds with bullish positions and the average amount invested in these stocks was $583 million. That figure was $2065 million in AVTR’s case. The Liberty SiriusXM Group (NASDAQ:LSXMA) is the most popular stock in this table. On the other hand Smith & Nephew plc (NYSE:SNN) is the least popular one with only 11 bullish hedge fund positions. Compared to these stocks Avantor, Inc. (NYSE:AVTR) is more popular among hedge funds. Our overall hedge fund sentiment score for AVTR is 72.7. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 5 most popular stocks among hedge funds returned 95.8% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 40 percentage points. These stocks returned 17.4% in 2021 through June 18th but still managed to beat the market by 6.1 percentage points. Hedge funds were also right about betting on AVTR as the stock returned 19.9% since the end of March (through 6/18) and outperformed the market by an even larger margin. Hedge funds were clearly right about piling into this stock relative to other stocks with similar market capitalizations.

Follow Avantor Inc. (NYSE:AVTR)

Follow Avantor Inc. (NYSE:AVTR)

Receive real-time insider trading and news alerts

Suggested Articles:

- How to Best Use Insider Monkey To Increase Your Returns

- Top 10 Cloud Computing Stocks To Buy

- 10 Best Semiconductor Stocks to Buy in 2021

Disclosure: None. This article was originally published at Insider Monkey.