Number crunching

There’s no beating around the bush: Atlantic Power Corp (NYSE:AT) had an absolute mess of a quarter. On the top line, its $114 million in sales came up 27% short of analyst estimates, and 9.3% lower than Q4 2011’s GAAP reported sales.

But falling sales were a common trend for utilities this quarter — the real trouble comes from the company’s bottom line. The utility reported GAAP EPS of -$0.50, a whopping $0.45 below Mr. Market’s expectations and almost double the loss Atlantic Power Corp (NYSE:AT) reported for 2011’s fourth quarter. This most recent news marks the sixth straight quarter that the utility has underwhelmed Wall Street.

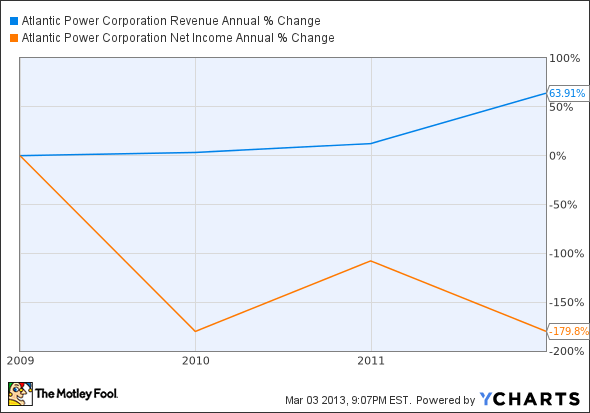

Atlantic Power Corp (NYSE:AT) is tiny compared to many of its competitors, and its acquisition-based strategy has pushed sales higher even as profit has plummeted. Revenue has rocketed 64% over the last five years, while net income fell into the red in 2009 and has dropped 180% in the same time period.

Source: AT Revenue Annual data by YCharts.

The dividend drop

Corporations use shareholders’ money to create value in three main ways:

- Invest in the company itself (maintenance, acquisitions, etc.), thereby increasing the inherent value of the company and its stock

- Buy back shares, thereby directly increasing the stock price

- Distribute dividends, thereby directly returning cash to shareholders

Atlantic has historically had one of the “best” dividend yields around, estimated at 10.2% before last week. But the utility’s payout was highly unsustainable, and Atlantic just announced that it will slash its dividend 66% from Cdn$0.096 to Cdn$0.033 per month starting in March.

As energy overhauls put the squeeze on many companies’ seemingly stalwart profits, dividends don’t always offer investors the best bang for their bucks. Exelon Corporation (NYSE:EXC) also dropped its dividend 40% this past quarter to keep its books balanced and free up cash flow for capital expenditures.

Speaking to shareholders, Atlantic CEO Barry Welch noted that:

In evaluating our financial position, cost of capital and updated financial projections, and how they fit with our growth strategy and ability to deliver attractive total return to shareholders, the board, supported by management’s recommendation, determined that it was in the best interest of the company and its shareholders to establish a lower and more sustainable Payout Ratio that balances yield and growth and is at the same time consistent with our outlook for current and prospective projects under a range of scenarios. We believe a lower Payout Ratio will improve our financial flexibility in order to deliver on our objective of providing a combination of sustainable income and solid growth from accretive acquisitions, construction ready and development projects, which we believe will enhance shareholder value over time.

It makes sense. In a year where Atlantic felt the regulatory squeeze, increased its long-term debt, and more than doubled its liabilities, the utility should be doing more with investors’ money than cramming it straight back into their open palms.

In the recent past and over the next few years, several utilities are undergoing massive modernization projects to ensure that they can offer more than just a dividend. Here’s how Atlantic stacks up against a few competitors: