All about the dividends

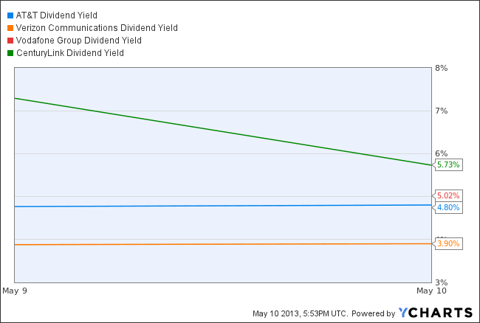

Additionally, I would like to look at some metrics to evaluate when deciding where I would put money at this point with these companies. I am already long all four companies, but if I were to put new money in right now, I would be selective as to where. Dividends are a compelling factor for me as far as this industry goes, so let’s take a look at where these stand.

T Dividend Yield data by YCharts

CenturyLink has the highest current dividend yield. CenturyLink, Inc. (NYSE:CTL), however, cut its

dividend

earlier this year. I believe the market reaction to that was way overdone, as did many other people, as it sank by over 20% the day that was announced. Since then, the price has recovered. I believe it was overdone especially because the company planned to buy back stock and pay down debt instead of maintaining the previous dividend, which is value added to the company.

The other stocks above have solid dividends, with long histories of increases. The recent stock price increases that the companies have experienced have lowered the yields, and a couple of years ago I would have wanted a 6% dividend yield. Now, 5% is the best we can hope for while the long-term bonds of these companies can net you a slightly higher yield.

Market capitalizations

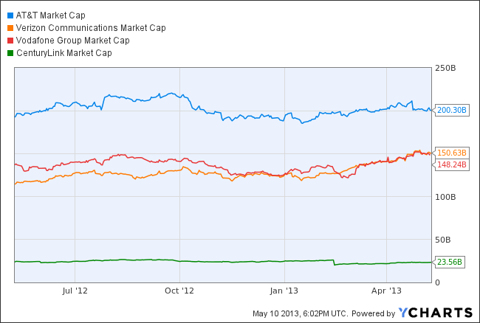

The following chart will look at the market cap for each company.

T Market Cap data by YCharts

AT&T Inc. (NYSE:T) has the highest market capitalization of this group. Verizon and Vodafone are a close second and third, with CenturyLink, Inc. (NYSE:CTL) far behind. I think market cap is important because it can help a company withstand a prolonged downturn, as evidenced by the companies getting through the financial crisis in 2008 without having to cut their dividends.

Conclusion

Based on these factors and qualitative considerations, I have the following opinions on these stocks. AT&T Inc. (NYSE:T) and Verizon are solid companies with a long history of dividend increases and value added spin-offs for shareholders. In the near term, I do not see anything out of the ordinary coming from these companies. With CenturyLink, Inc. (NYSE:CTL), its acquisition of Savvis and its PrismTV are two exciting developments and growth opportunities. I view PrismTV as something that could be spun off in the future, but I think that will take many years to materialize into something worth a few billion dollars.

For the near term, I would say that Vodafone is the way to go. It pays a strong dividend and there is the possibility that shareholders could get shares of Verizon if a buyout of Verizon Communications Inc. (NYSE:VZ) Wireless comes through. The exciting potential that Vodafone Group Plc (ADR) (NASDAQ:VOD) has from its potential divestiture in Verizon Wireless motivates me to add to my position here if I were going to do anything. I hold all of these stocks in my portfolio and think that they are all great long-term investments. Please conduct your own research and due diligence before deciding to invest in any of these stocks.

The article Excellent Telecom Stocks With Great Dividends originally appeared on Fool.com is written by Anthony Parsons.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.