Aristotle Capital Management, LLC, an investment management company, released its “Value Equity Strategy” third quarter 2024 investor letter. A copy of the letter can be downloaded here. The U.S. share market reached record highs in the quarter, with the S&P 500 Index rising 5.89%. The market showed wider gains, unlike the previous quarter, with the S&P 500 Equal Weight Index beating the cap-weighted S&P 500 Index by 3.71%. The composite returned 6.47% gross of fees (6.39% net of fees) in the third quarter underperforming the 9.43% return of the Russell 1000 Value Index and outperforming the 5.89% return of the S&P 500 Index. Security selection led the composite to underperform in the quarter relative to the Russell 1000 Value Index, while allocation had a slight negative impact. In addition, you can check the fund’s top 5 holdings to determine its best picks for 2024.

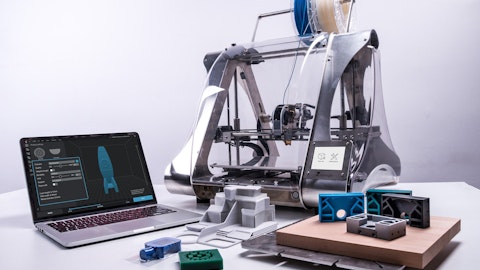

Aristotle Capital Value Equity Strategy highlighted stocks like Autodesk, Inc. (NASDAQ:ADSK) in its Q3 2024 investor letter. Autodesk, Inc. (NASDAQ:ADSK) offers 3D design, engineering, and entertainment technology solutions. The one-month return of Autodesk, Inc. (NASDAQ:ADSK) was 5.21%, and its shares gained 33.00% of their value over the last 52 weeks. On October 11, 2024, Autodesk, Inc. (NASDAQ:ADSK) stock closed at $281.67 per share with a market capitalization of $60.702 billion.

Aristotle Capital Value Equity Strategy stated the following regarding Autodesk, Inc. (NASDAQ:ADSK) in its Q3 2024 investor letter:

“We first invested in Autodesk, Inc. (NASDAQ:ADSK)—the global industry standard for computer‐aided design in the architecture, engineering and construction industry (AEC)—during the second quarter of 2022. During our holding period, the company remained at the cutting edge of enabling improvement through innovation and promoting the use of open standards, or open building information modeling (BIM). The company also improved its profitability, supported by further adoption of its cloud offerings. We continue to believe the company is uniquely positioned to benefit, as the AEC industry has increasingly sought to resolve the inefficiencies that arise when many parties are needed to complete a building project. However, we decided Autodesk was the best candidate for sale to fund what we believe to be a more optimal investment in Verizon Communications.”

A software engineer using AutoCAD Civil 3D to create a 3D design in a modern office setting.

Autodesk, Inc. (NASDAQ:ADSK) is not on our list of 31 Most Popular Stocks Among Hedge Funds. As per our database, 55 hedge fund portfolios held Autodesk, Inc. (NASDAQ:ADSK) at the end of the second quarter which was 52 in the previous quarter. While we acknowledge the potential of Autodesk, Inc. (NASDAQ:ADSK) as an investment, our conviction lies in the belief that AI stocks hold greater promise for delivering higher returns, and doing so within a shorter timeframe. If you are looking for an AI stock that is as promising as NVIDIA but that trades at less than 5 times its earnings, check out our report about the cheapest AI stock.

In another article, we discussed Autodesk, Inc. (NASDAQ:ADSK) and shared the list of unsexy AI stocks according to Goldman Sachs. Aristotle Capital Value Equity Strategy initiated a position in Autodesk, Inc. (NASDAQ:ADSK) during Q2 2022. In addition, please check out our hedge fund investor letters Q3 2024 page for more investor letters from hedge funds and other leading investors.

READ NEXT: Michael Burry Is Selling These Stocks and A New Dawn Is Coming to US Stocks.

Disclosure: None. This article is originally published at Insider Monkey.